- United States

- /

- Beverage

- /

- NYSE:KO

The Coca-Cola Company (NYSE:KO) Remains a Linebacker of a Defensive Portfolio

The Coca-Cola Company (NYSE: KO) stock opened the year with a statement, making a new all-time high. It took almost 2 years to reach the pre-pandemic highs steadily.

With the distinctive brand, above-average dividend, and a P/E ratio beyond the industry's average – the market seems optimistic about the company.

Check our latest analysis on Coca-Cola.

Institutional Optimism

While some might sarcastically refer to them as prophets in hindsight, institutions tend to upgrade ratings after the company has experienced a rally. For Coca-Cola, the latest upgrade came from Guggenheim Securities, which elevated it to Buy from Neutral.

Guggenheim analyst Laurent Grandet raised the price target to US$66 (from US$61), reflecting on the accelerating overall demand and recovery at a faster pace than expected.

Meanwhile, facing inflationary pressures, JPMorgan selected Coca-Cola as one of the more insulated companies due to the strong brand equity, asset-light business model, and solid gross margins.

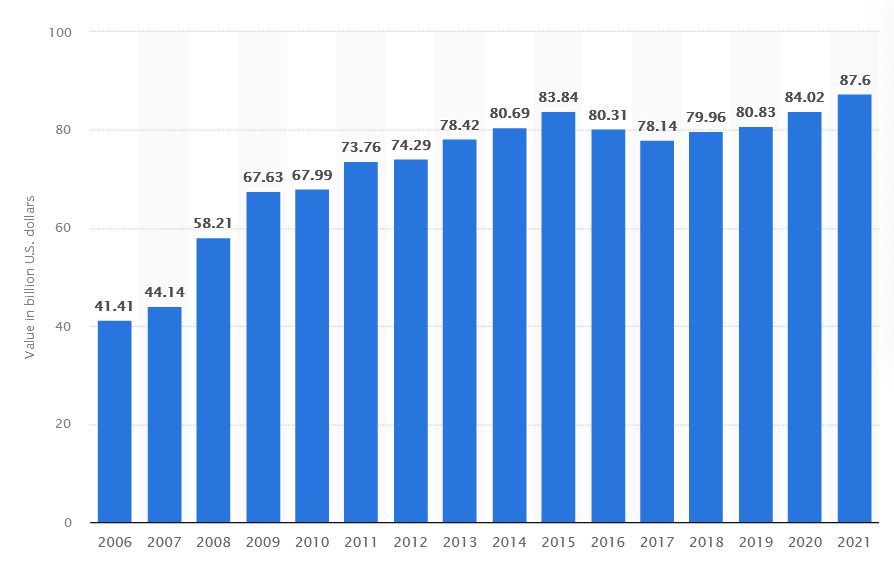

The following chart shows that the brand value is in a positive trend, setting a new high in 2021.

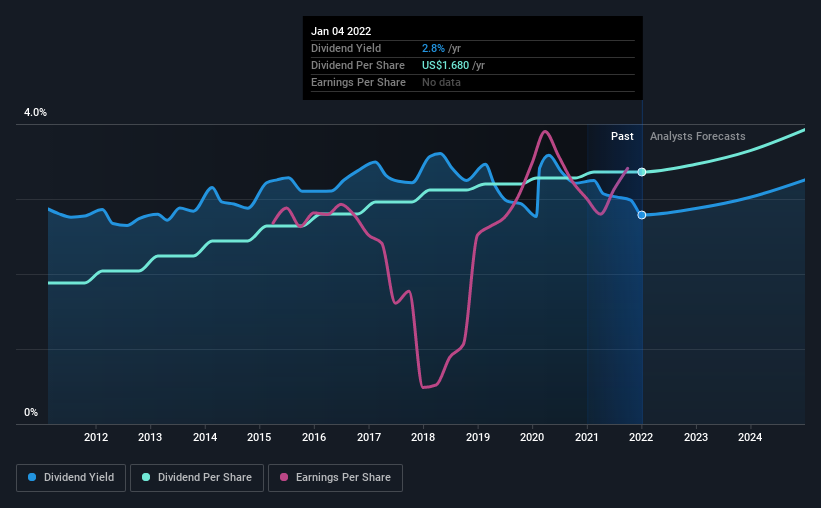

While Coca-Cola's 2.8% dividend yield is not the highest, we think its multi-decade payment history is impressive. Some simple research can reduce the risk of buying Coca-Cola for its dividend.

Payout ratios

Last year, Coca-Cola paid out 82% of its profit as dividends. It's paying out most of its earnings, limiting the amount that can be reinvested in the business. This may indicate a limited need for additional capital or highlight a commitment to paying a dividend.

We also measure dividends paid against a company's levered free cash flow to see if enough cash was generated to cover the dividend. Coca-Cola paid out 77% of its cash flow last year. This may be sustainable, but it does not leave much of a buffer for unexpected circumstances. It's encouraging to see that the dividend is covered by profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Consider getting our latest analysis on Coca-Cola's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point in buying a stock if its dividend is regularly cut or is not reliable. Coca-Cola has been paying dividends for a very long time, but we only examine the past 10 years of payments for this analysis.

During this period, the dividend has been stable, implying the business could have relatively consistent earnings power. Back in 2021, the first annual payment was US$0.9, compared to US$1.7 last year. This works out to be a compound annual growth rate (CAGR) of approximately 6.0% a year over that time.

Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) grew, as this is essential to maintaining the dividend's purchasing power over the long term. Earnings have grown at around 4.1% a year for the past five years, which is better than seeing them shrink.

Earnings are not growing quickly, and the company is paying out most of its profit as dividends. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

Conclusion

Dividend investors should always want to research about 3 things: dividend's affordability, payment track record, and growth perspective. First, we think Coca-Cola is paying out an acceptable percentage of its cash flow and profit. Furthermore, earnings growth has been mediocre, but stability has been outstanding.

While not the most exciting stock, there are times when the good defense takes priority over growth, and we believe that is when Coca-Cola has a place in many portfolios.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 2 warning signs for Coca-Cola that investors should take into consideration.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives