- United States

- /

- Beverage

- /

- NYSE:KO

Does Coca-Cola’s Push Into Healthier Beverages Signal Room for More Growth in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Coca-Cola's legendary brand means its stock is still a smart buy at today's prices? You're in the right place to dig into what the numbers and the story behind them really show.

- The stock has climbed 16.6% over the past year and posted gains of 4.4% in the last month, signaling a bounce in market confidence or possibly something bigger at play.

- Headlines this quarter have been buzzing about Coca-Cola's continued push into healthier beverage offerings and its global expansion agreements. These moves have captured investor attention and may have played a role in the recent strength in share price.

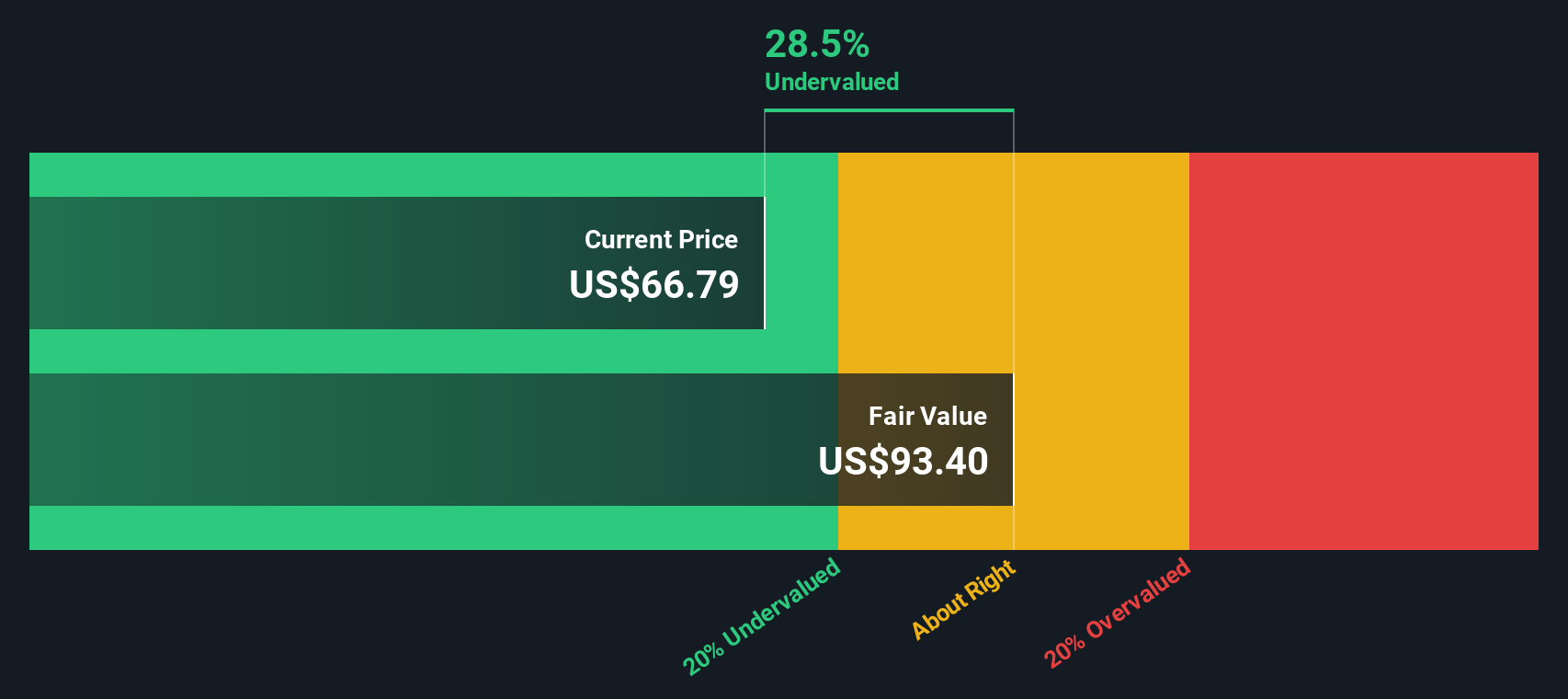

- When we put Coca-Cola through our value checks, it scores 2 out of 6 for undervaluation, meaning it only meets two of the preferred criteria. We'll break down how we get that score by comparing different valuation approaches, but stick around for an even better way to interpret what Coca-Cola's price really says about its future.

Coca-Cola scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coca-Cola Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of Coca-Cola by projecting its future cash flows and discounting them back to their value in today's dollars. This approach helps determine what the company is really worth based on how much cash it is expected to generate in the years ahead.

Coca-Cola's current Free Cash Flow stands at $5.60 Billion. Analysts forecast significant growth over the next five years, and after that, Simply Wall St extrapolates the trend. According to these projections, the company’s Free Cash Flow could climb as high as $19.40 Billion by 2035. All projections use the US Dollar as the reporting currency.

By calculating all these future cash streams and applying the 2 Stage Free Cash Flow to Equity model, the DCF places Coca-Cola’s intrinsic fair value at $89.90 per share. This is about 20.0% higher than the current market price, suggesting the stock is undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola is undervalued by 20.0%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: Coca-Cola Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Coca-Cola, as it helps investors compare the price they are paying for every dollar of current earnings. For stable, mature businesses, the PE offers a snapshot of how much future growth and risk the market is pricing in.

Higher PE ratios can sometimes be justified for companies with faster expected earnings growth or lower risk. Lower ratios may signal either slower prospects or elevated uncertainty. The "normal" or "fair" PE for a business is influenced by all of these factors.

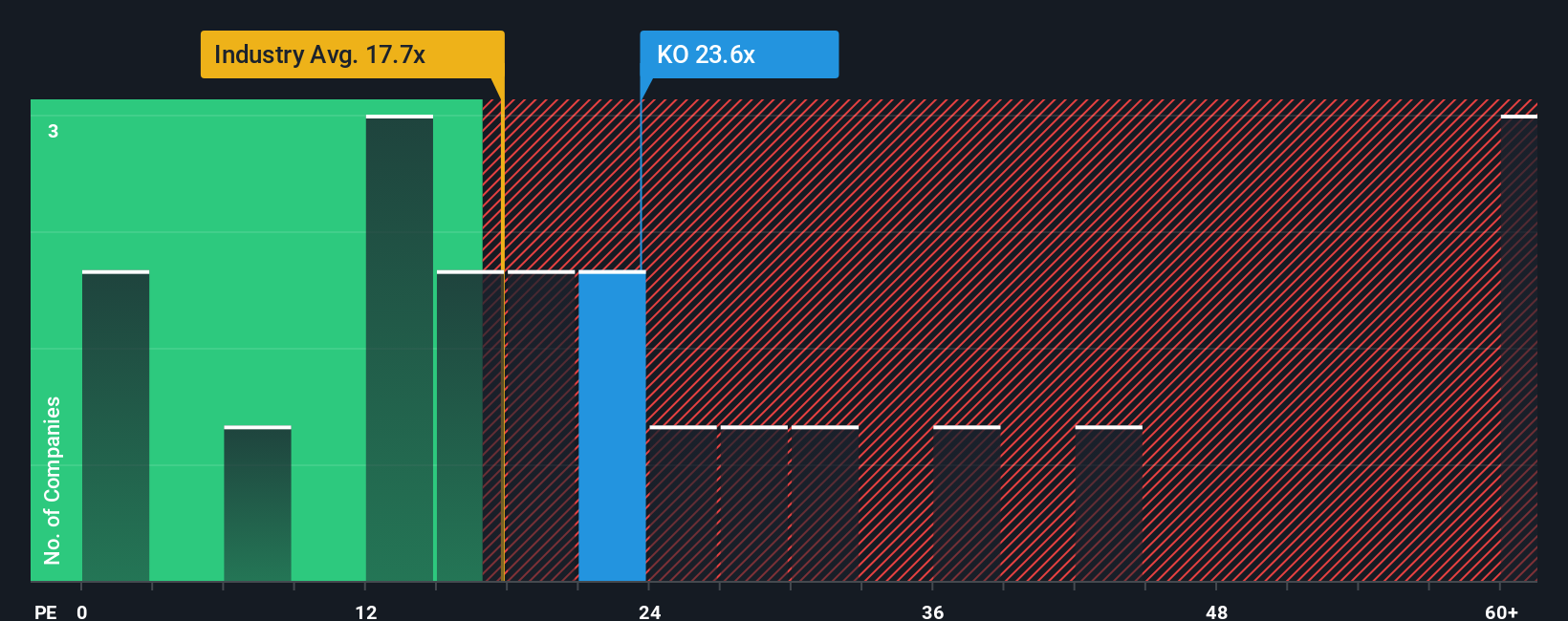

As of now, Coca-Cola trades at a PE ratio of 23.75x. This is above the average for the Beverage industry, which stands at 17.81x, but below the average for its closest peers at 27.51x. Simply Wall St's proprietary "Fair Ratio" is 23.13x, calculated to reflect Coca-Cola’s specific growth outlook, risk profile, high profit margins, industry context, and large market capitalization.

Compared with just industry or peer benchmarks, the Fair Ratio offers a more nuanced view because it incorporates not just broad sector trends, but also Coca-Cola’s unique fundamentals, such as its growth rates, profitability, and risks, which may not be fully reflected in generic averages.

With Coca-Cola’s current PE ratio almost identical to its Fair Ratio, market pricing appears quite reasonable.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coca-Cola Narrative

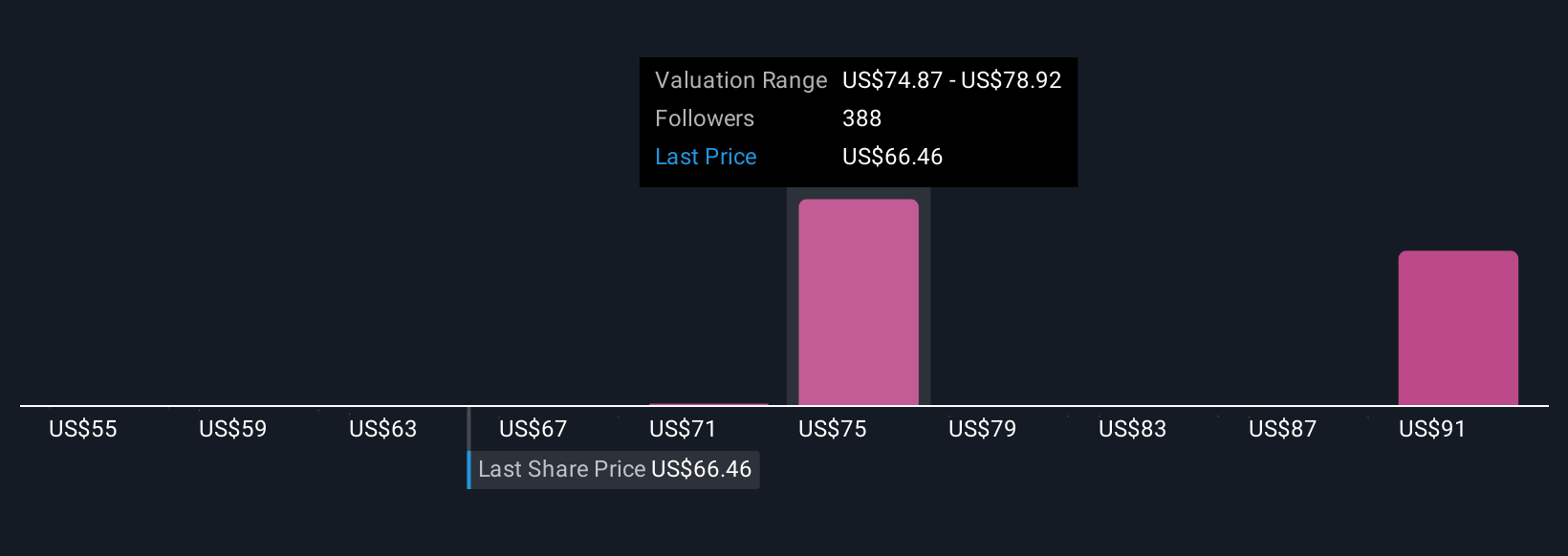

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. In the context of investing, a Narrative is your own story, a set of beliefs and assumptions about Coca-Cola’s future, from its revenue and margin growth to risks and the fair value you think is justified.

Rather than just relying on static numbers, Narratives on Simply Wall St let you connect the company’s story, what it’s doing, where it’s heading, and why, directly to a financial forecast, which then calculates a fair value based on your assumptions. This approach is both accessible and powerful, giving users of all experience levels a way to clarify and act on their investment thesis right from the Community page alongside millions of other investors.

With Narratives, you can see in real time how your forecast compares to the current stock price, helping you decide if the market is over- or underestimating the company, and instantly respond to new news or financial reports as Narratives update dynamically.

For example, some investors may see Coca-Cola’s value as high as $85 per share, based on strong emerging market momentum and resilient earnings, while others view fair value closer to $67, citing regulatory risk and plateauing growth. The right Narrative for you is the one that best fits your own outlook and conviction.

For Coca-Cola, however, we'll make it really easy for you with previews of two leading Coca-Cola Narratives:

Fair value: $77.57

Undervalued by approximately 7.2%

Expected revenue growth rate: 5.3%

- Analysts believe revenue growth in emerging markets, investments in digital, and value-added dairy products will drive earnings and margin expansion.

- Sustainability efforts, e-commerce, and an asset-light operating model are seen as strengthening Coca-Cola’s long-term profitability and resilience.

- Risks include health trends, increased competition, regulatory and supply chain pressures. The consensus price target is about 13.8% above the recent share price.

Fair value: $71.00

Overvalued by approximately 15.4%

Expected revenue growth rate: 6.6%

- The classic Coca-Cola business model and strong dividend history support a case for stability, but current valuation is seen as rich given more uncertain market conditions.

- Management faces headwinds from regulatory risks, currency impacts, and shifting consumer demand towards healthier and more innovative beverage options.

- Bullish digital and direct-to-consumer initiatives may pay off. However, the narrative sees the stock as fairly valued and notes that costs and macro risks could weigh on future results.

Do you think there's more to the story for Coca-Cola? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026