- United States

- /

- Beverage

- /

- NYSE:KO

Coca-Cola (KO) Valuation: Is the Defensive Giant Priced for Long-Term Growth?

Reviewed by Simply Wall St

Coca-Cola (KO) remains an industry mainstay for income-focused investors, drawing attention for its reliable performance. Recent share movement has been fairly muted. As a result, current interest centers on how its fundamentals support long-term value amid shifting market trends.

See our latest analysis for Coca-Cola.

Coca-Cola’s share price has steadily advanced this year, gaining 15.15% year-to-date, and its one-year total shareholder return sits at a robust 15.04%. That enduring appeal speaks to the company’s defensive qualities and its ability to keep rewarding long-term investors even as the broader market mood shifts.

If you’re looking to broaden your watchlist beyond blue-chip staples, now is a great time to discover fast growing stocks with high insider ownership

But with shares sitting near record highs, investors have to wonder: is Coca-Cola undervalued based on its solid fundamentals, or is today’s price fully reflecting all future growth potential?

Most Popular Narrative: 5.5% Overvalued

Coca-Cola’s fair value in this most-followed narrative is $67.50 per share, modestly below the recent closing price of $71.21. The analysis highlights how macro factors, especially interest rates, could tip the balance for investors looking for steady returns.

“The Federal Reserve’s recent 25 basis point cut may appear modest, but for Coca-Cola (NYSE: KO), it carries meaningful implications for valuation. As a consumer staples giant with steady free cash flows and a reputation as a dividend aristocrat, KO is highly sensitive to discount rates in long-term models.”

This valuation is not built on wishful thinking, but on a surprising combination of durable cash flow, premium multiples and strategic moves into emerging beverage categories. Get the inside track on which underlying assumptions, business shifts and long-range financial projections power this premium assessment. There is more going on than meets the eye.

Result: Fair Value of $67.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer preferences and the impact of new health regulations could challenge Coca-Cola’s margin strength and change future growth assumptions.

Find out about the key risks to this Coca-Cola narrative.

Another View: What Do the Multiples Say?

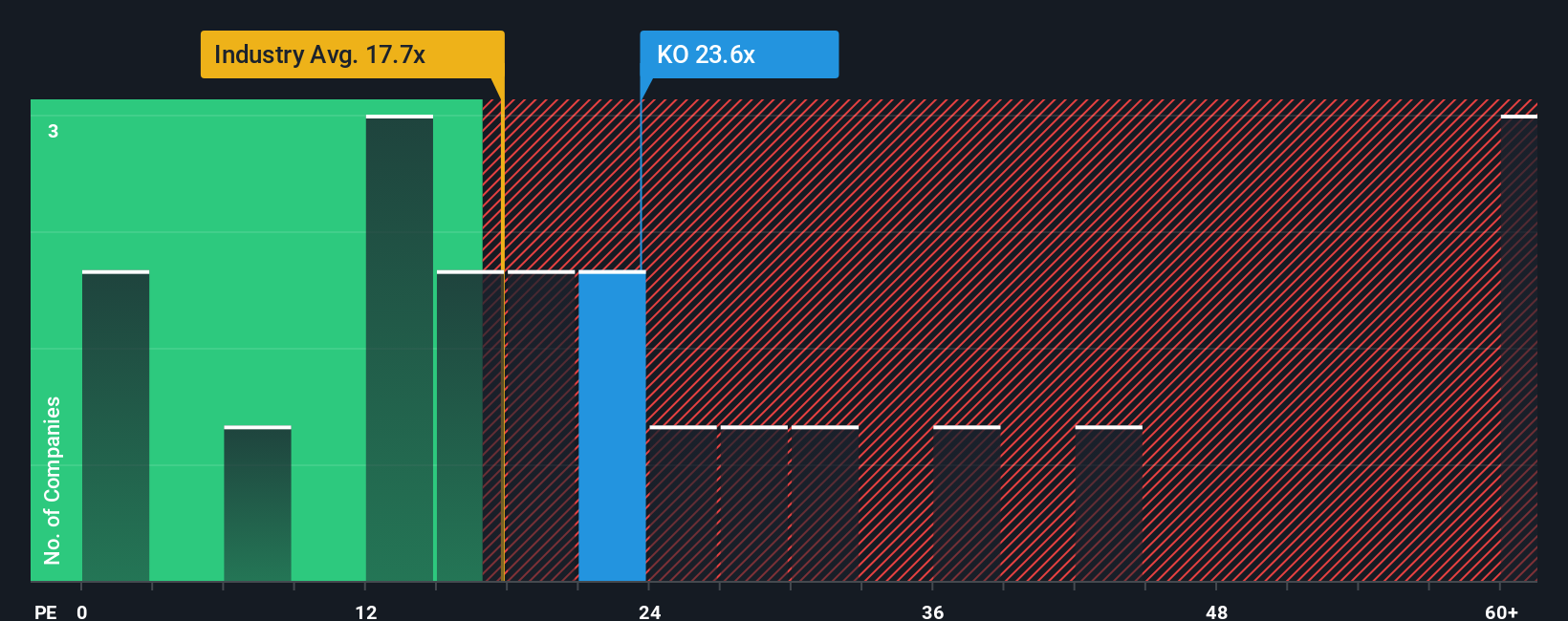

Looking past fair value models, the current valuation based on earnings tells a more complicated story. Coca-Cola trades at 23.5 times earnings, below the peer average of 26.5 but considerably above the broader beverage industry benchmark of 17.6, as well as its fair ratio of 22.7. This suggests investors are still willing to pay a premium for its stability, but leaves less room for upside if sector sentiment shifts. Is this a healthy premium, or a risk as markets change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coca-Cola Narrative

If your perspective differs or you value hands-on research, you can dive into the numbers and build your own Coca-Cola narrative in just a few minutes: Do it your way

A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act quickly to get ahead of the pack in fast-evolving sectors, lucrative trends, and future growth stories that others might miss. Use these hand-picked screeners to spot opportunities before the market catches on:

- Catch the next wave of healthcare breakthroughs by checking out these 30 healthcare AI stocks, which are changing the way medicine and AI intersect.

- Secure consistent income streams with these 16 dividend stocks with yields > 3%, offering yields that surpass 3 percent and bring financial stability to your portfolio.

- Tap into technological innovations by reviewing these 26 quantum computing stocks, where tomorrow’s quantum computing leaders are emerging today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives