- United States

- /

- Food

- /

- NYSE:K

Kellanova (K): Evaluating Valuation After Recent AI and Sustainability Advancements

Reviewed by Kshitija Bhandaru

If you have been watching Kellanova (NYSE:K) lately, the company has made some meaningful moves that could catch your attention. The latest updates focus on two fronts: driving smarter advertising through artificial intelligence and backing sustainable agriculture with partners like ADM. Both of these initiatives reveal that Kellanova is not just talking about innovation and responsibility, but actually measuring real results across its operations.

Share price performance over the past year has been a mixed bag, with recent momentum showing slight declines but long-term returns still holding up. Investors saw the stock slip around 2% over the past month and 1% over the past three months, edging down 4% so far this year. Looking further back, the five-year return is more reassuring, up 53%, which shows that while recent sentiment may be subdued, the company has delivered strong growth in the bigger picture. These operational updates arrive at a time when market momentum is not especially high, prompting some to wonder if Kellanova’s latest progress could reignite interest.

So after this combination of modest share performance and news of tangible improvements, should investors consider this a fresh entry point, or has the market already priced in these future gains?

Most Popular Narrative: 6.5% Undervalued

According to the most widely followed narrative, Kellanova shares are trading below what analysts see as their fair value, suggesting the stock is currently undervalued by a moderate margin.

"Kellanova's return to full commercial activity and stepped-up innovation across regions are expected to drive improvements in volume growth and net sales. This includes launching Pringles Mingles in North America and Cheez-It in Europe, contributing to revenue growth."

Curious how long-term forecasts, global product launches, and bold assumptions add up to an analyst target above today's price? The heart of this narrative lies in future profit margins and growth rates. These numbers are only revealed deep within the full analysis. Ready to unpack what justifies this surprising valuation? The answer will likely challenge your expectations.

Result: Fair Value of $83.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as slower consumer spending in Europe or a disappointing launch of Pringles Mingles could threaten Kellanova’s growth assumptions.

Find out about the key risks to this Kellanova narrative.Another View

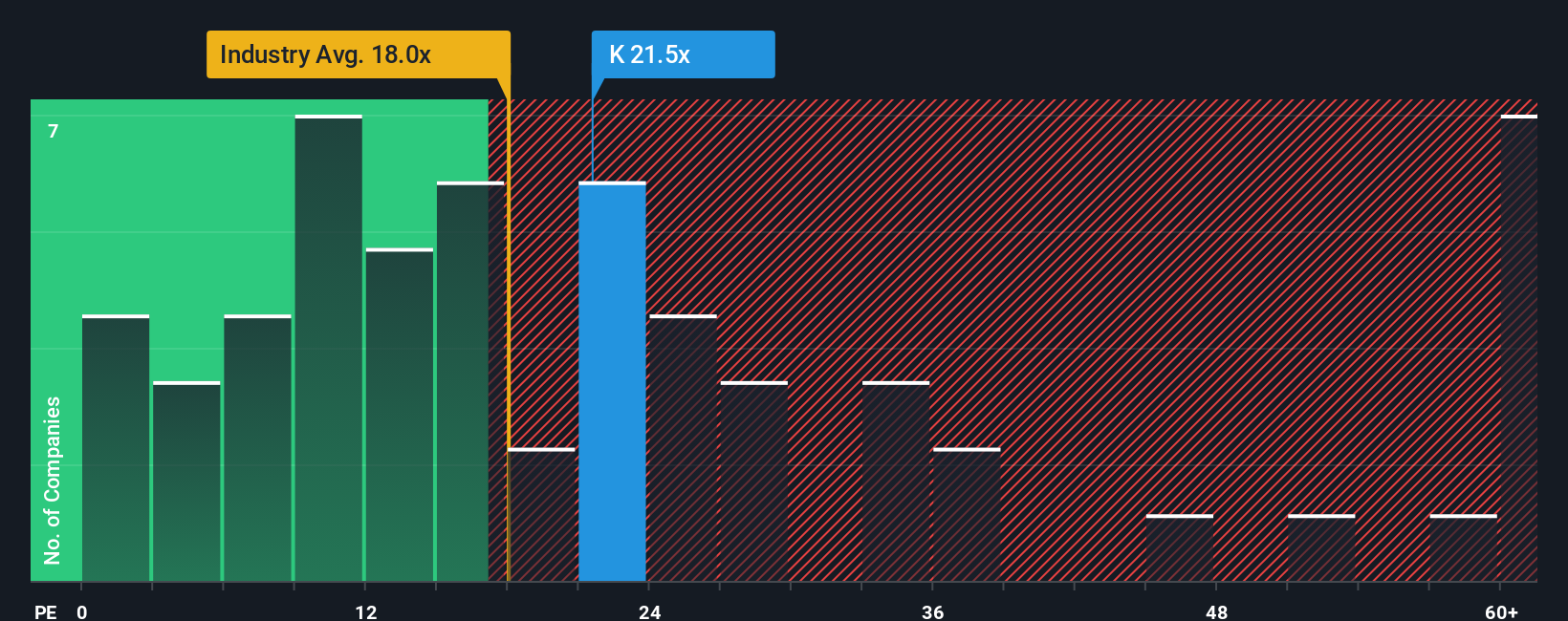

While analyst forecasts point to value in Kellanova shares, looking at the company's current price-to-earnings ratio compared to the broader US Food industry tells a different story. By this measure, shares may actually be expensive. Could the market be pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Kellanova to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Kellanova Narrative

If you want to see the numbers for yourself or arrive at your own conclusion, the tools to shape a narrative are at your fingertips. You can create your own perspective in just a few minutes. Do it your way

A great starting point for your Kellanova research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Hundreds of stocks offer growth and value opportunities beyond today’s headlines. Don’t wait to see what others are finding. Seize your chance to get ahead with these handpicked stock ideas:

- Unlock potential gains by scanning for hidden bargains and solid financials using our undervalued stocks based on cash flows.

- Spot tomorrow’s trailblazers in artificial intelligence by checking out our curated selection of AI penny stocks.

- Boost your portfolio’s income with companies offering attractive yields when you browse our picks for dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kellanova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:K

Kellanova

Manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives