- United States

- /

- Food

- /

- NYSE:INGR

Will Ingredion’s (INGR) New Buyback Reflect Resilience or Mask Deeper Operational Hurdles?

Reviewed by Sasha Jovanovic

- Ingredion Incorporated recently reported its third quarter 2025 earnings, revealing sales of US$1.82 billion and net income of US$171 million, along with updated full-year guidance and the announcement of a new share repurchase program for up to 8 million shares through 2028.

- While the company saw continued strength in its Texture & Healthful Solutions segment, ongoing challenges at its Argo plant and softer demand in Latin America affected overall results, highlighting both resilience and operational headwinds.

- We will examine how the launch of a major share buyback plan could reshape Ingredion's investment narrative amid these mixed results.

Find companies with promising cash flow potential yet trading below their fair value.

Ingredion Investment Narrative Recap

To own shares in Ingredion, investors must be confident in the company’s ability to offset ongoing challenges, like weaker demand in Latin America and operational disruptions at key U.S. plants, by capitalizing on growth in high-margin specialty ingredients. The latest earnings report has not meaningfully altered this core dynamic: resilience in the Texture & Healthful Solutions segment remains the leading catalyst, while dependence on emerging market stability and product mix trends presents the biggest current risk.

Of the recent company announcements, the launch of a new share repurchase program for up to 8 million shares stands out as most relevant. This move reinforces management’s signal of confidence in Ingredion’s financial strength and aims to balance shareholder returns, even as short-term volume and margin pressures weigh on performance.

However, against this constructive outlook, investors should pay close attention to persistent foreign exchange and economic volatility in Latin America, since...

Read the full narrative on Ingredion (it's free!)

Ingredion's outlook forecasts $7.8 billion in revenue and $696.0 million in earnings by 2028. This reflects annual revenue growth of 2.0% and a $20 million earnings increase from current earnings of $676.0 million.

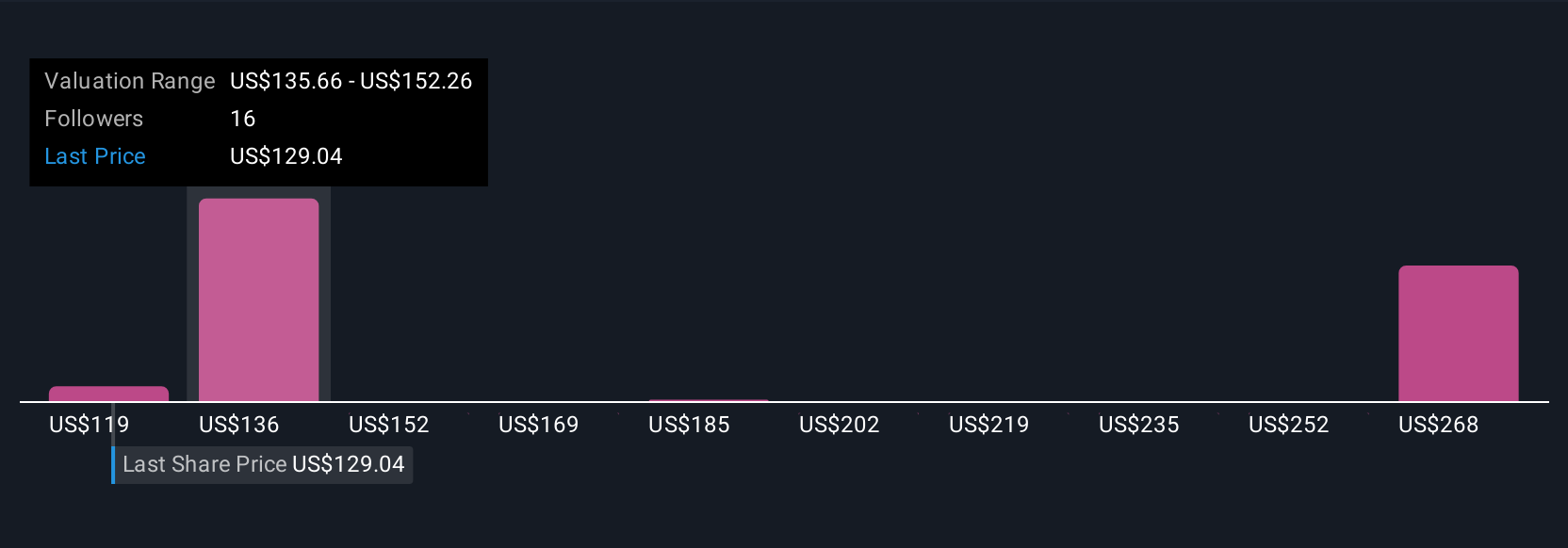

Uncover how Ingredion's forecasts yield a $141.83 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span US$96.88 to US$141.83 per share. Many see promise in the continued growth of Texture & Healthful Solutions, yet risks from emerging market volatility are shaping widely diverse opinions, explore the range of views here.

Explore 5 other fair value estimates on Ingredion - why the stock might be worth 10% less than the current price!

Build Your Own Ingredion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingredion research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Ingredion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingredion's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGR

Ingredion

Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives