- United States

- /

- Food

- /

- NYSE:INGR

Does Ingredion Incorporated's (NYSE:INGR) P/E Ratio Signal A Buying Opportunity?

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll look at Ingredion Incorporated's (NYSE:INGR) P/E ratio and reflect on what it tells us about the company's share price. Looking at earnings over the last twelve months, Ingredion has a P/E ratio of 13.34. That means that at current prices, buyers pay $13.34 for every $1 in trailing yearly profits.

View our latest analysis for Ingredion

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Ingredion:

P/E of 13.34 = $82.340 ÷ $6.173 (Based on the year to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price'.

Does Ingredion Have A Relatively High Or Low P/E For Its Industry?

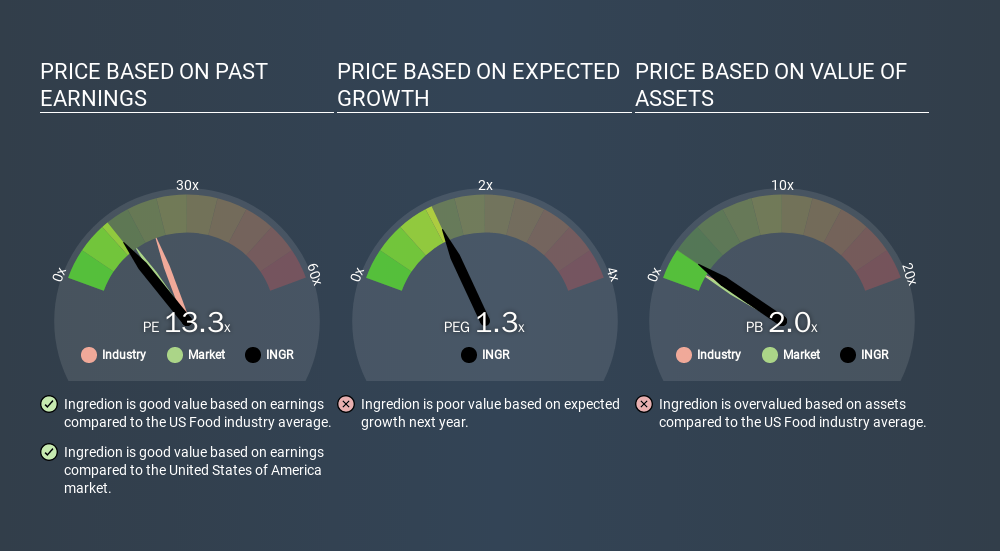

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. If you look at the image below, you can see Ingredion has a lower P/E than the average (21.2) in the food industry classification.

Ingredion's P/E tells us that market participants think it will not fare as well as its peers in the same industry. Since the market seems unimpressed with Ingredion, it's quite possible it could surprise on the upside. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. That means even if the current P/E is low, it will increase over time if the share price stays flat. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

Ingredion's earnings per share fell by 1.2% in the last twelve months. But it has grown its earnings per share by 5.1% per year over the last five years. And over the longer term (3 years) earnings per share have decreased 2.7% annually. So you wouldn't expect a very high P/E.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

So What Does Ingredion's Balance Sheet Tell Us?

Ingredion's net debt equates to 29% of its market capitalization. You'd want to be aware of this fact, but it doesn't bother us.

The Verdict On Ingredion's P/E Ratio

Ingredion trades on a P/E ratio of 13.3, which is below the US market average of 15.3. Since it only carries a modest debt load, it's likely the low expectations implied by the P/E ratio arise from the lack of recent earnings growth.

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course you might be able to find a better stock than Ingredion. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:INGR

Ingredion

Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success