- United States

- /

- Food

- /

- NYSE:HSY

Hershey (HSY) Announces Kirk Tanner As New CEO

Reviewed by Simply Wall St

The announcement of Kirk Tanner as the new CEO of Hershey (HSY) could have influenced the company's recent stock price move of 12% over the last week. Tanner, who brings extensive experience from PepsiCo, is expected to lead the company into the next phase of growth. The broader market, reflected by the S&P 500, reached new highs due to optimism surrounding a U.S.-Japan trade deal and strong corporate earnings, which likely played a role in Hershey's share price increase. The company's ascent remains in step with the market's positive sentiment during this period.

Be aware that Hershey is showing 1 possible red flag in our investment analysis.

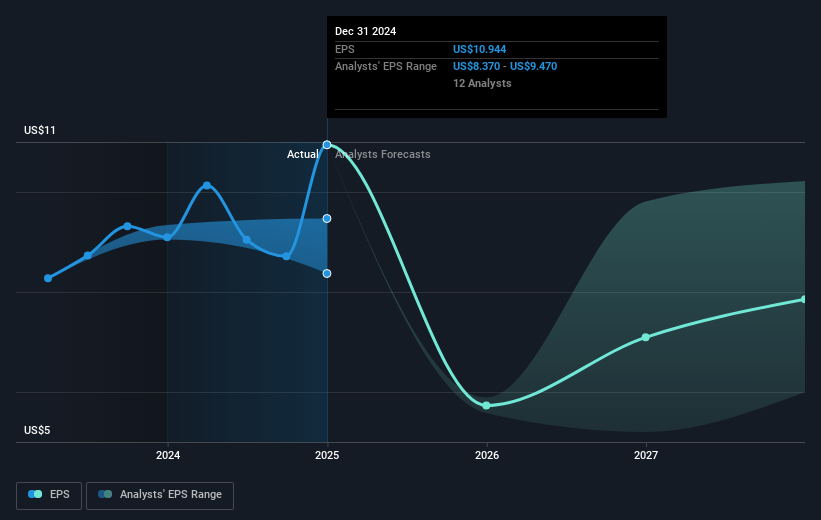

The appointment of Kirk Tanner as Hershey's new CEO coincides with a 12% rise in the company's stock price over the past week. This recent leadership change, coupled with positive market sentiment, might play a significant role in influencing Hershey's narrative around strategic diversification and innovation efforts, such as the new Reese's product line. Analysts project a revenue growth of 4.2% annually over the next three years, though the impact of high cocoa prices and tariffs remains a concern. Tanner's background could be critical in navigating these challenges and potentially stabilizing or boosting Hershey's net margins.

Over the last five years, Hershey's total shareholder return, which includes share price gains and dividends, has been a considerable 39.80%. This performance showcases the company's resilience and success in shareholder value creation over a more extended period. However, over the past year, Hershey underperformed the overall U.S. market while still outpacing the broader U.S. Food industry. With a current share price of US$181.69, Hershey's stock is trading above the consensus analyst price target of US$166.43. This suggests that the market is pricing in the company's growth prospects or accounting for potential strategic improvements under new leadership.

Assess Hershey's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives