- United States

- /

- Food

- /

- NYSE:HRL

Should Weaker Earnings and Guidance Prompt Reevaluation of Hormel Foods' (HRL) Dividend-Driven Investment Thesis?

Reviewed by Sasha Jovanovic

- Hormel Foods recently reported its fiscal Q3 2025 results, missing analysts' expectations on adjusted earnings per share and offering weaker forward guidance that points to only modest revenue growth in the coming quarter.

- Despite ongoing operational challenges, Hormel Foods has maintained its reputation as a steady dividend payer, marking 59 consecutive years of dividend increases and reinforcing its image as a reliable income provider for shareholders.

- We will explore how Hormel's weaker earnings and growth guidance could reshape its investment narrative around revenue growth and margin recovery.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hormel Foods Investment Narrative Recap

To own Hormel Foods, investors need to believe that its leadership in protein-centric food categories, steady innovation, and strong dividend history can outweigh current setbacks in revenue and margin growth. The recent earnings disappointment and modest guidance did little to change the near-term outlook, where the main catalyst remains successful margin recovery while the greatest risk is ongoing cost inflation and slow pricing pass-through, an impact that remains material in light of Q3's miss.

Of all recent events, the reaffirmed quarterly dividend, now at $0.29 per share, stands out. This consistent payout comes at a time when earnings are under pressure and reinforces Hormel’s value as an income provider, even as growth is challenged. Against a backdrop of lower guidance, this reliability plays to the core reason many maintain a stake in the company.

But despite this stability, investors must not overlook the risk that persistent commodity inflation poses for margin recovery and future earnings because...

Read the full narrative on Hormel Foods (it's free!)

Hormel Foods' narrative projects $13.0 billion revenue and $952.2 million earnings by 2028. This requires 2.5% yearly revenue growth and a $197.7 million earnings increase from $754.5 million.

Uncover how Hormel Foods' forecasts yield a $28.75 fair value, a 22% upside to its current price.

Exploring Other Perspectives

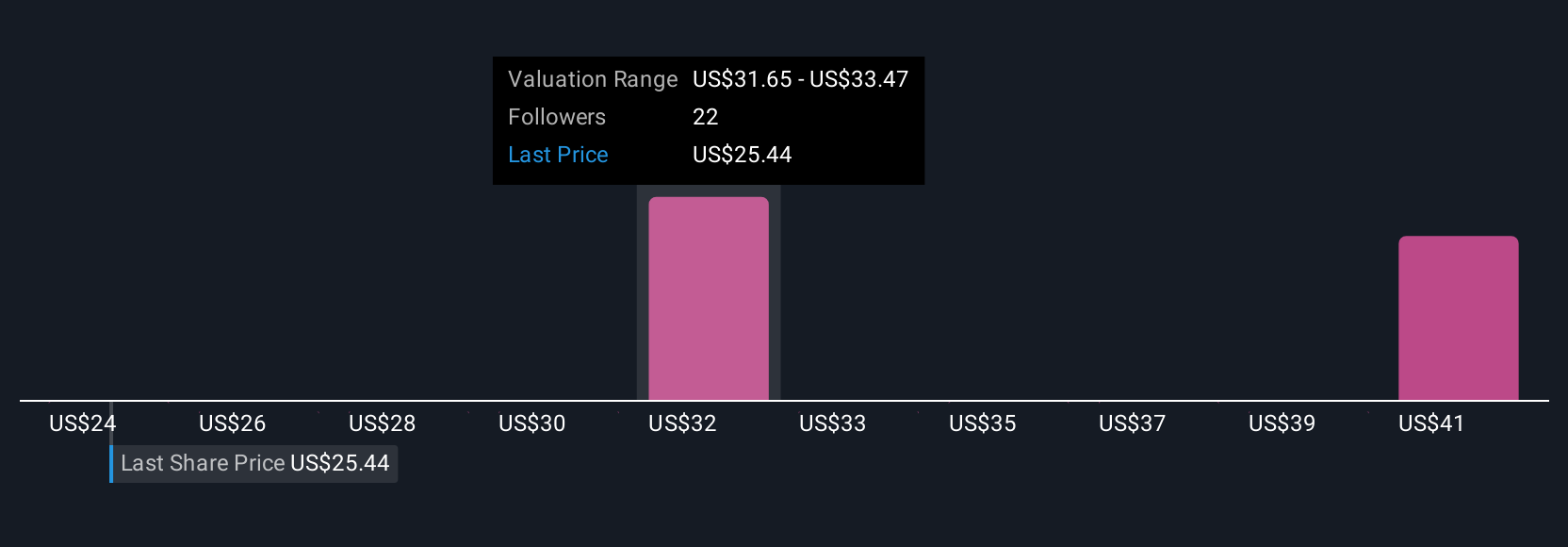

Five private investor fair value estimates from the Simply Wall St Community span US$24.36 to US$42.58 per share. As you weigh these diverse target ranges, remember that ongoing commodity cost pressures remain a key challenge for Hormel and could impact its return to stronger growth.

Explore 5 other fair value estimates on Hormel Foods - why the stock might be worth just $24.36!

Build Your Own Hormel Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hormel Foods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hormel Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hormel Foods' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hormel Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.