- United States

- /

- Food

- /

- NYSE:HRL

Hormel Foods (HRL) Valuation Check After Mixed Earnings and 2026 Turnaround Guidance

Reviewed by Simply Wall St

Hormel Foods (HRL) turned heads after an earnings update in which revenue fell short but profit came in ahead of expectations, and management reiterated its 2026 turnaround plan focused on targeted growth and cost savings.

See our latest analysis for Hormel Foods.

Despite the upbeat 2026 guidance and a fresh shelf registration that gives Hormel more financial flexibility, the share price has only managed a 1 month share price return of 8.26% while the 3 year total shareholder return of negative 43.87% shows that longer term momentum has clearly faded.

If Hormel’s slow burn turnaround has you rethinking your watchlist, this is a good moment to explore fast growing stocks with high insider ownership for ideas with stronger momentum and insider conviction.

With earnings under pressure, a 49 percent implied intrinsic discount and only modest gains despite upgraded analyst targets, is Hormel a classic value play setting up for a rebound, or is the market already pricing in its 2026 recovery?

Most Popular Narrative: 10.6% Undervalued

With Hormel Foods last closing at $23.85 versus a narrative fair value near the mid 20s, the story frames today’s price as a discount to steady, compounding fundamentals rather than a broken thesis.

The company's active modernization, innovation, and investment in healthier, leaner, and natural products (e.g., Jennie O, Applegate, renovation of core brands) aligns with consumers' rising emphasis on health and wellness, helping preserve pricing power and protect or expand net margins in the future.

Want to see how slow and steady revenue growth, margin rebuild, and a richer earnings multiple combine into that valuation gap? The narrative lays out a step by step roadmap, from cautious top line assumptions to a profit profile that needs a premium rating to work. Curious how those moving parts justify paying more for a food stock with muted sales growth today? Dive in to unpack the full chain of assumptions behind this fair value call.

Result: Fair Value of $26.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity inflation and slower than expected pricing power could easily cap margin expansion and derail the rebound reflected in today’s valuation.

Find out about the key risks to this Hormel Foods narrative.

Another View: Earnings Multiple Sends a Different Signal

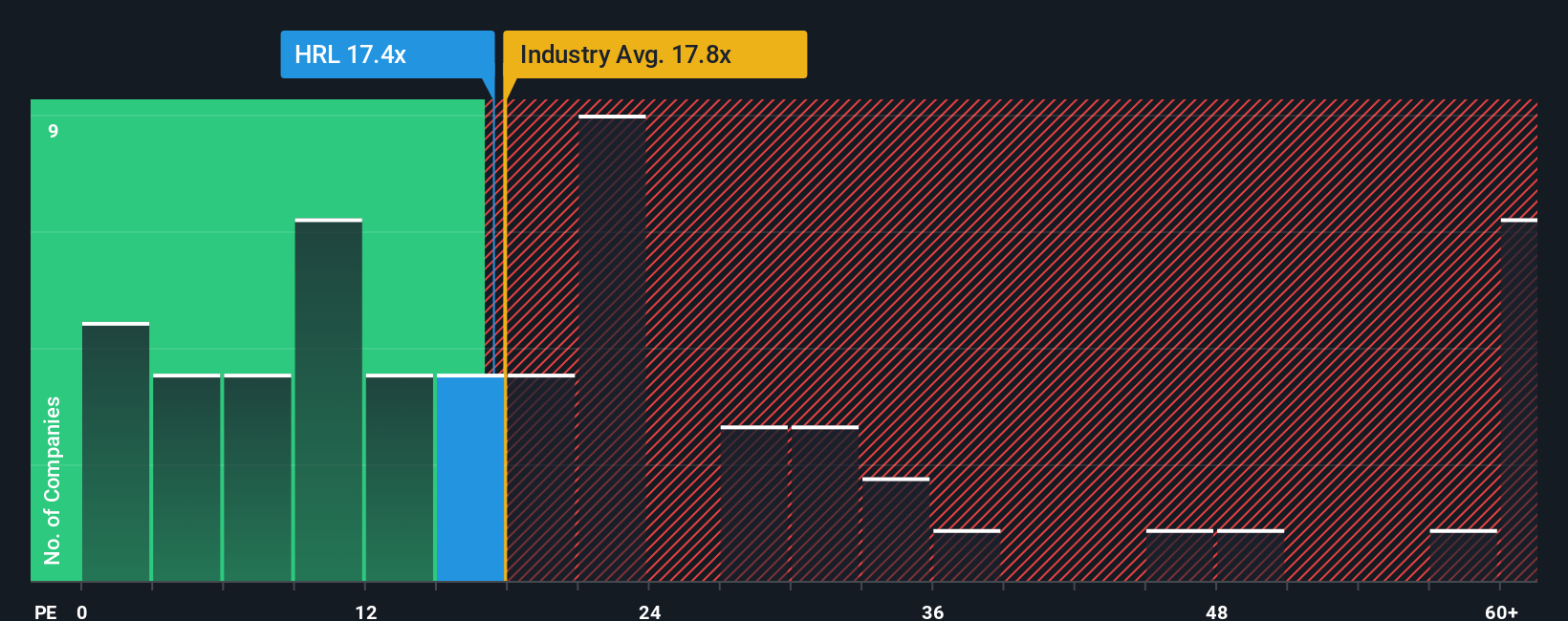

When moving away from narrative fair value, the current price starts to look stretched. Hormel trades on a price to earnings ratio of 27.4x versus a US Food industry average of 20.6x, a peer average of 19.7x, and a fair ratio of 21.7x, implying downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hormel Foods Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative in minutes: Do it your way.

A great starting point for your Hormel Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one turnaround story when you can confidently scan the market for stronger trends, smarter risk reward setups, and fresh opportunities today.

- Explore market mispricings by targeting these 901 undervalued stocks based on cash flows that may be trading below their assessed potential based on future cash flows.

- Consider the AI revolution early by focusing on these 27 AI penny stocks positioned at the intersection of rapid innovation and scalable business models.

- Seek reliable income potential through these 15 dividend stocks with yields > 3% offering yields that can help support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hormel Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026