When the market gets turbulent, the Consumer Staples sector gets interesting as money looks for safety. So far, 2022 looks special as high inflation pressures the economy while geopolitical turmoil threatens the food supply.

Yet, General Mills, Inc. (NYSE: GIS) is raising guidance, and we'll look into 3 takeaways that show how they can successfully fight off those challenges. Three Arguments for General Mills' (NYSE:GIS) Outperformance in 2022

See our latest analysis for General Mills

FY Third quarter 2022 results

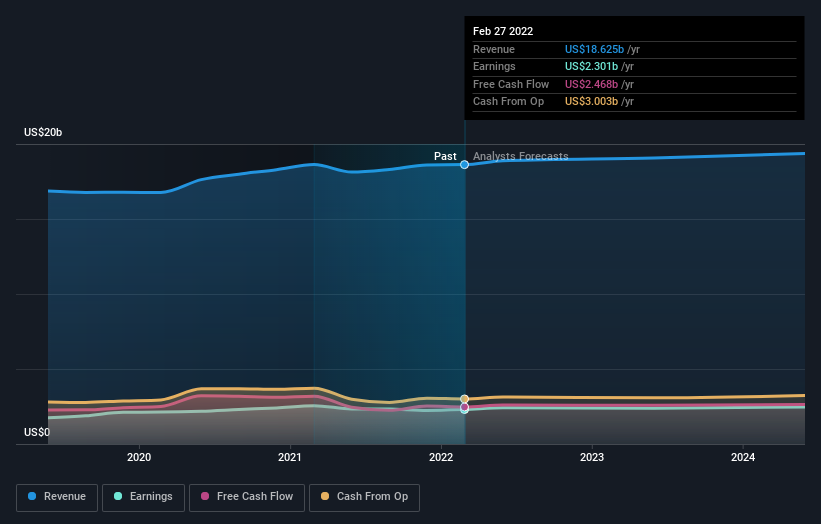

- EPS: US$1.09 (up from US$0.97 in 3Q 2021).

- Revenue: US$4.54b (flat on 3Q 2021).

- Net income: US$660.3m (up 11% from 3Q 2021).

- Profit margin: 15% (up from 13% in 3Q 2021).

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 38%.

Over the last 3 years, on average, earnings per share have increased by 10% per year, whereas the company’s share price has risen by 9% per year.

3 Arguments for Better Performance

1. Growing Sales: Compared to the pre-pandemic levels, the company has grown both net sales(+11%) and adjusted earnings per share (+12%). Now the company expects organic sales to increase by 5%, while the previous range indicated between 4-5%.

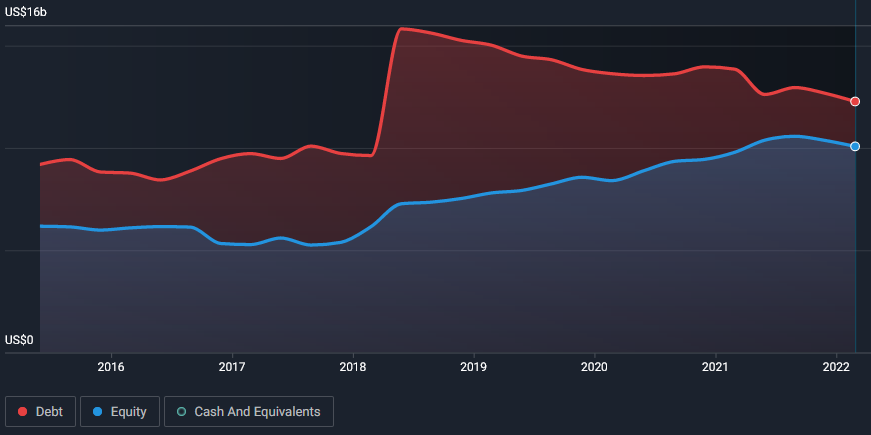

2. Reducing Debt: Management has actively worked on deleveraging the company. Nowadays, the debt-to-equity ratio stands at 113%, but it has been reduced from 184% over the last 5 years. Debt remains comfortably covered by operating cash flow.

You can find the complete Financial Health outlook for General Mills on our platform.

3. Successfully Managing Supply-Chain: While some categories remained stable through the supply chain crunch, others experienced a temporary dip but only to 75% on-shelf availability. This development is important for mitigating potential switching over to competitors’ products and fortifying brand loyalty.

Can we expect growth from General Mills?

Future outlook is an important aspect when you’re buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a low price is always a good investment, so we need to consider the company's future expectations. General Mills' earnings are expected to be in the teens in the upcoming years, indicating a solid future ahead.

What this means for you:

Year-to-date, the Consumer Staples sector is down, it still outpaces the broad market as a defensive-oriented sector. Meanwhile, while a price-to-earnings ratio of 18 might look high, we have to point out that the sector average is 23.8x, with some prominent names like Costco Wholesale (NYSE: COST) trading as high as 45.4x. Feel free to explore the full sector breakdown.

If the company stays on this path, we can see the stock catching up to those valuations, especially if the current broad market rally starts losing steam.

If you want to dive deeper into General Mills, you'd also look into what risks it is currently facing. You'd be interested to know that we found 2 warning signs for General Mills, and you'll want to know about them. If you are no longer interested in General Mills, you can use our free platform to see our list of over 50 other stocks with high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:GIS

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026