- United States

- /

- Food

- /

- NYSE:GIS

General Mills (GIS): Evaluating Valuation After Strong Q1 Results and New Long-Term Growth Strategy

Reviewed by Kshitija Bhandaru

If you're watching General Mills (GIS) lately, you know there’s more than just breakfast cereal behind the headlines. The company’s shares have caught investors’ attention after fiscal first-quarter results beat Wall Street expectations, thanks in large part to targeted bets on core brands and ongoing innovation across its portfolio. Alongside solid earnings, General Mills outlined a path forward: it reaffirmed its fiscal 2026 outlook, continued spending on R&D, and invited investors to its upcoming Investor Day for a closer look at its long-term ambitions. For anyone weighing what to do with their GIS shares, this combination of upside surprise and future talk feels like a real moment to pause and reassess.

Over the past year, General Mills hasn’t exactly been the market’s darling, with the stock declining nearly 29%. Price action has faded over the past 3 months as well. Still, the recent momentum around earnings, steady share repurchases, and a fresh dividend increase suggest new layers investors should consider. When viewed alongside earlier developments, such as tough North American retail trends and leadership changes, it is fair to say that sentiment is still shifting. However, the conversation about value versus risk is very much alive.

After a year of choppy performance and renewed optimism on the back of stronger earnings, is the market overlooking an opportunity to buy General Mills, or is the latest rally already baking in the company’s next phase?

Most Popular Narrative: 6.6% Undervalued

According to the most widely followed narrative, General Mills appears undervalued by 6.6% compared to consensus estimates. This view summarizes the outlook from leading market analysts and converges on a discounted fair value for the company despite tepid growth expectations and near-term headwinds.

"Guidance for FY26 and initial Q4 results have generally come in below street expectations, leading to EPS resets and lower price targets from several analysts. Weak volume trends, sluggish center store category growth, and market share pressures continue to weigh on outlook. However, sequential improvements in volume share are being noted."

Could General Mills surprise the market in the coming years? The fair value calculation here hinges on a handful of future-facing financial assumptions and a bold projected recovery. Want to see what levers analysts believe could unlock hidden upside for GIS, and just how achievable those targets really are? The details behind this valuation may not be what you expect.

Result: Fair Value of $53.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stronger marketing on core brands, or better-than-expected innovation launches, could quickly shift the outlook and challenge the prevailing cautious sentiment.

Find out about the key risks to this General Mills narrative.Another View: What Does Our DCF Model Say?

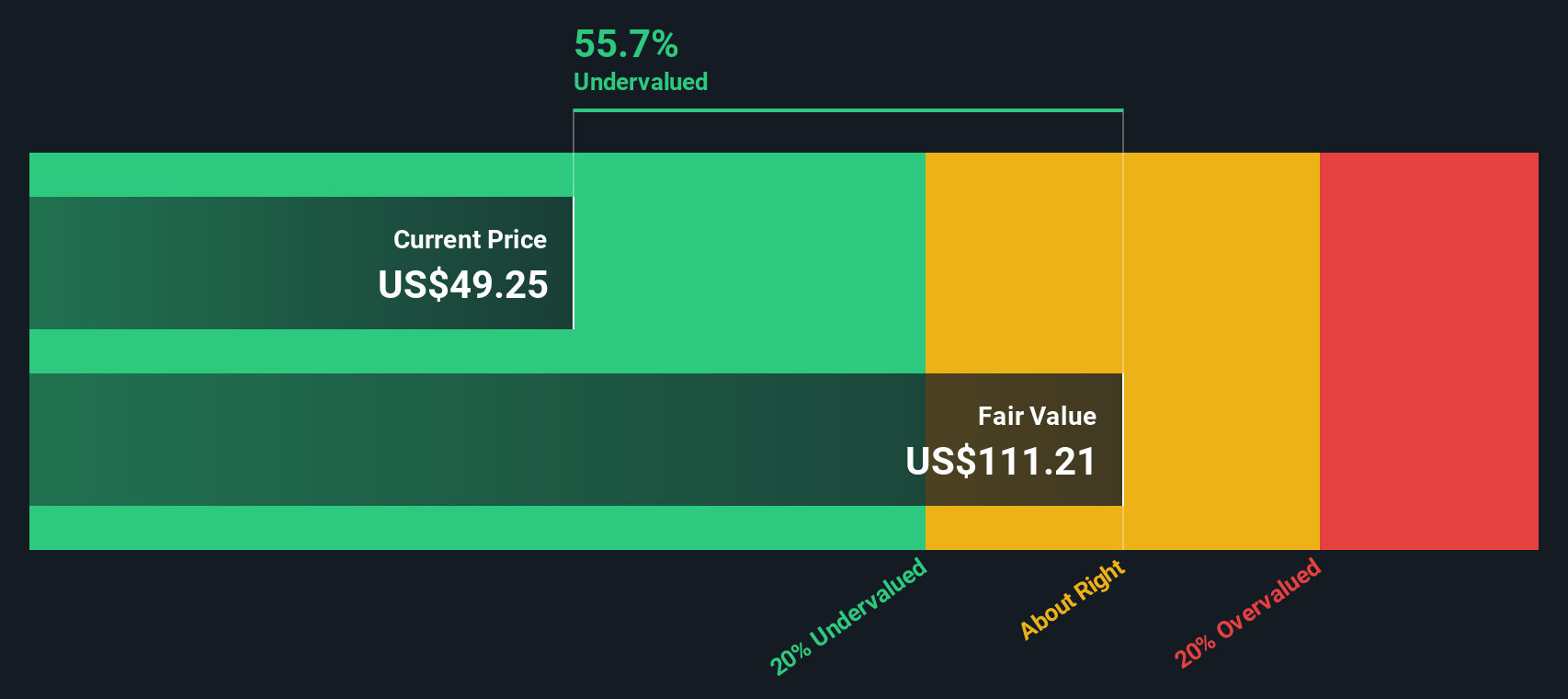

Looking from a different angle, our DCF model also points to undervaluation for General Mills. This approach focuses on projected cash flows instead of earnings ratios and offers another layer to the valuation discussion. But could this method capture risks or potential that the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out General Mills for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own General Mills Narrative

If you find yourself wanting to test your own assumptions or dig deeper into what drives General Mills’ valuation, the tools here let you build your own take in just minutes. Do it your way.

A great starting point for your General Mills research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

The best opportunities often come to those ready to move with the market, not just watch from the sidelines. Supercharge your research by checking out these handpicked stock themes and stay ahead of the investing crowd:

- Spot potential in companies reshaping healthcare using artificial intelligence by heading straight to the healthcare AI stocks.

- Unlock higher income streams by exploring dividend stocks with yields > 3% offering attractive yields and reliable payouts for long-term investors.

- Catch early momentum in up-and-coming tech innovators making an impact. Review the latest AI penny stocks poised for breakout growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIS

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives