- United States

- /

- Food

- /

- NYSE:DOLE

The Bull Case For Dole (DOLE) Could Change Following Launch of Colada Royale Pineapple and Social Initiative

Reviewed by Sasha Jovanovic

- Dole announced the launch of its new Colada Royale Pineapple, featuring unique coconut and piña colada notes, which became available in North American supermarkets after its debut at the IFPA Global Produce and Floral Show in October 2025.

- Proceeds from the new product will help fund a community center for farm workers in Honduras, highlighting Dole’s commitment to social responsibility and worker welfare alongside product innovation.

- We’ll now explore how the introduction of the Colada Royale Pineapple may influence Dole’s investment narrative and growth outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Dole Investment Narrative Recap

To be a shareholder in Dole, you need to believe in the long-term resilience of its global fresh produce business, its ability to defend margins in a competitive industry, and the potential for new product innovation to support premium pricing. While the Colada Royale Pineapple launch reinforces Dole’s focus on brand and value-added produce, its influence on immediate earnings or margins appears limited, with extreme weather and commodity risk remaining the top short-term catalyst and risk to monitor.

Among recent company updates, Dole’s follow-on equity offering of US$157.90 million stands out. Fresh equity can provide greater financial flexibility to manage debt, support operational investments, and buffer against unpredictable sourcing and shipping costs, issues interlinked with the latest product launch and its stated social impact.

Yet, despite promising fresh initiatives, the real challenge for investors lies in rising working capital needs and elevated net debt, especially if...

Read the full narrative on Dole (it's free!)

Dole's outlook anticipates $9.1 billion in revenue and $163.0 million in earnings by 2028. This is based on a projected 1.4% annual revenue growth and a $49.1 million increase in earnings from the current $113.9 million.

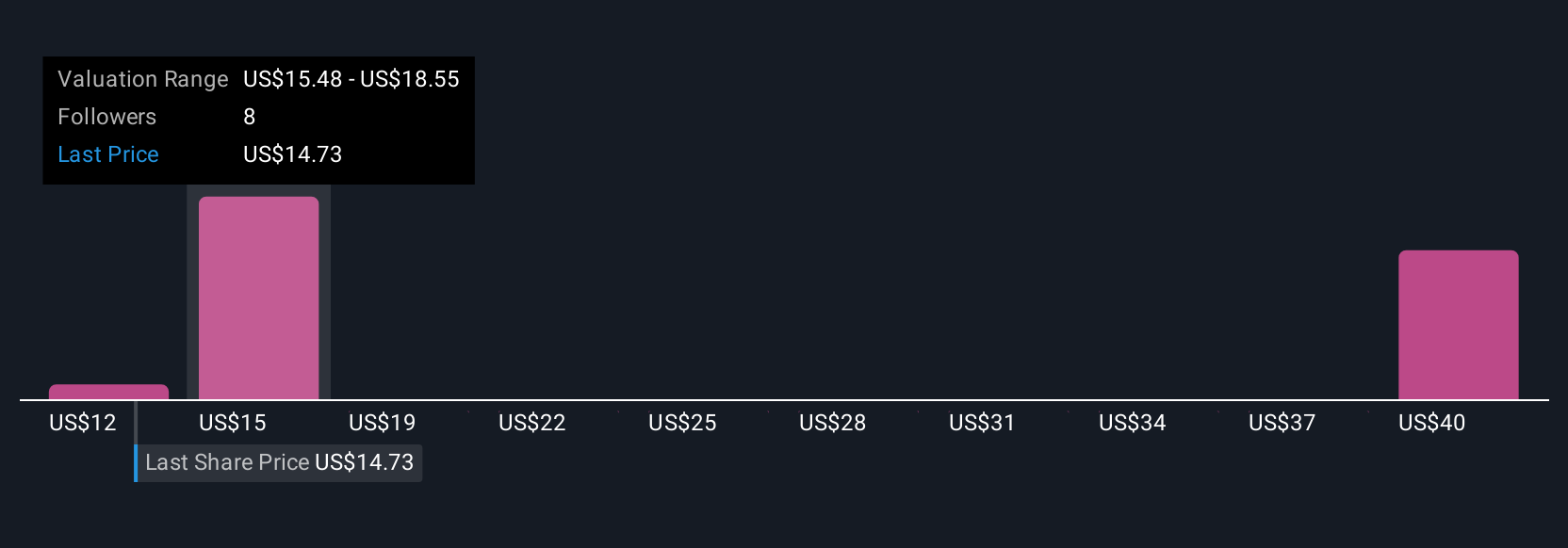

Uncover how Dole's forecasts yield a $17.83 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community range from US$12.41 to US$42.83 per share. Many see future industry demand as supportive, but ongoing weather and supply chain risks are never far from mind, explore different viewpoints to see how your stance compares.

Explore 4 other fair value estimates on Dole - why the stock might be worth 6% less than the current price!

Build Your Own Dole Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dole research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dole research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dole's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOLE

Dole

Engages in sourcing, processing, marketing, and distribution of fresh fruit and vegetables worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives