- United States

- /

- Food

- /

- NYSE:DOLE

Did Dole’s (DOLE) Colada Royale Pineapple Debut Just Shift Its Produce Innovation Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Dole unveiled the DOLE® Colada Royale pineapple, a sustainably grown, non-GMO fruit with piña colada and coconut notes, as well as a program to expand mango offerings from Ecuador for enhanced year-round supply and organic options.

- These innovations highlight Dole’s efforts to diversify its product range, cater to evolving consumer preferences, and reinforce sustainability commitments, while also engaging communities near key sourcing locations.

- We'll explore how the launch of the Colada Royale pineapple could shape Dole’s investment narrative through greater produce innovation and differentiation.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Dole Investment Narrative Recap

To be a Dole shareholder, you need confidence in the global demand for fresh produce, Dole’s widening product portfolio, and its capacity to manage costs when sourcing and shipping pressures mount. The new DOLE® Colada Royale pineapple and expanded Ecuador mango program showcase efforts to diversify and appeal to consumer trends, but these recent launches do not materially shift the biggest short term catalyst, which remains Dole’s ability to deliver stable earnings despite rising sourcing costs. The most relevant development tied to current catalysts is the recently completed $157.9 million follow-on equity offering, which strengthens Dole’s balance sheet as it supports innovation and addresses working capital needs during volatile operating periods. Yet, in contrast to product breakthroughs and capital raises, investors should be aware of the operational risks tied to crop disease and commodity price swings that continue to...

Read the full narrative on Dole (it's free!)

Dole's narrative projects $9.1 billion revenue and $163.0 million earnings by 2028. This requires 1.4% yearly revenue growth and a $49.1 million earnings increase from $113.9 million today.

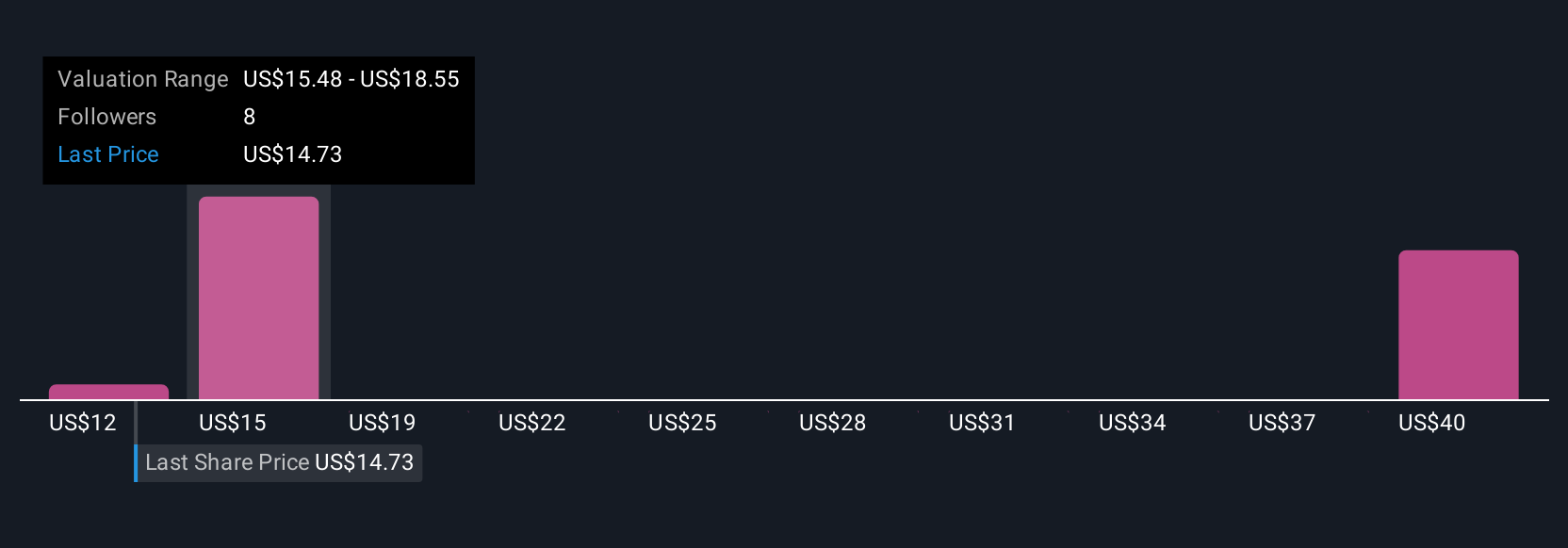

Uncover how Dole's forecasts yield a $17.83 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$12.41 to US$42.41, drawing on four unique analyses. Given Dole’s exposure to sourcing and shipping cost pressures, you may want to explore this wide range of viewpoints for further insight into what could shape performance ahead.

Explore 4 other fair value estimates on Dole - why the stock might be worth 6% less than the current price!

Build Your Own Dole Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dole research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dole research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dole's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOLE

Dole

Engages in sourcing, processing, marketing, and distribution of fresh fruit and vegetables worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives