- United States

- /

- Food

- /

- NYSE:DAR

How Leadership Changes and Tax Credit Sales Could Shape Darling Ingredients' (DAR) Strategy and Flexibility

Reviewed by Sasha Jovanovic

- Darling Ingredients announced that Matt Jansen, Chief Operating Officer – North America, departed the company effective September 26, 2025, and separately, the firm agreed to sell US$125 million in production tax credits from its Diamond Green Diesel joint venture under the Inflation Reduction Act, with proceeds expected in 2025.

- This combination of leadership change and financial maneuvers reflects Darling Ingredients’ ongoing focus on operational adaptation and balance sheet flexibility amid evolving industry conditions.

- We'll explore how the announced sale of production tax credits may impact Darling Ingredients’ investment narrative and future outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Darling Ingredients Investment Narrative Recap

Shareholders in Darling Ingredients are typically focused on the company’s role as a key supplier to the renewable fuels and specialty ingredients markets, where policy change and demand trends are crucial drivers. The announced sale of US$125 million in production tax credits is a factor in Darling’s efforts to support near-term cash generation and debt reduction, but has minimal direct impact on the immediate regulatory risks and industry margin pressures that currently overshadow the biggest near-term catalysts.

Among the recent company updates, the agreement to sell production tax credits generated from the Diamond Green Diesel joint venture stands out, as it directly addresses Darling Ingredients’ high leverage. While proceeds from this deal could allow greater financial flexibility, near-term earnings and cash generation remain tied to broader regulatory developments and market pricing for renewable fuels.

However, with the volatility driven by regulatory and policy uncertainty around renewable fuel obligations, investors should be aware that…

Read the full narrative on Darling Ingredients (it's free!)

Darling Ingredients' outlook anticipates $6.5 billion in revenue and $673.1 million in earnings by 2028. This scenario assumes 4.3% annual revenue growth and a $567.7 million increase in earnings from the current $105.4 million level.

Uncover how Darling Ingredients' forecasts yield a $46.17 fair value, a 47% upside to its current price.

Exploring Other Perspectives

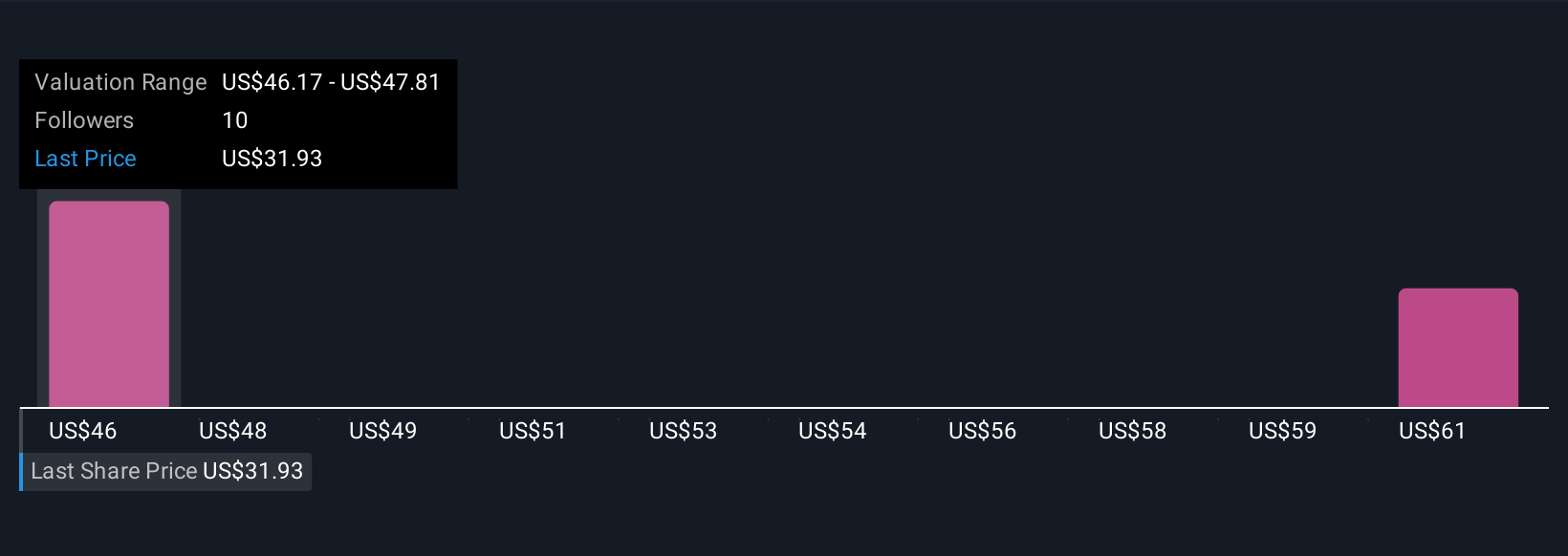

Two members in the Simply Wall St Community valued Darling Ingredients between US$46.17 and US$62.62 per share. While expectations for a resolution to regulatory policy uncertainty are shaping professional outlooks, community estimates differ significantly, offering you a range of viewpoints to consider.

Explore 2 other fair value estimates on Darling Ingredients - why the stock might be worth just $46.17!

Build Your Own Darling Ingredients Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Darling Ingredients research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Darling Ingredients research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Darling Ingredients' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAR

Darling Ingredients

Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives