- United States

- /

- Food

- /

- NYSE:DAR

Darling Ingredients (DAR): Assessing Valuation After $125 Million Tax Credit Sale and Policy Tailwinds

Reviewed by Kshitija Bhandaru

Darling Ingredients (DAR) has agreed to sell $125 million in production tax credits, a move expected to boost the company’s near-term financials. Proceeds, slated for 2025, are connected to ongoing policy tailwinds.

See our latest analysis for Darling Ingredients.

After a tough stretch marked by softer renewable diesel margins and an executive departure, Darling Ingredients has seen renewed attention due to its upcoming $125 million tax credit sale and the tailwind from new EPA fuel standards. The 1-year total shareholder return sits at -14%, signaling lingering skepticism. However, recent policy momentum and fresh capital could set the stage for better days ahead.

If these shifting dynamics have you watching the broader market, it’s the perfect moment to discover fast growing stocks with high insider ownership

With shares trading at a significant discount to analyst targets and fresh capital on the way, is this a rare window to scoop up Darling Ingredients before growth returns? Or is the market already accounting for the company’s future potential?

Most Popular Narrative: 31.2% Undervalued

With Darling Ingredients closing at $31.75 and the most popular narrative suggesting a fair value of $46.17, the gap is significant. This prompts a closer look at what drives this view.

Ongoing expansion into high-growth, high-margin specialty ingredients via the Nextida JV and rising global demand for health & wellness products (e.g., collagen, functional peptides), backed by scientific validation and early repeat orders, is expected to meaningfully broaden Darling's product portfolio, diversify revenues, and drive Food segment EBITDA growth starting in 2026.

What’s the hidden story behind this steep discount? Dive into how analysts are betting on a shift toward specialty ingredients and bold financial projections. The real surprise lies in the forecasts powering this aggressive valuation. Want to see the numbers behind the optimism?

Result: Fair Value of $46.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty around biofuels regulation and weak renewable diesel margins could still prevent Darling Ingredients from realizing analysts' optimistic profit forecasts.

Find out about the key risks to this Darling Ingredients narrative.

Another View: What Do Valuation Ratios Say?

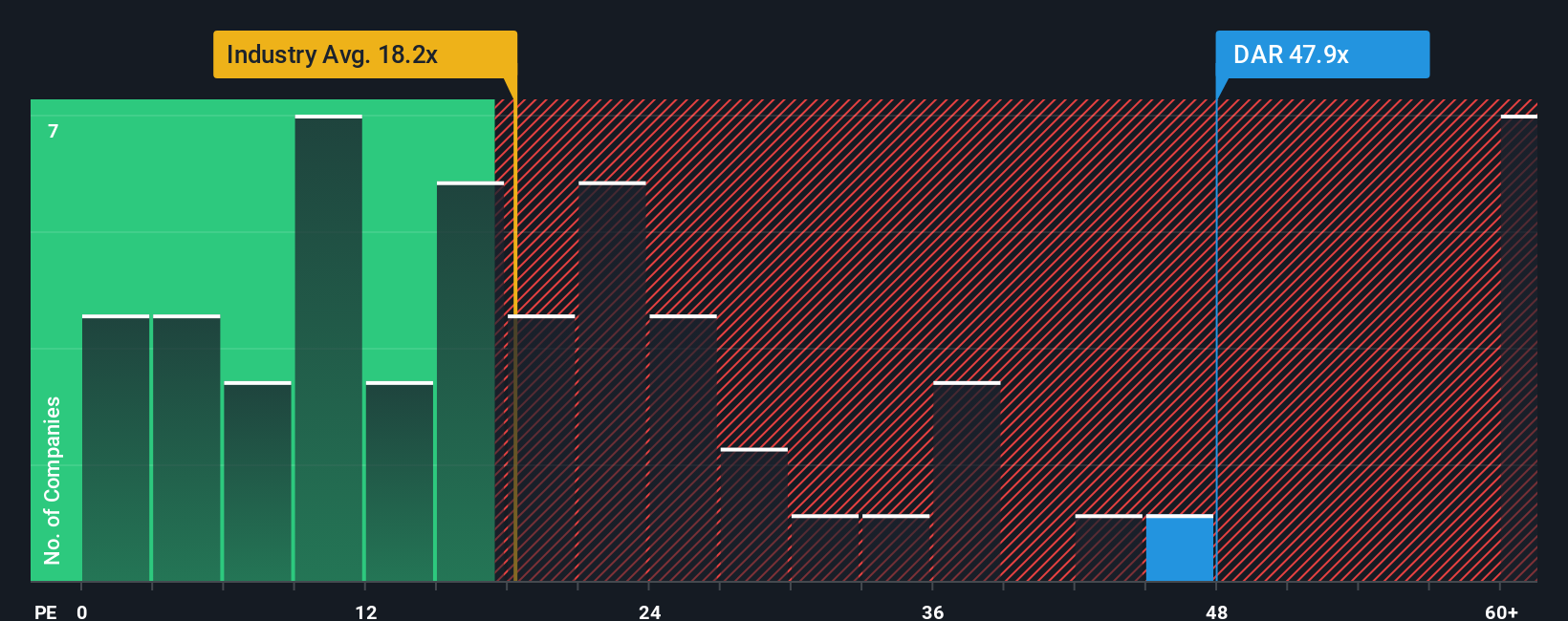

Taking a look at how the company is priced compared to both its peers and the broader industry, Darling Ingredients trades at a price-to-earnings ratio of 47.7x, far higher than the US Food industry average of 18x and the peer average of 15.4x. It also sits above the fair ratio of 41.5x, suggesting that, while analysts may see upside, the stock could be carrying added valuation risk in the near term. Is the market overly optimistic, or does it see something the numbers don't capture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Darling Ingredients Narrative

If you see things differently or would rather dive into the details yourself, it takes just a few minutes to shape your own perspective. Do it your way

A great starting point for your Darling Ingredients research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to just one stock when there are countless winning ideas out there. Take action and find companies with the strongest potential using analyst-backed insights and proven strategies.

- Uncover cash-flow bargains by unlocking undervalued stocks that stand out from the crowd using these 896 undervalued stocks based on cash flows.

- Capitalize on rapid healthcare innovations by searching for tomorrow’s leaders through these 32 healthcare AI stocks.

- Boost your portfolio’s income with steady performers and cherry-pick reliable options among these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAR

Darling Ingredients

Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives