- United States

- /

- Food

- /

- NYSE:CAG

Conagra Brands (CAG): Assessing Valuation in Light of its "Future of Snacking 2025" Strategy Shift

Reviewed by Simply Wall St

Conagra Brands (CAG) just pulled back the curtain on its "Future of Snacking 2025" report, highlighting major trends influencing the $150 billion snacking market. From bold flavor innovations to globally inspired snacks and better-for-you options, Conagra is signaling a strong focus on product reinvention and category growth. For investors evaluating the stock, this proactive response to evolving consumer tastes brings a new storyline that could shift expectations for the business and its valuation.

Looking at the broader picture, Conagra’s share price has experienced a significant decline, falling 35% over the past year and about 16% in the past three months. Recent months have offered little relief, despite the company's ongoing efforts to modernize its portfolio and improve operational efficiency. In this context, optimism from innovation balances with persistent challenges to earnings and sentiment, leaving momentum subdued for the time being.

With the stock at lower levels while management intensifies growth initiatives, some may wonder whether Conagra is now undervalued or if the market is already anticipating several years of transformation and factoring that into the price.

Most Popular Narrative: 8.6% Undervalued

According to community narrative, Conagra Brands is considered undervalued with a fair value estimate 8.6% above its current share price. This estimate is based on analysts’ consensus future projections and a discount rate of 6.81%.

Strong consumer demand and steady consumption trends bode well for future revenue growth. This suggests that the company can maintain its top-line momentum even in a challenging economic environment. The stabilization of supply chain constraints, particularly in the latter half of next year, is expected to improve operational efficiencies and margins, which could benefit overall earnings performance.

Curious about the factors driving this positive valuation? The analysts’ narrative highlights stable demand, operational improvements, and headline financial figures that may stand out. Explore the projections and catalyst assumptions that could influence your outlook on Conagra’s future value.

Result: Fair Value of $20.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent inflation or supply chain disruptions could quickly change the company's outlook. This may introduce fresh uncertainty about future profitability and market performance.

Find out about the key risks to this Conagra Brands narrative.Another View: The DCF Model Perspective

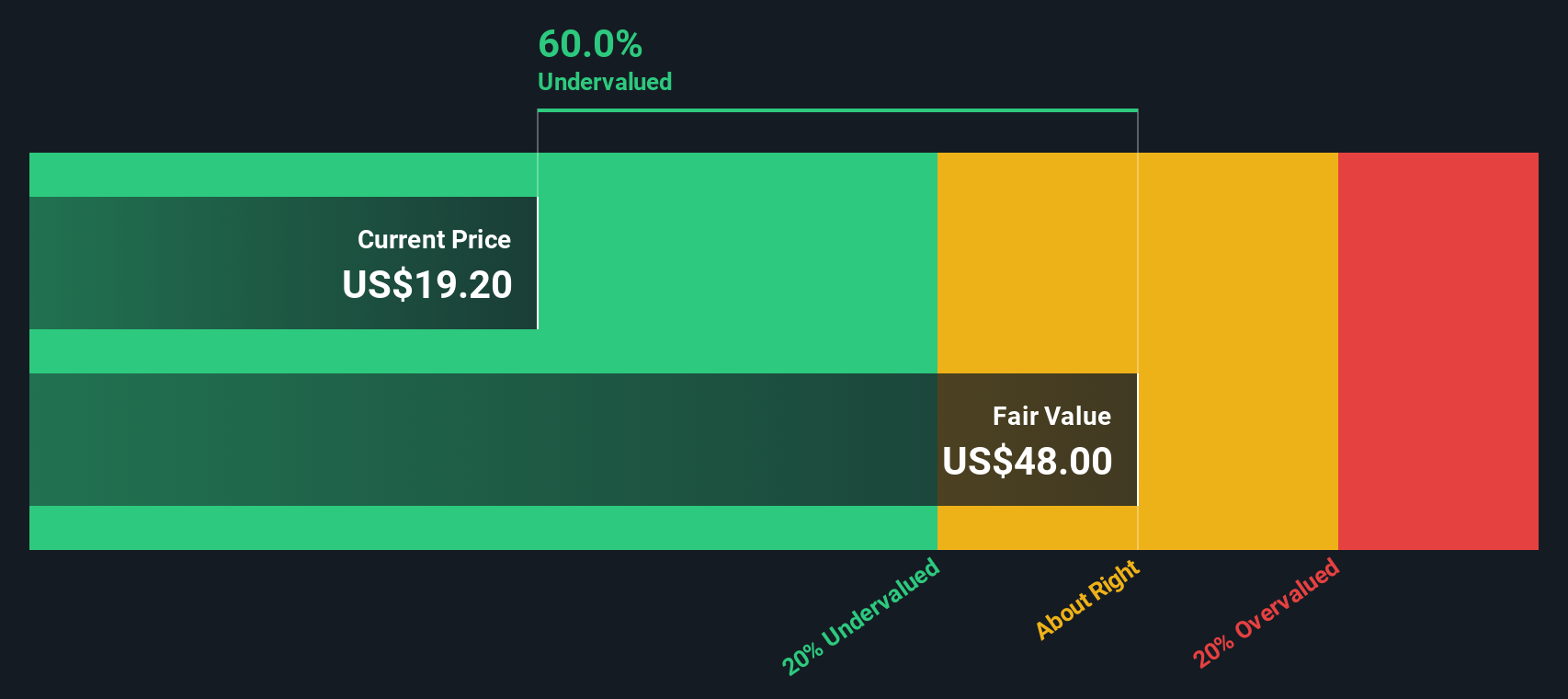

Taking a different approach, our DCF model also suggests that Conagra Brands is trading at a discount to its intrinsic value. Still, every model has its own assumptions. Could this alternative view better capture the company's true outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Conagra Brands Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, it’s easy to build your own assessment in just a few minutes. Do it your way.

A great starting point for your Conagra Brands research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to give your portfolio an edge, don’t stop with Conagra. Now is the perfect time to expand your research and spot opportunities you might otherwise miss. Take a closer look at unique stocks and market themes designed to help you stay a step ahead of the crowd:

- Tap into the market’s best value opportunities with companies trading below their true worth by using our undervalued stocks based on cash flows.

- Accelerate your potential returns by targeting high-yield picks among companies offering dividend stocks with yields > 3%.

- Catch the tech revolution shaping tomorrow’s industries with access to AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:CAG

Conagra Brands

Operates as a consumer packaged goods food company primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives