- United States

- /

- Food

- /

- NYSE:BG

Bunge (BG): Valuation Insights as Analyst Optimism Builds on Strong Execution and Upbeat Q3 Outlook

Reviewed by Simply Wall St

Markets responded positively to Bunge Global (BG) after management signaled stronger than expected third quarter results, citing Viterra’s improved performance. This reinforced the company’s reputation for prudent guidance ahead of its Q3 earnings call.

See our latest analysis for Bunge Global.

After some volatility earlier in the year, Bunge Global’s share price has surged with a 17.6% gain over the past month. This reflects renewed momentum as investors factor in the company’s strong track record and upbeat Q3 outlook. Even when zooming out, the one-year total shareholder return sits at a healthy 13.6%, which hints at both resilience and longer-term potential as markets respond to signals of ongoing operational strength.

If Bunge’s recent run has you wondering what other companies are gaining traction, this could be the right moment to broaden your view and discover fast growing stocks with high insider ownership

With shares rallying and optimism running high, the real question now looms: Is Bunge Global still trading below its true value, or has the recent momentum already factored in all the predicted growth?

Most Popular Narrative: 3.9% Overvalued

Bunge Global’s most followed narrative places fair value at $92.78, slightly below its last close of $96.37. The recent price surge means the narrative now sees the shares modestly overvalued, so the story behind its elevated valuation is worth a closer look.

Organic investments in crush expansions (e.g., Morristown, Destrehan) and value-added product lines (specialty oils, plant-based proteins) are expected to ramp up in late 2024 and beyond. This is anticipated to enhance capacity, shift the product mix toward higher-margin offerings, and support long-term net margin expansion.

Want to know what’s driving this bold valuation call? The narrative hinges on dramatic shifts in profit mix, more ambitious revenue growth, and a controversial profit multiple. Think you know how these numbers fit together? There is one key assumption that sets this narrative apart. See the details for yourself.

Result: Fair Value of $92.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent headwinds in refined oils or slower than expected integration with Viterra could undercut Bunge Global’s growth story in the coming quarters.

Find out about the key risks to this Bunge Global narrative.

Another View: Are Multiples Telling a Different Story?

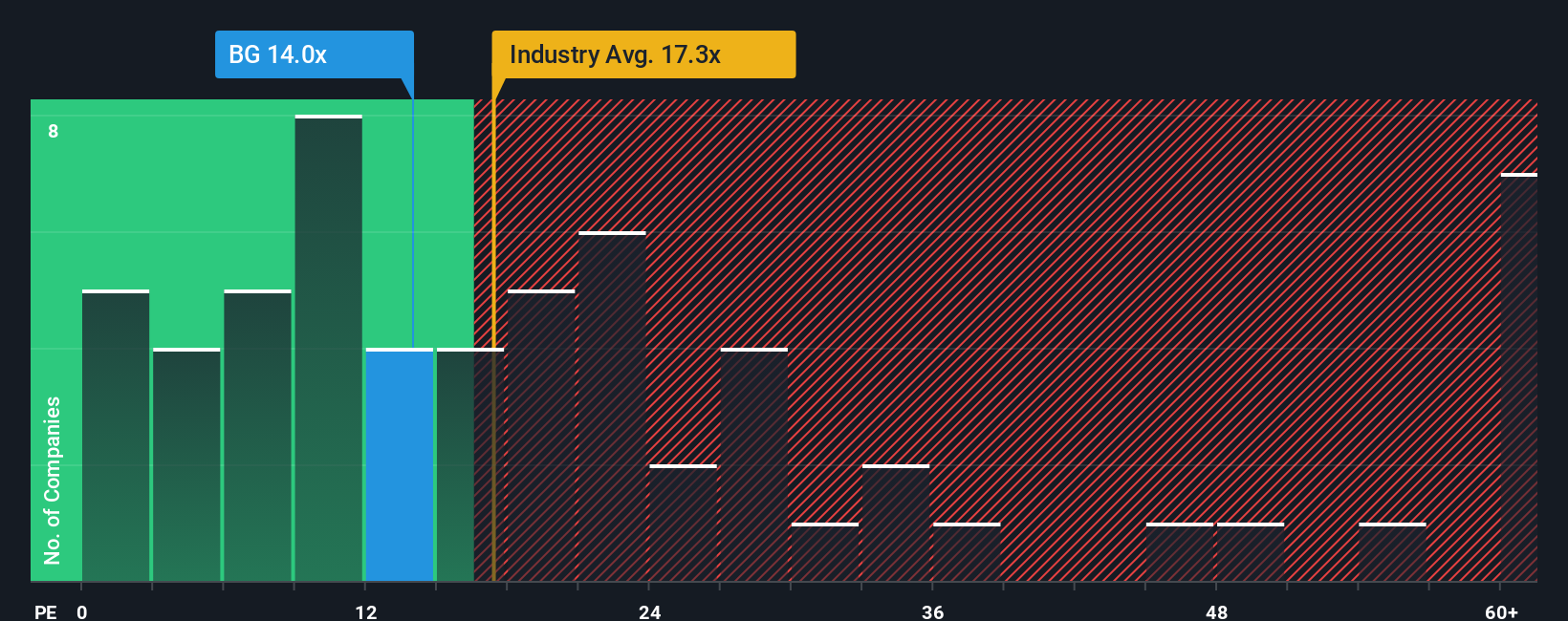

While the narrative sees Bunge Global as modestly overvalued, our analysis using the current price-to-earnings ratio reveals a contrasting perspective. At 14x earnings, Bunge trades below both its peer group (24.6x) and the US Food industry average (18.6x). This suggests a possible value opportunity if the market moves closer to the fair ratio of 27x. Does this gap highlight untapped potential, or does it signal something the narrative misses?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bunge Global Narrative

If you see things differently or want to test your own assumptions, you can easily shape your own analysis in just a few minutes. Do it your way

A great starting point for your Bunge Global research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities pass by. The best investment edges come from timely research and discovering new trends before the crowd catches on.

- Capture hidden value by analyzing these 864 undervalued stocks based on cash flows to spot companies trading well below intrinsic worth before their next move.

- Power up your portfolio with these 26 AI penny stocks, featuring businesses that are turning artificial intelligence into real-world growth.

- Boost long-term returns by reviewing these 21 dividend stocks with yields > 3%, where companies are rewarding shareholders with reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bunge Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BG

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives