- United States

- /

- Beverage

- /

- NYSE:BF.B

Brown-Forman (BF.B): Evaluating Value as Analysts Prepare for Weaker Results After High-Profile Partnership Exits

Reviewed by Simply Wall St

Brown-Forman (BF.B) faces heightened attention ahead of its second-quarter results, as analysts brace for weaker earnings and revenue compared to last year because of recent changes in several business partnerships.

See our latest analysis for Brown-Forman.

Shares of Brown-Forman have struggled to find solid footing this year, with a 1-month share price return of 4.1% but a sharp 24.1% decline year-to-date. This reflects shifting investor sentiment after the company’s high-profile partnership changes. Looking longer term, momentum has faded even further, as the total shareholder return sits at -37.9% over the past year and is even deeper in negative territory over three and five years. This puts recent short-lived rallies in perspective for any potential rebound.

If you’re looking for fresh investment opportunities beyond the familiar names, now’s a great time to explore fast growing stocks with high insider ownership.

With shares already down sharply and analyst forecasts still cautious, the question now is whether Brown-Forman is trading at a compelling discount or if the market is accurately factoring in slower growth prospects. Is there genuine value here, or is future upside already reflected in the current price?

Most Popular Narrative: 8.7% Undervalued

Brown-Forman’s most widely followed narrative sees fair value notably above the last close of $28.22, suggesting room for upside if forecasts hold true. The stage is set as steady but unspectacular financial projections intersect with big-picture shifts in premium global spirits demand. Below is a pivotal quote underpinning this narrative's price target.

The ongoing trend towards premium and craft spirits among younger, urban consumers is being addressed through innovation (for example, launches like Jack Daniel's Tennessee Blackberry and focus on super premium whiskeys), which should lift average selling prices, gross margins, and drive long-term earnings growth.

This fair value narrative isn’t just about brand names. There is a quantitative strategy at play: future profitability, margin trajectories, and a bold call on the long-term growth engine. Wondering which financial levers support this optimistic view? Hit the link to see what drives the valuation math.

Result: Fair Value of $30.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in the U.S. and Europe or a shift toward lower-alcohol alternatives could limit Brown-Forman’s upside and dampen growth expectations.

Find out about the key risks to this Brown-Forman narrative.

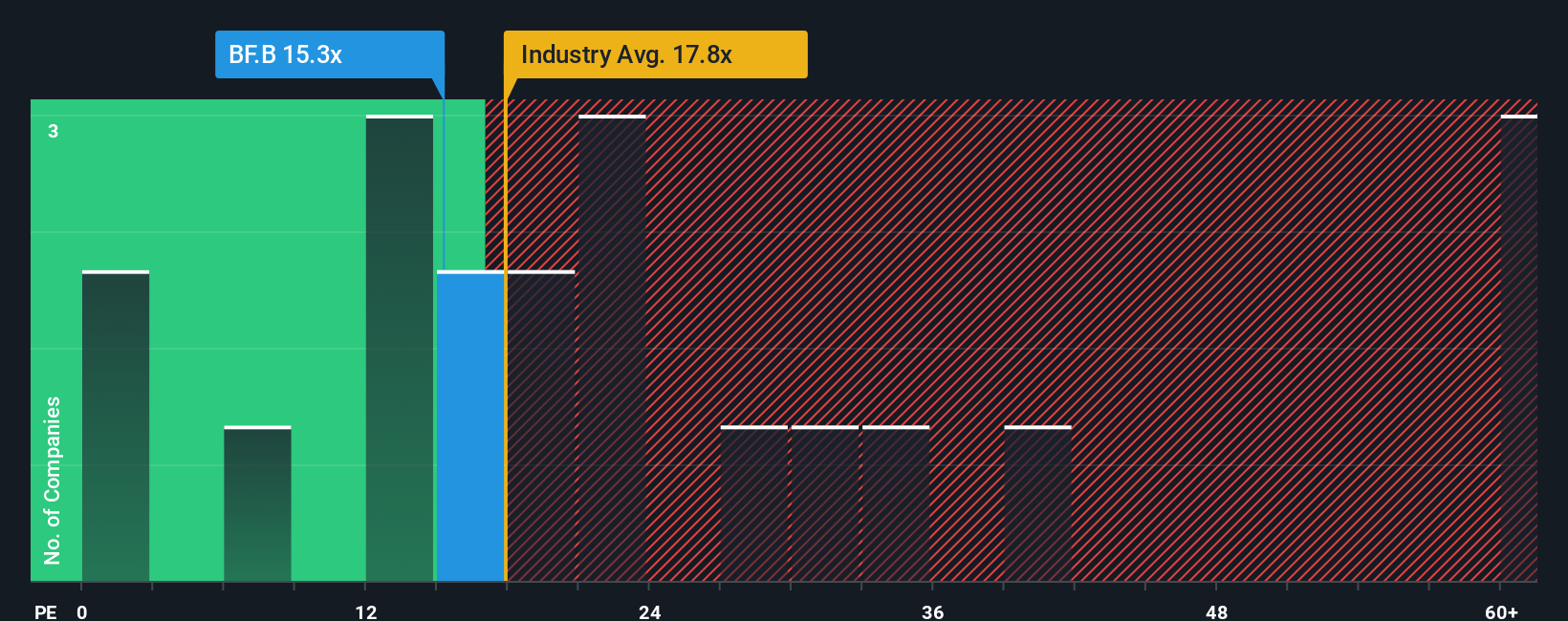

Another View: Finding Value in Multiples

Looking at Brown-Forman’s price-to-earnings ratio of 15.8x, it sits just above the peer average of 15.3x, yet below both the global beverage industry average of 17.6x and its own fair ratio of 17.6x. This suggests the stock appears neither sharply cheap nor expensive compared to its sector.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brown-Forman Narrative

If you have a different take on what the numbers are signalling or want to dig deeper on your own terms, you can easily craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Brown-Forman research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Opportunities?

Smart investors never limit themselves to just one story. Supercharge your research and stay ahead by tapping into hand-picked stock ideas powered by the Simply Wall Street Screener.

- Capture the upside of financial innovation by scanning these 81 cryptocurrency and blockchain stocks, which is shaping tomorrow’s decentralized payment networks and digital economies.

- Unlock steady income potential with these 21 dividend stocks with yields > 3%, featuring strong yields and robust payout histories.

- Spot emerging leaders in artificial intelligence by browsing these 26 AI penny stocks, which are poised for rapid growth amid groundbreaking tech shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown-Forman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BF.B

Brown-Forman

Manufactures, distills, bottles, imports, exports, markets, and sells a variety of alcohol beverages.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives