- United States

- /

- Food

- /

- NYSE:ADM

Archer-Daniels-Midland (NYSE:ADM) Q1 Earnings Decline to US$295 Million as Sales Drop

Reviewed by Simply Wall St

Archer-Daniels-Midland (NYSE:ADM) recently reported a significant decline in their first-quarter earnings, with sales decreasing to USD 20,175 million and net income falling sharply to USD 295 million. Despite these results, ADM's share price saw a 10% rise over the past month, slightly outperforming the market, which climbed 2% during the same period. This movement could be seen as contradictory amid the broader market's response to earnings reports and tariff uncertainties. Nevertheless, the broader optimism in equity performance and expectations for corporate earnings growth might have supported ADM's share gains.

We've spotted 2 warning signs for Archer-Daniels-Midland you should be aware of.

Archer-Daniels-Midland's recent earnings decline and the contrasting 10% share price rise illustrate a complex landscape for this agricultural giant. While lower earnings saw ADM's net income decrease to US$295 million and sales drop to US$20.18 billion, the company's share price still managed to outperform the broader market over the past month. This recovery in share price may be fueled by positive sentiment around its strategic focus on operational improvements and growth investments, such as biosolutions, aimed at enhancing margins and future revenue.

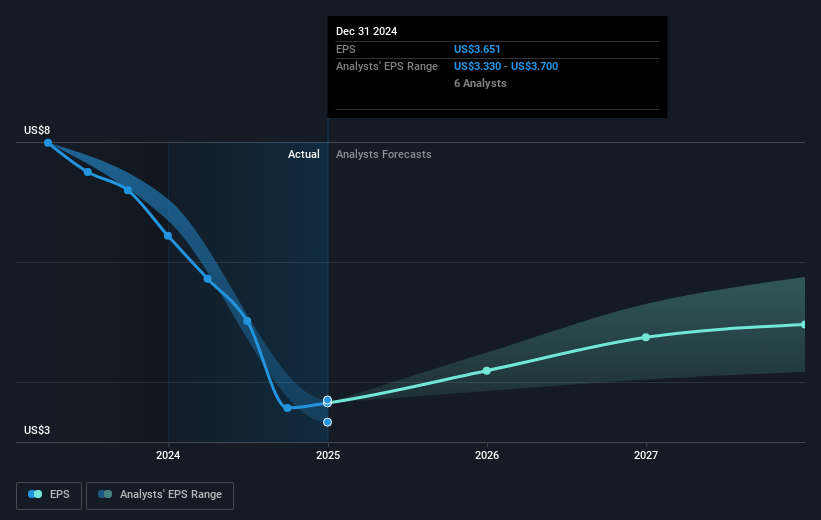

Over a longer five-year period, ADM's total return, including dividends, was a significant 53.85%, showcasing a robust performance when viewed against recent fluctuations. Despite underperforming the market, which returned 8.2% last year, ADM continues to show potential for growth. Analysts anticipate a modest revenue growth of 2.6% annually and expect earnings to reach US$2.3 billion by April 2028, supported by strategic initiatives and targeted cost actions. Nevertheless, regulatory uncertainties and competitive pressures remain key risks that could impact these forecasts. Furthermore, significant deviations in share performance indicate the market's mixed sentiment.

With ADM's current share price closely aligned with the consensus target of US$49.73, the limited pricing gap suggests analysts see it as fairly valued, though individual projections vary. This ongoing appraisal hinges on ADM achieving anticipated earnings growth and maintaining an acceptable price-to-earnings ratio of 11.3x by 2028. Investors weighing these factors should consider ADM's position relative to industry challenges and emerging opportunities to discern whether its current valuation accurately reflects future prospects.

Take a closer look at Archer-Daniels-Midland's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Archer-Daniels-Midland, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives