- United States

- /

- Food

- /

- NasdaqGM:VITL

Vital Farms (VITL): Assessing Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Vital Farms (VITL) has caught the attention of investors after a period of share price volatility, which has prompted a closer look at both its recent performance and long-term prospects in the specialized food market.

See our latest analysis for Vital Farms.

After a spectacular run-up over the past three years, with a total shareholder return of nearly 119%, Vital Farms shares have cooled off lately, dropping 37% over the last 90 days and sitting at $32.12. The latest moves suggest that investors are recalibrating risk and expectations after a period of strong growth. However, the company remains well ahead over the longer term.

If you’re curious what else investors are watching, now’s the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

But with such a significant pullback and impressive gains still visible on the long-term chart, the key question is whether Vital Farms is now undervalued or if the market has already taken all future growth potential into account.

Most Popular Narrative: 38.9% Undervalued

Compared to Vital Farms’ last close at $32.12, the most widely followed narrative sets fair value dramatically higher, reflecting bullish long-term fundamentals beyond the current volatility.

Significant expansion of farm and production network, including acceleration of CapEx to build out capacity (two production lines at the Seymour, Indiana facility and additional cold storage), positions Vital Farms to fully capitalize on unmet and pent-up demand. This removes prior supply constraints and unlocks further revenue and earnings growth.

Want to see what is driving such ambitious estimates? The heart of this narrative hinges on game-changing growth rates and elevated future profit margins. Find out which bold projections could justify a valuation leap that will surprise most investors.

Result: Fair Value of $52.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and heavy capital spending could pressure margins and challenge Vital Farms’ ability to fully deliver on these growth expectations.

Find out about the key risks to this Vital Farms narrative.

Another View: Market-Based Valuation Sends a Caution Signal

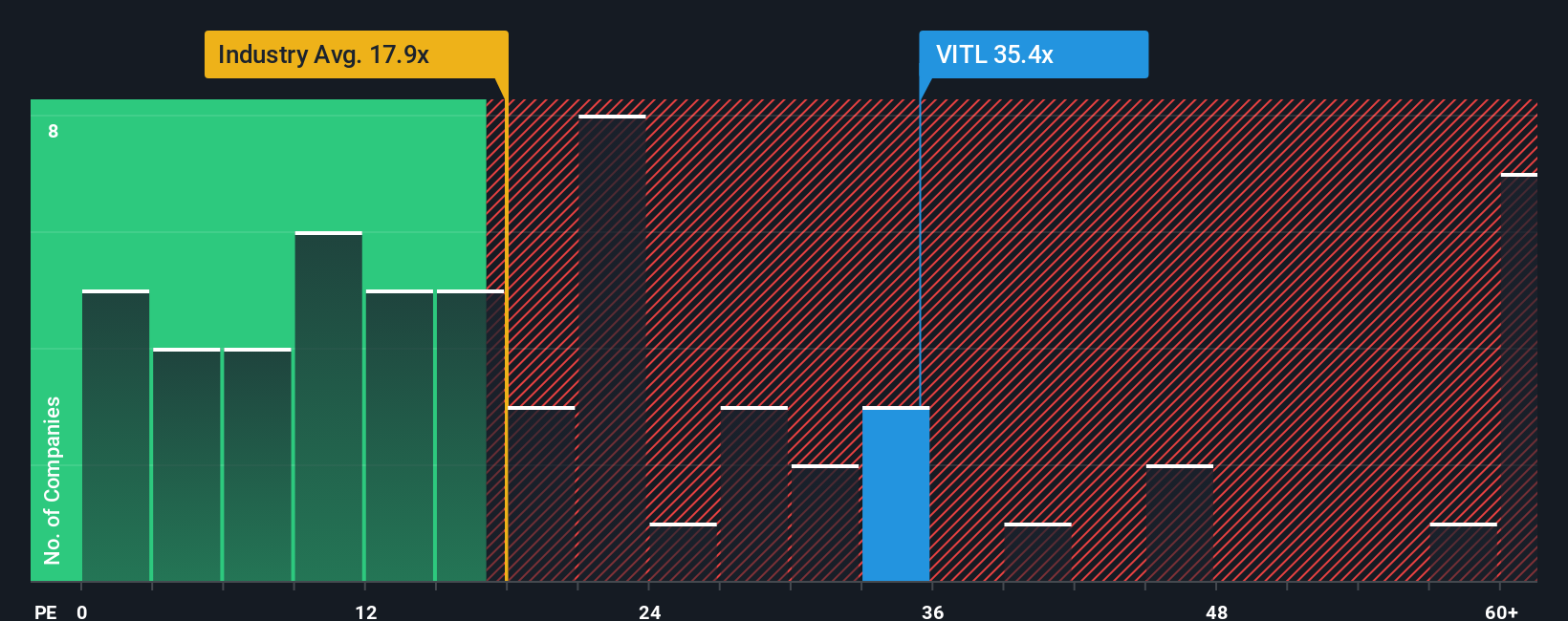

While analyst forecasts and narrative-driven models point to significant upside, the company's current share price is trading at a notably high price-to-earnings ratio of 23.8x. This is more expensive than both industry peers at 20x and the US Food sector average at 20.9x. The market’s appetite for premium growth is clear. However, what happens if growth slows or sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vital Farms Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can shape your own analysis in just a few minutes, and Do it your way.

A great starting point for your Vital Farms research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself up for your next smart move by using these powerful shortcuts to find standout opportunities. Missing out could mean overlooking tomorrow’s top performers.

- Accelerate your search for breakthrough tech by targeting these 28 quantum computing stocks making serious progress in quantum computing and next-generation innovation.

- Zero in on steady income potential when you analyze these 15 dividend stocks with yields > 3% that consistently deliver yields above 3% and reward investors.

- Spot tomorrow’s success stories by focusing on these 924 undervalued stocks based on cash flows that show immense value based on strong cash flow, before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VITL

Vital Farms

A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.