- United States

- /

- Food

- /

- NasdaqGM:VITL

Does Vital Farms’ Raised Guidance and Revenue Beat Signal a New Chapter for VITL?

Reviewed by Sasha Jovanovic

- Earlier this week, Vital Farms reported a significant 25.4% year-on-year revenue increase, surpassing analyst expectations and delivering strong EBITDA and operating income results while also raising its full-year guidance by the highest margin among its perishable food peers.

- This financial performance highlights the company's ability to combine robust revenue growth and operational efficiency, positioning it as a standout in the specialty food industry.

- We'll explore how Vital Farms' raised full-year guidance, reflecting management’s confidence, could influence its long-term investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Vital Farms Investment Narrative Recap

To be a shareholder in Vital Farms, you need to believe in the sustained shift toward ethically produced, premium food products and Vital Farms’ ability to maintain both its strong growth and pricing power. The recent revenue beat and improved full-year outlook reinforce the near-term catalyst of rising consumer demand but do not materially change the outsized risk: the company’s increased capital expenditures, which could squeeze margins if expected demand does not fully materialize.

Vital Farms’ announcement of an expanded farm network and enhanced capacity, adding 200 family farms and expecting a sizable production ramp-up, directly aligns with the company’s efforts to unlock further revenue, an immediate catalyst in supporting its upbeat guidance. However, as with any rapid expansion, the scale and efficiency of these efforts remain closely watched given the costs involved.

By contrast, what every investor should watch closely is the risk that rising production costs and aggressive capital investments could squeeze margins if demand growth falls short…

Read the full narrative on Vital Farms (it's free!)

Vital Farms' outlook projects $1.2 billion in revenue and $103.0 million in earnings by 2028. This scenario assumes 22.5% annual revenue growth and an earnings increase of $51.4 million from the current earnings of $51.6 million.

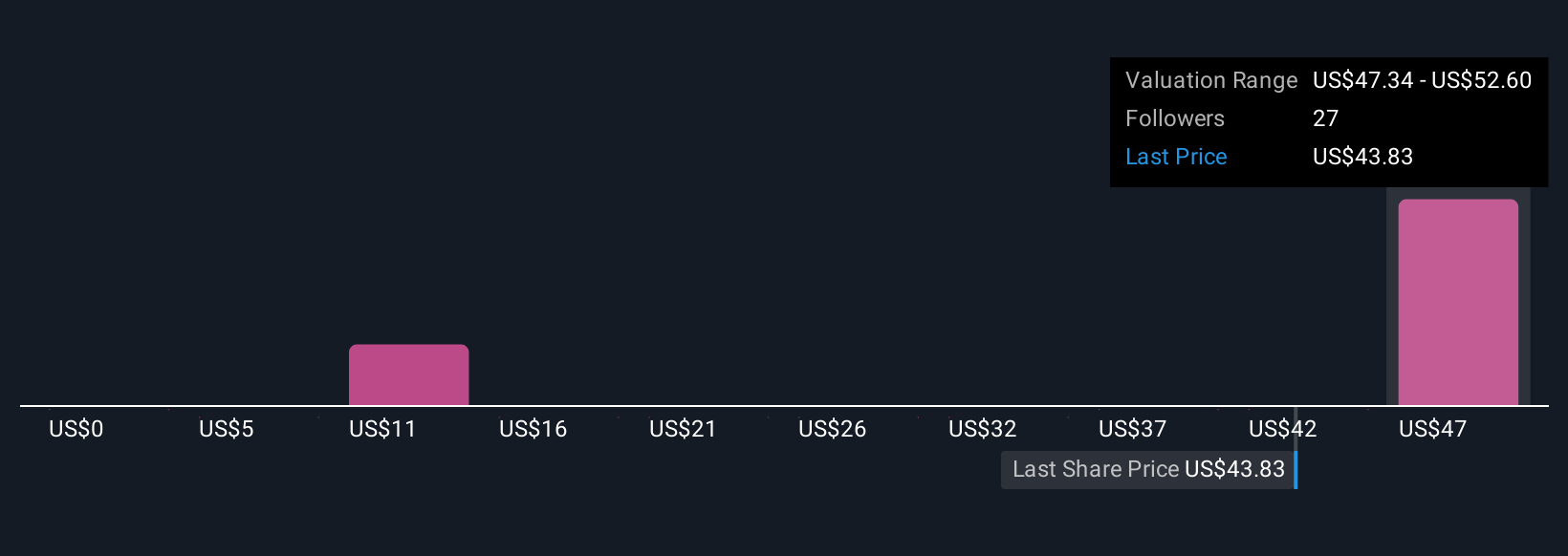

Uncover how Vital Farms' forecasts yield a $52.60 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range widely from US$5.26 to US$52.60 per share, reflecting diverse outlooks. As you weigh these differing perspectives, consider how Vital Farms’ large-scale network expansion could drive growth or add pressure to profitability targets.

Explore 5 other fair value estimates on Vital Farms - why the stock might be worth less than half the current price!

Build Your Own Vital Farms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vital Farms research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vital Farms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vital Farms' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VITL

Vital Farms

A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives