- United States

- /

- Food

- /

- NasdaqCM:VFF

Unveiling 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

As the United States market navigates the aftermath of a historic government shutdown, major indices like the Dow Jones and Nasdaq have experienced fluctuations, with technology shares leading recent declines. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking to uncover potential growth stories that may not yet be widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Village Farms International (VFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Village Farms International, Inc. operates as a producer, marketer, and distributor of greenhouse-grown produce such as tomatoes, bell peppers, cucumbers, and mini-cukes in North America with a market capitalization of $406.65 million.

Operations: Village Farms International generates revenue primarily from the production, marketing, and distribution of greenhouse-grown produce in North America. The company has a market capitalization of $406.65 million.

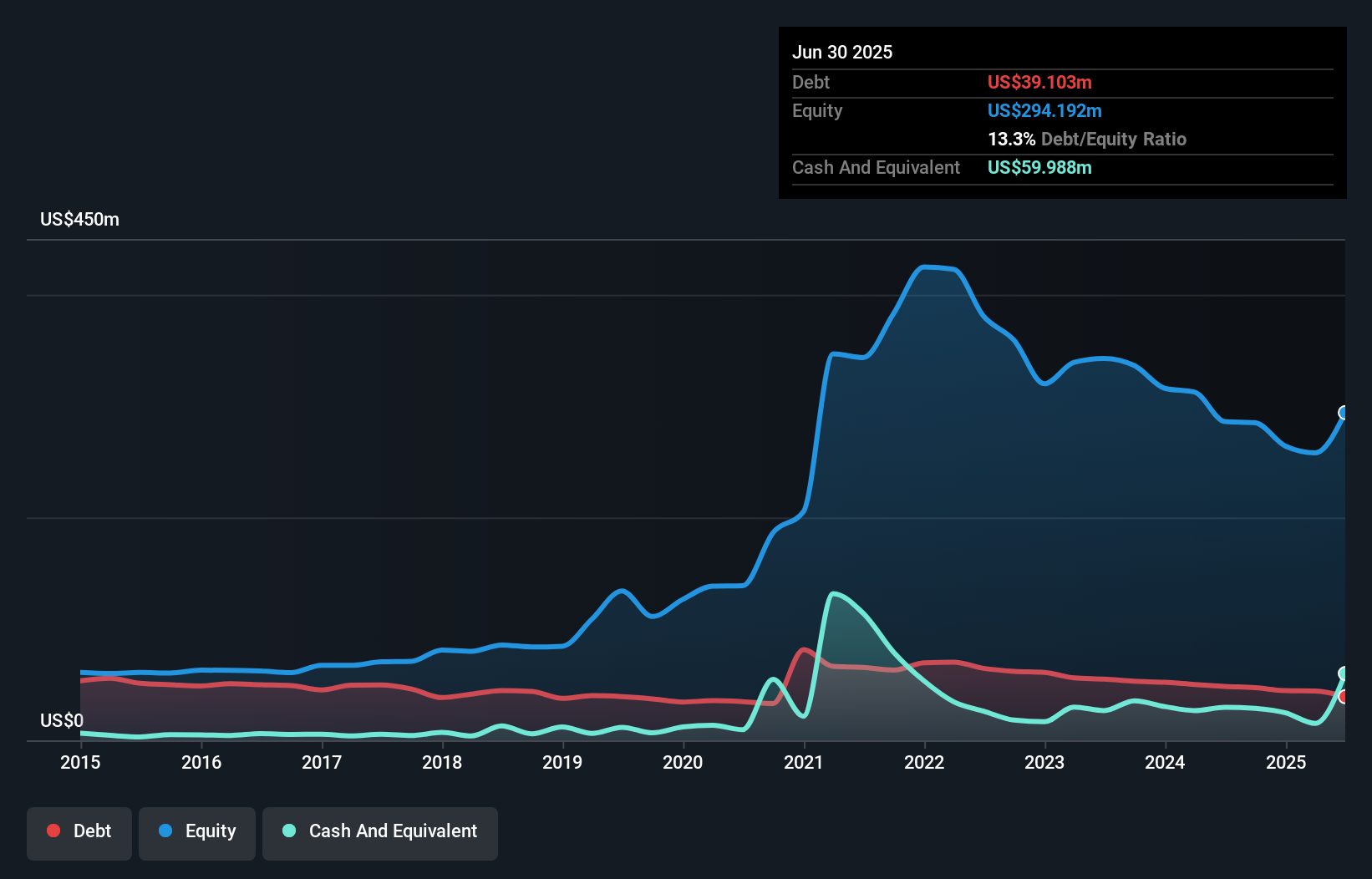

Village Farms International has shown a notable turnaround, with net income reaching US$10.22 million in the latest quarter, compared to a loss of US$0.82 million a year ago. Sales increased to US$66.74 million from US$54.94 million, highlighting its growth momentum. The company recently launched an innovative cannabis packaging solution, enhancing its market presence in Canada's growing convenience segment where pre-rolls account for 55% of sales. With more cash than total debt and positive free cash flow, Village Farms is financially sound but faces challenges like regulatory risks and competitive pressures as it expands internationally into markets like Germany and the UK.

Metropolitan Bank Holding (MCB)

Simply Wall St Value Rating: ★★★★★★

Overview: Metropolitan Bank Holding Corp. is the bank holding company for Metropolitan Commercial Bank, offering a variety of business, commercial, and retail banking products and services with a market capitalization of $718.18 million.

Operations: Metropolitan Bank Holding Corp. generates revenue primarily through its banking segment, totaling $261.46 million.

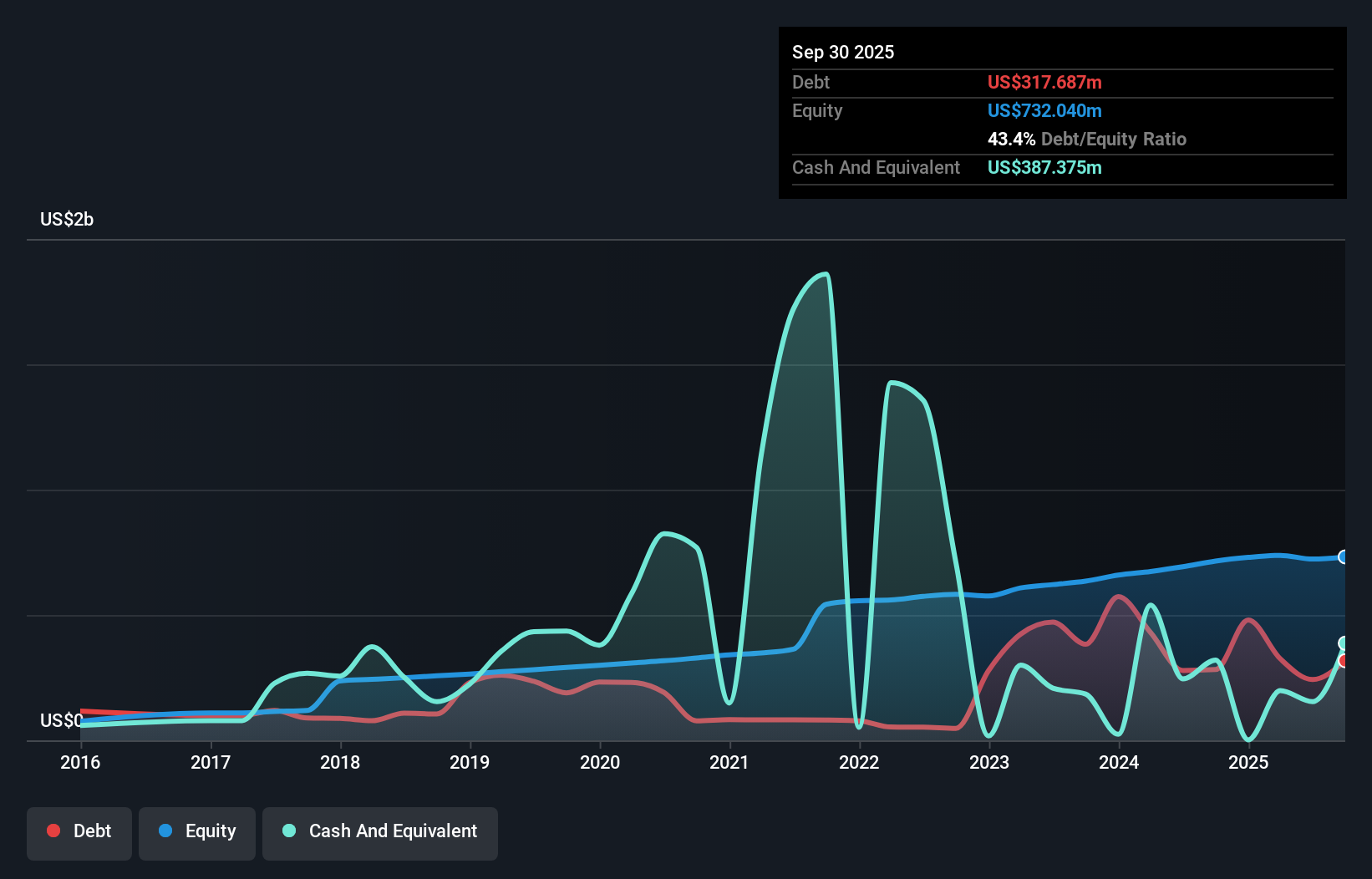

Metropolitan Bank Holding, with total assets of US$8.2 billion and equity of US$732 million, is making strides in the tech space by investing in digital platforms to boost fintech partnerships. The bank's focus on low-risk funding sources, primarily customer deposits making up 94% of liabilities, supports its robust asset quality. Bad loans are at a manageable 1.2% of total loans, backed by a sufficient allowance at 116%. Despite recent challenges in earnings growth lagging behind industry averages and some concentration risks in commercial real estate loans, it trades at an attractive 38.4% below estimated fair value.

Northpointe Bancshares (NPB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Northpointe Bancshares, Inc., the bank holding company for Northpointe Bank, offers a range of banking products and services in the United States with a market capitalization of $560.14 million.

Operations: Northpointe Bancshares generates revenue primarily through interest income from loans and investments, as well as fees from banking services. The company's net profit margin has shown variability, reflecting changes in interest rates and operational efficiency.

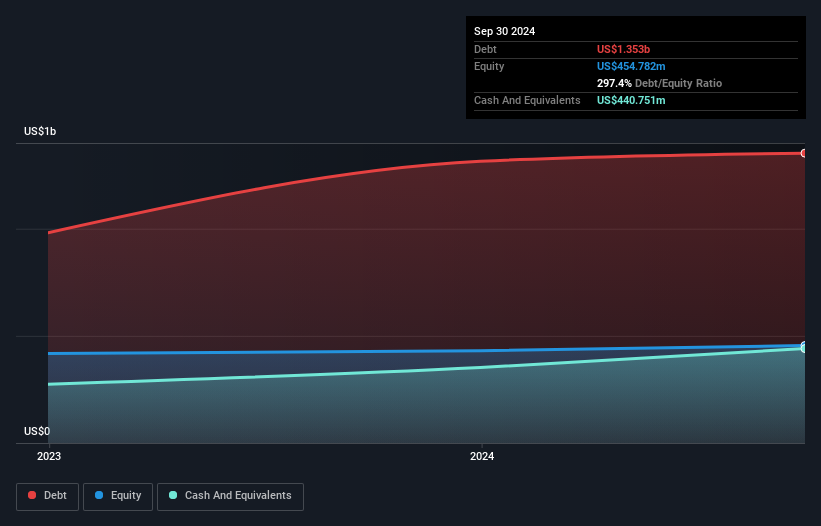

With total assets of US$6.8 billion and equity of US$623.5 million, Northpointe Bancshares stands out with its robust financial structure. Total deposits reach US$4.8 billion while loans amount to US$6 billion, supported by a 2.3% net interest margin. Despite a low allowance for bad loans at 15%, the bank maintains an appropriate level of non-performing loans at 1.4%. Earnings have surged by 65% over the past year, significantly outpacing industry growth rates, and are forecasted to grow annually by about 21%. Trading below estimated fair value enhances its appeal in the market landscape.

- Click to explore a detailed breakdown of our findings in Northpointe Bancshares' health report.

Gain insights into Northpointe Bancshares' past trends and performance with our Past report.

Where To Now?

- Investigate our full lineup of 295 US Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VFF

Village Farms International

Produces, markets, and distributes greenhouse grown tomatoes, bell peppers, cucumbers, and mini-cukes in North America.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives