- United States

- /

- Food

- /

- OTCPK:TTCF.Q

Tattooed Chef's (NASDAQ:TTCF) Weakness in 2022 Can Extend Beyond Supply Chain

After a long period of sideways movement, Tattooed Chef, Inc. ( NASDAQ: TTCF ) is on a bearish down spiral. Investors are rightfully skeptical with the latest data indicating a shrinking gross profit margin.

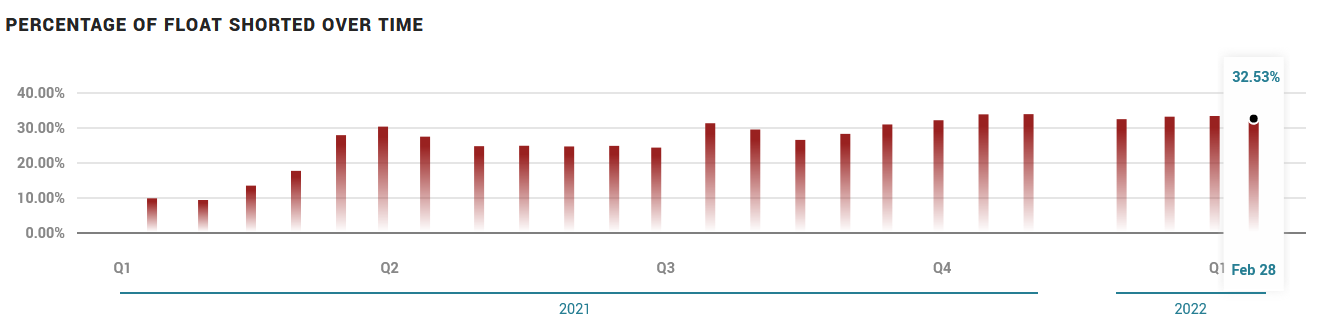

Meanwhile, short interest is exceptionally high – well over 30%.

See our latest analysis for Tattooed Chef

Q4 Earnings Results

- GAAP EPS: -US$0.17 (miss by US$0.09)

- Revenue: US$52.34m (beat by US$1.27m)

- Revenue growth: +32.2% Y/Y

FY 2022 guidance:

- Revenue: US$280-285m vs. consensus US$283m

- Gross margin: 10-12%

- Capital expenditures: approx US$20m

While in the full year 2021, revenue rose 43.7% to US$213.4m, it is notable that the gross margin dived Q4 to just above 2%. This is concerning information, despite the company blaming it on higher freight and shipping costs - which might be only temporary.

Short Interest Remains High

Looking at the short interest data, we notice that it has been elevated for months now after tripling up in Q1 2021.

At this pace, it would take a whopping 18 days to cover the shorts, which shows short-sellers conviction.

According to retail trackers like SwaggyStocks , there isn't significant buzz about the company. Thus the odds of a retail-driven short squeeze remain low.

Outlining the Total Returns

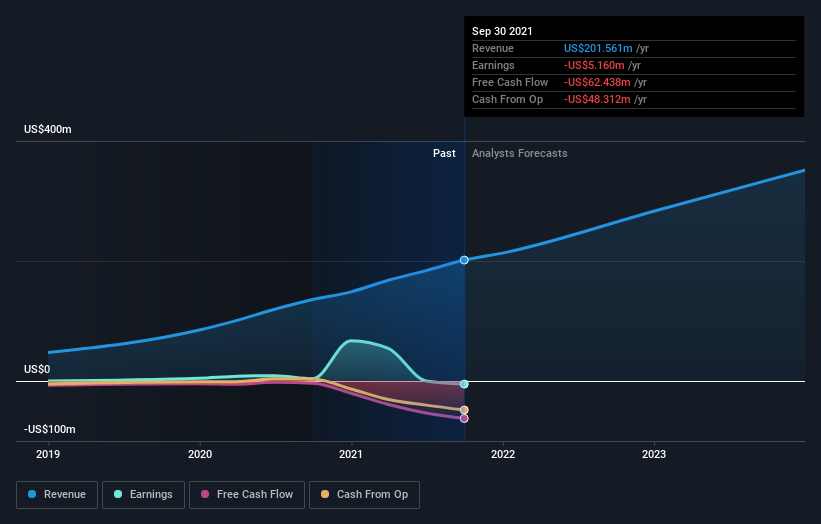

Given that Tattooed Chef didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. We'd generally expect to see good revenue growth when a company doesn't profit. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible and it never makes a profit.

Tattooed Chef grew its revenue by 49% over the last year.That's a strong result which is better than most other loss-making companies.The share price drop of 46% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its revenue growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Although it is positive that insiders have made purchases in the last year, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Tattooed Chef in this interactive graph of future profit estimates .

A Different Perspective

The last twelve months weren't great for Tattooed Chef shares, which cost holders 46%, while the market was up about 1.4%. While the company recorded solid growth, we took notice of depressed profit margins toward the end of the year.

Even with resolving the ongoing global supply chain bottlenecks, we are now skeptical about unprofitable growth companies in this sector. With an active war zone in Ukraine, growing sanctions against Russia, and a problematic harvest in China, too many negative factors threaten plant-based production, directly or indirectly. Many of these companies will have to raise the prices or further lower their profit margins to absorb those costs.

It's always interesting to track share price performance over the longer term, but to understand Tattooed Chef better, we need to consider many other factors. For example, we've discovered 2 warning signs for Tattooed Chef that you should be aware of before investing here.

Tattooed Chef is not the only stock that insiders are buying. For those who like to find winning investments, this free list of growing companies with recent insider purchasing could be just the ticket.

Please note the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tattooed Chef might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About OTCPK:TTCF.Q

Tattooed Chef

A plant-based food company, produces and sells a portfolio of frozen foods.

Low risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives