- United States

- /

- Food

- /

- NasdaqCM:SMPL

Will New $150M Loan and Debt Extension Shift Simply Good Foods' (SMPL) Growth Trajectory?

Reviewed by Sasha Jovanovic

- On November 19, 2025, Simply Good Foods USA Inc., a subsidiary of The Simply Good Foods Company, amended its credit agreement to establish a US$150,000,000 incremental term loan facility and extend the maturity dates of its revolving and term loan facilities.

- This financial maneuver is intended to provide greater flexibility for working capital, growth investments, and potential share repurchases, underscoring the company’s response to ongoing operational challenges and market changes.

- We'll explore how the added credit facility and extended debt maturities could reshape Simply Good Foods' investment outlook and growth plans.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Simply Good Foods Investment Narrative Recap

To be a shareholder in Simply Good Foods, you need confidence in its ability to revitalize key brands, particularly Quest and OWYN, to drive growth despite near-term headwinds in Atkins and margin pressures. The recent US$150,000,000 credit facility amendment provides added financial flexibility, but it does not directly address the most immediate catalyst of growing Quest's salty snack business or the biggest risk from Atkins declines, so its impact in the short term is likely minimal.

Among recent developments, the increase in the share buyback authorization by US$150,000,000 to a total of US$300,000,000 stands out. This move reinforces Simply Good Foods' ongoing efforts to return capital to shareholders, particularly as it pairs with expanded credit capacity that could potentially support further buybacks, though shifts in earnings are likely to remain the more powerful near-term share price catalyst.

On the flip side, investors should be aware of ongoing margin pressures from cost inflation and input prices that could...

Read the full narrative on Simply Good Foods (it's free!)

Simply Good Foods' outlook anticipates $1.6 billion in revenue and $204.1 million in earnings by 2028. This projection is based on a 4.1% annual revenue growth rate and reflects a $58.8 million increase in earnings from the current $145.3 million figure.

Uncover how Simply Good Foods' forecasts yield a $29.70 fair value, a 50% upside to its current price.

Exploring Other Perspectives

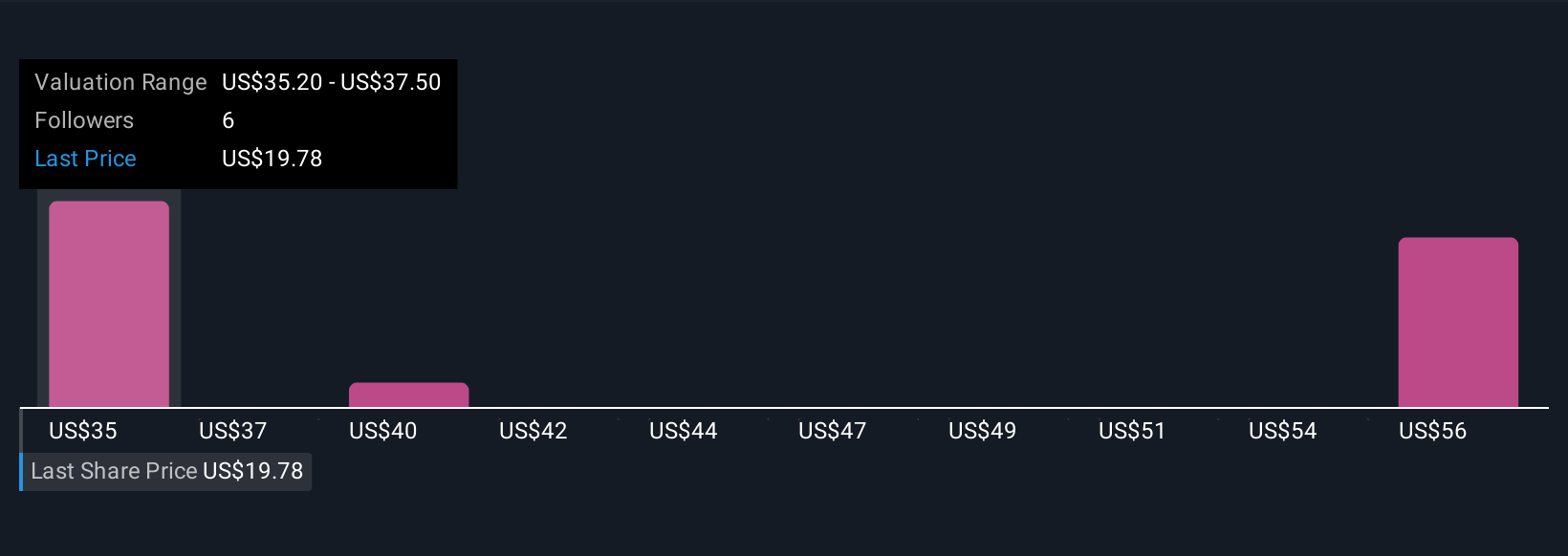

Community estimates for Simply Good Foods’ fair value range from US$29.70 to US$57.56, compiled from 3 perspectives in the Simply Wall St Community. While many see significant upside, persistent margin pressures from cost inflation mean your outlook on future profitability could differ sharply from others, compare your views with the wider community.

Explore 3 other fair value estimates on Simply Good Foods - why the stock might be worth over 2x more than the current price!

Build Your Own Simply Good Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simply Good Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simply Good Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simply Good Foods' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMPL

Simply Good Foods

A consumer-packaged food and beverage company, engages in the development, marketing, and sale of snacks and meal replacements, and other products in North America and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.