- United States

- /

- Food

- /

- NasdaqGS:SFD

Smithfield Foods (SFD): Assessing Valuation as Market Sentiment Shifts

Reviewed by Simply Wall St

Smithfield Foods (SFD) shares have moved in recent weeks, giving investors a chance to revisit the company’s underlying fundamentals. With recent market activity in focus, it is useful to review Smithfield’s financial trajectory and past performance.

See our latest analysis for Smithfield Foods.

Smithfield Foods’ share price return tells an interesting story: after a strong start to the year with an 11.3% gain year-to-date, momentum has tapered off recently as the stock slipped 8.2% over the past month. This suggests investors are reassessing near-term growth versus longer-term prospects. Overall, the market’s recent moves appear more related to shifting risk perceptions than business fundamentals.

If you’re curious where else opportunity might be building, consider expanding your search and discover fast growing stocks with high insider ownership

With Smithfield Foods currently trading at a notable discount to analyst price targets and its fundamentals showing steady growth, investors are left to ask: is this a genuine buying opportunity, or is the market already accounting for its future gains?

Price-to-Earnings of 10.5: Is it justified?

Smithfield Foods is trading on a price-to-earnings ratio of 10.5, which places it well below both its industry peers and the broader sector average. With the stock last closing at $21.99, investors are looking at a valuation that implies the market is skeptical about future earnings relative to other food industry companies.

The price-to-earnings ratio is a key metric that tells investors how much they are paying for each dollar of current earnings. In established, steady-growth sectors like food production, this ratio helps gauge whether a stock is perceived as a bargain or richly valued compared to competitors.

Smithfield Foods’ price-to-earnings of 10.5 stands out against the US Food industry average of 18.2. This deep discount suggests the market may be underestimating Smithfield’s earnings power. When viewed against the estimated fair price-to-earnings ratio of 16.6, there is further evidence the stock could rerate higher if fundamentals remain intact and sentiment improves.

Explore the SWS fair ratio for Smithfield Foods

Result: Price-to-Earnings of 10.5 (UNDERVALUED)

However, persistent market skepticism and unexpected shifts in consumer demand could quickly put pressure on Smithfield Foods’ current valuation narrative.

Find out about the key risks to this Smithfield Foods narrative.

Another View: What Does the SWS DCF Model Say?

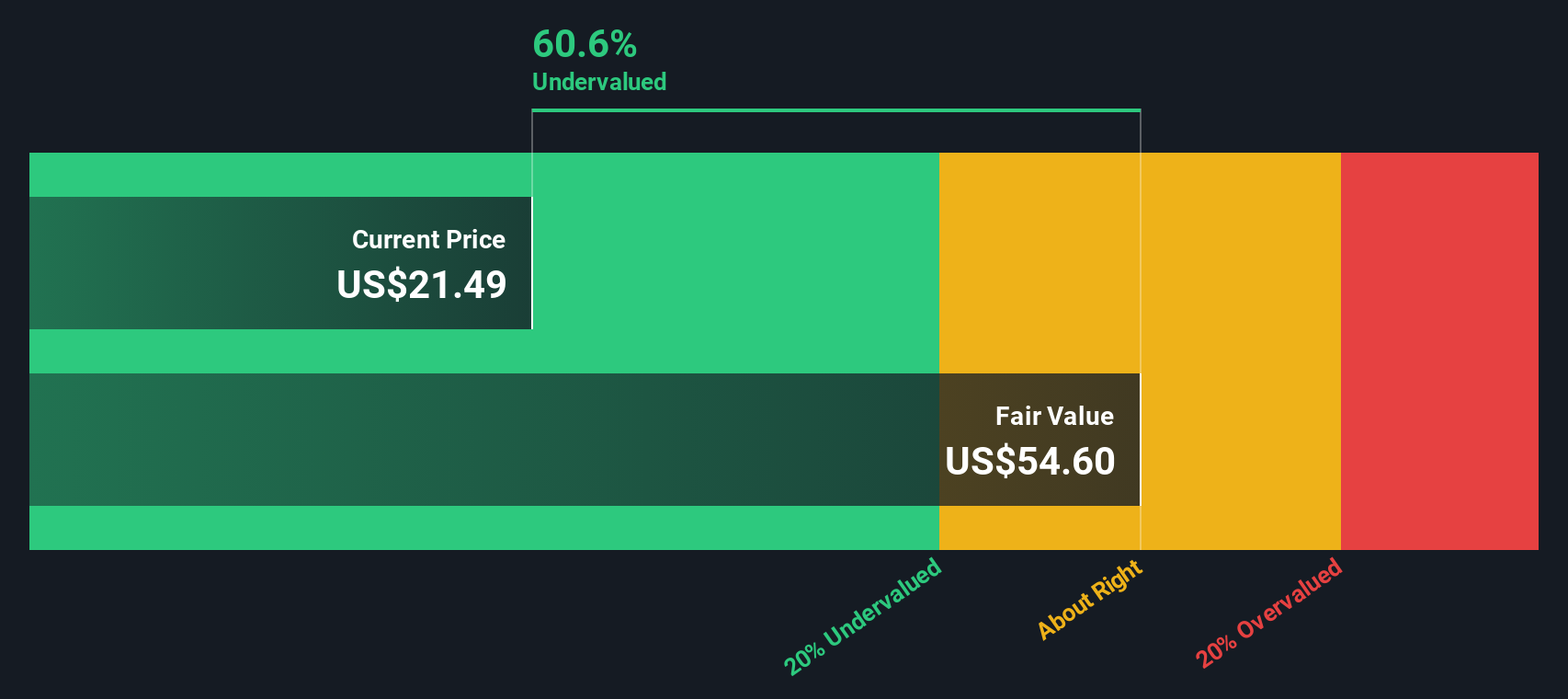

While Smithfield Foods appears undervalued by earnings metrics, our DCF model offers another perspective. According to this approach, the stock trades a significant 59.7% below our estimate of fair value, suggesting even more upside potential than traditional ratios indicate. Yet, can any valuation model fully capture all the real-world risks and rewards?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Smithfield Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Smithfield Foods Narrative

If the analysis here doesn't fully match your perspective, why not take a few minutes to dive into the numbers yourself and build your own story: Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Smithfield Foods.

Looking for more investment ideas?

There’s a world of smart investment moves beyond Smithfield Foods. Don’t wait on market shifts when your next top-performing idea could be a click away.

- Catch the momentum with these 24 AI penny stocks as artificial intelligence accelerates change and powers a new generation of innovative companies.

- Boost your portfolio’s potential with steady income streams from these 17 dividend stocks with yields > 3%, featuring top picks yielding over 3%.

- Seize value now by targeting discounted opportunities with these 872 undervalued stocks based on cash flows, which spot stocks trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFD

Smithfield Foods

Produces packaged meats and fresh pork in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives