- United States

- /

- Food

- /

- NasdaqGS:SFD

Is Smithfield Foods (SFD) Undervalued? A Fresh Look at the Market’s Pricing vs Earnings and DCF Estimates

Reviewed by Simply Wall St

Smithfield Foods (SFD) has been quietly grinding higher this year, and that steady climb has plenty to do with its improving fundamentals, from modest revenue growth to faster expanding profits.

See our latest analysis for Smithfield Foods.

At a last close of $21.93, Smithfield’s year to date share price return of 11.04% signals improving sentiment as investors gradually price in its steady earnings momentum rather than chasing short term swings.

If this kind of steady compounding appeals to you, it might be worth scanning for other consumer facing names with healthier balance sheets and upside potential through fast growing stocks with high insider ownership.

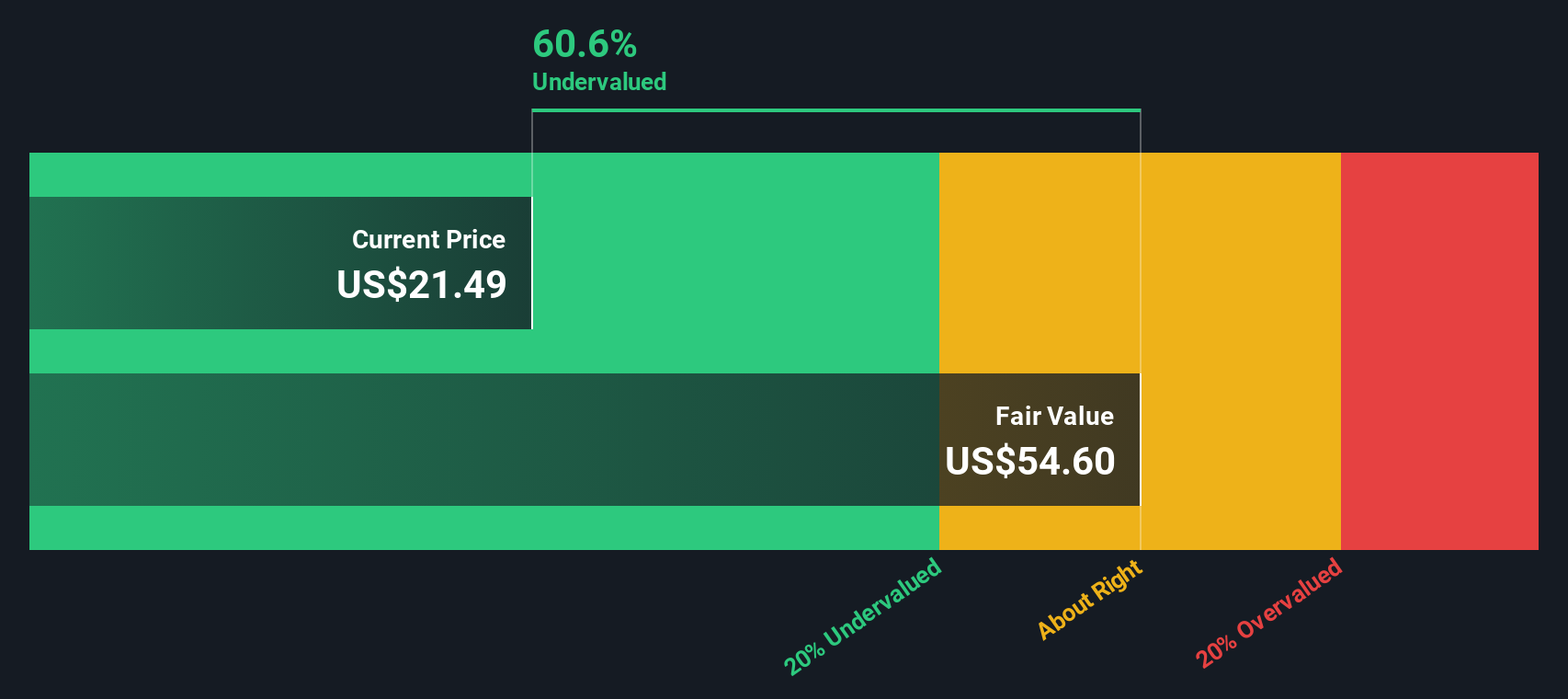

But with analysts seeing nearly 34% upside and valuation models implying an even steeper discount, is Smithfield still flying under the radar, or has the market already baked in its next leg of growth?

Price-to-Earnings of 9.9x: Is it justified?

Smithfield shares changed hands at $21.93 at the last close, and that price implies a modest 9.9x price-to-earnings multiple that appears clearly undervalued against both peers and the wider food sector.

The price-to-earnings ratio compares what investors are paying for each dollar of current earnings, and it is a key reference point for an established, profitable business like Smithfield. With earnings growing strongly in recent years and still expected to rise, a lower multiple suggests the market is cautious about how durable that profit strength will be rather than paying up for it.

Set against the US Food industry average multiple of 20.4x and a peer average of 15x, Smithfield’s 9.9x stands out as materially cheaper, implying investors are assigning a discount to its earnings profile. Relative to an estimated fair price-to-earnings ratio of 15.8x, the gap is even starker, indicating potential upside if sentiment shifted and the market moved closer to that fair ratio benchmark.

Explore the SWS fair ratio for Smithfield Foods

Result: Price-to-Earnings of 9.9x (UNDERVALUED)

However, softer revenue growth and recent share price volatility could quickly undermine this undervaluation story if profit momentum or pricing power slips.

Find out about the key risks to this Smithfield Foods narrative.

Another View: DCF Points to a Much Deeper Discount

While the 9.9x earnings multiple already hints at value, our DCF model goes much further. It puts fair value closer to $73.26 a share, around 70% above today’s $21.93 price. If that cash flow path plays out, is the market misreading Smithfield’s staying power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Smithfield Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Smithfield Foods Narrative

If you see the story differently or prefer to dive into the numbers yourself, you can build a complete view in minutes. Start with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Smithfield Foods.

Looking for more investment ideas?

Before you move on, lock in your next steps with focused stock ideas from the Simply Wall Street Screener, so you are not leaving potential returns on the table.

- Capture potential rebounds by targeting quality names trading at appealing valuations through these 906 undervalued stocks based on cash flows, and position yourself ahead of a sentiment shift.

- Ride structural growth in digital assets by studying these 81 cryptocurrency and blockchain stocks, where listed companies are building real businesses around blockchain and cryptocurrency infrastructure.

- Strengthen your income strategy by scanning these 15 dividend stocks with yields > 3% and zeroing in on companies offering attractive yields with room for sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFD

Smithfield Foods

Produces packaged meats and fresh pork in the United States and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026