- United States

- /

- Food

- /

- NasdaqGS:PPC

With Pilgrim's Pride Corporation (NASDAQ:PPC) It Looks Like You'll Get What You Pay For

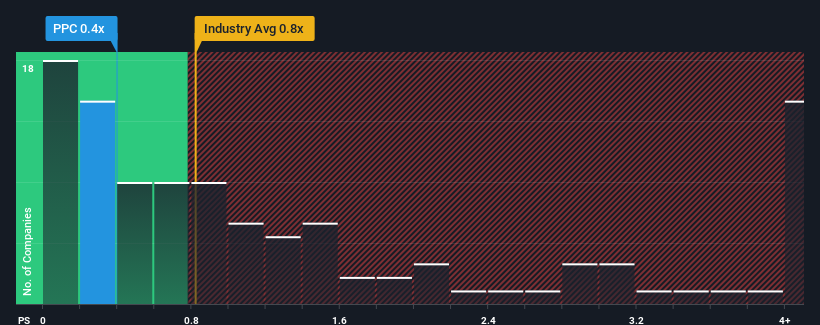

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Food industry in the United States, you could be forgiven for feeling indifferent about Pilgrim's Pride Corporation's (NASDAQ:PPC) P/S ratio of 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Pilgrim's Pride

How Pilgrim's Pride Has Been Performing

While the industry has experienced revenue growth lately, Pilgrim's Pride's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Pilgrim's Pride will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Pilgrim's Pride?

In order to justify its P/S ratio, Pilgrim's Pride would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.4%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 4.0% as estimated by the four analysts watching the company. That's shaping up to be similar to the 2.1% growth forecast for the broader industry.

In light of this, it's understandable that Pilgrim's Pride's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Pilgrim's Pride maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Pilgrim's Pride (1 makes us a bit uncomfortable) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PPC

Pilgrim's Pride

Produces, processes, markets, and distributes fresh, frozen, and value-added chicken and pork products to retailers, distributors, and foodservice operators.

Outstanding track record with flawless balance sheet.