- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP) Valuation: Is the Market Overlooking Long-Term Opportunities?

Reviewed by Simply Wall St

PepsiCo (PEP) shares have seen movement recently as investors digest the company’s latest performance and position in the competitive food and beverage sector. The stock’s history of stable brands keeps it a close watch for market participants.

See our latest analysis for PepsiCo.

This year’s price action has been a case of subtle swings, with PepsiCo’s share price showing near-term stability despite a one-year total shareholder return of -5.54%. After a modest 1-day share price gain and a slightly positive 90-day result, momentum feels steady rather than energetic at the moment. For investors, the broader view reveals that long-term holders have still achieved a positive five-year total return, while shorter-term sentiment has cooled as the market reassesses growth and risk expectations.

If you’re interested in broadening your investment search beyond the usual suspects, this is the perfect time to discover fast growing stocks with high insider ownership.

With the stock trading at a discount to analyst price targets but experiencing modest recent returns, investors now face a key question: Is PepsiCo undervalued at current levels, or is the market already factoring in its future potential?

Most Popular Narrative: 3% Undervalued

PepsiCo’s most recent close was $147.98, sitting just below the widely followed fair value of $152.57. Investors are considering if modest international softness risks upend the case for value, or if strategic partnerships will fuel the next chapter.

“Sustained investment and strategic focus on international expansion, particularly in emerging markets (e.g., India, LatAm, Middle East), is broadening PepsiCo's addressable market and driving faster, margin-accretive revenue growth. This positions the company to benefit from population growth and rising disposable incomes. (Expected impact: Top-line revenue and geographic diversification.)”

Want to know why this price target stands out? It hinges on a future margin leap and analyst conviction; yet some of the numbers behind that fair value may surprise you. Click through for the assumptions powering this story.

Result: Fair Value of $152.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow consumer uptake of healthier products and ongoing input cost pressures could challenge PepsiCo’s growth story and test analyst optimism in the coming period.

Find out about the key risks to this PepsiCo narrative.

Another View: Are Shares Priced for Perfection?

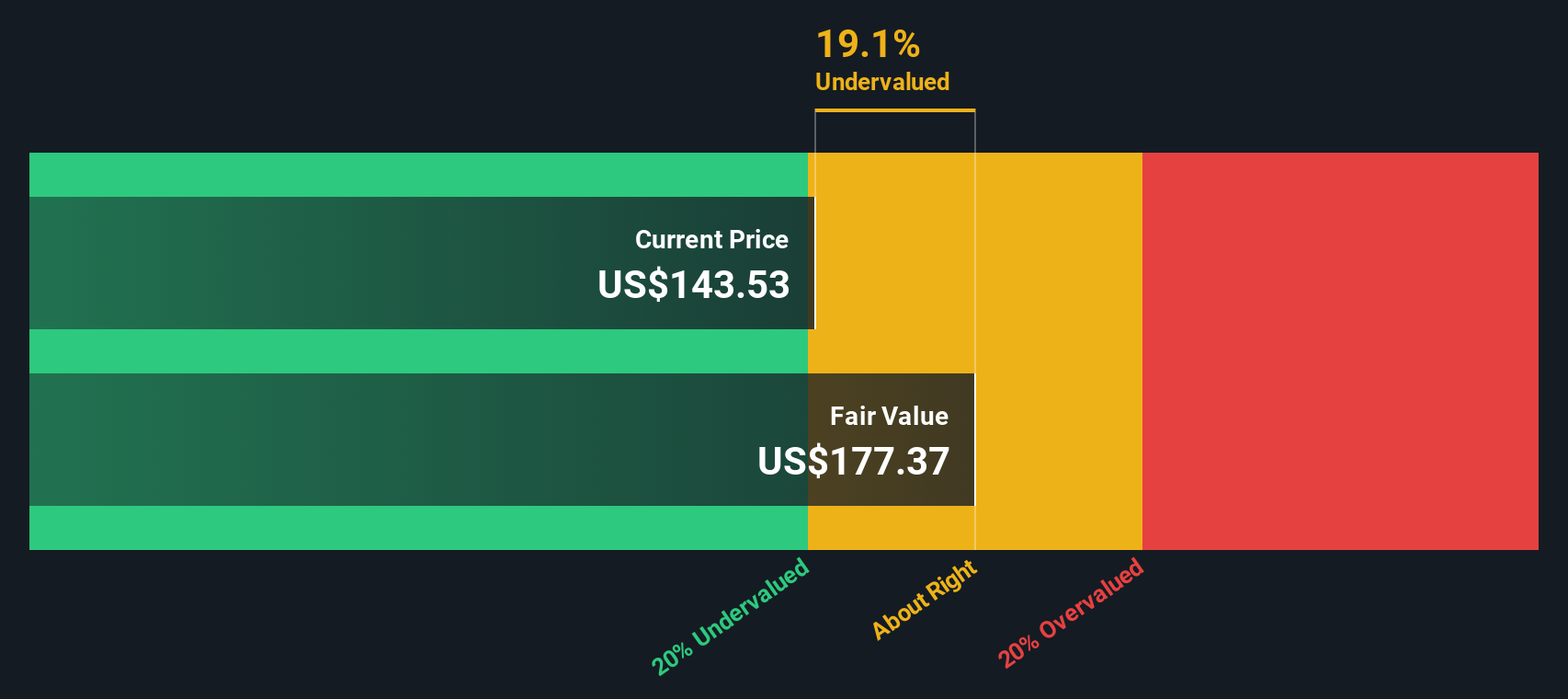

While analysts see PepsiCo as undervalued compared to their price target, our DCF model tells a different story. The SWS DCF model calculates a fair value that is well above the current share price. This suggests the market might be missing something significant. Could there be an overlooked upside, or a reason for the gap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PepsiCo Narrative

If you see the numbers differently or want to follow your own path, crafting a personalized narrative takes just a few minutes. Do it your way.

A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

Smart investors never stop searching for fresh opportunities. Use Simply Wall Street’s powerful screener to find companies that fit your strategy, before the crowd notices.

- Grow your income stream with reliable picks by checking out these 15 dividend stocks with yields > 3% offering attractive yields above 3%.

- Catch the next big technological leap and jump into the world of tomorrow by browsing these 25 AI penny stocks pushing the limits of artificial intelligence.

- Tap into the momentum of digital finance. See which companies are reshaping transactions and blockchain technology through these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success