- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP) Partners With Cargill To Advance Regenerative Agriculture Practices Across 240,000 Acres

Reviewed by Simply Wall St

PepsiCo (PEP) recently announced a strategic collaboration with Cargill focusing on regenerative agriculture practices and key supply chain resilience, potentially adding weight to last month's 3.6% price movement. The announcement came amidst a mixed market environment shaped by inflation data and a flurry of earnings reports, which saw major indexes like the Dow Jones and S&P 500 experiencing slight fluctuations. Despite a generally flat market, PepsiCo's engagement in sustainable initiatives and consumer-facing collaborations, such as new product launches in Canada, could have enhanced investor sentiment, aligning with broader market trends demonstrating resilience and innovation.

You should learn about the 2 possible red flags we've spotted with PepsiCo.

PepsiCo's recent collaboration with Cargill on regenerative agriculture and supply chain resilience aligns well with its strategic focus on sustainability and innovation. This initiative may bolster revenue and earnings prospects by improving cost efficiencies and brand perception. Over the past five years, PepsiCo's total return, including share price appreciation and dividends, was 18.21%. However, this long-term performance contrasts with its more recent struggle, where PepsiCo underperformed the US Beverage industry over the past year, which saw a decline of 3.5% in its returns.

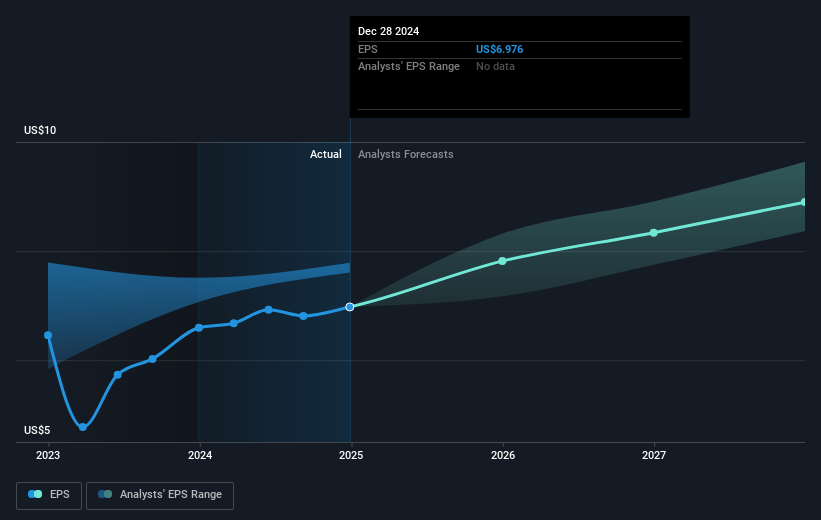

The market's mixed environment, touched by inflation and earnings variability, reflects on PepsiCo's current share price of US$135.57, which shows an 8.94% discount to the consensus price target of US$147.70. The announcement of the regenerative agriculture initiative may influence future revenue upwards by increasing sustainable product offerings, potentially aiding in the company's forecasted revenue growth of 2.9% annually over the next few years. Earnings forecasts might experience positive adjustments, although challenges such as tariffs and economic uncertainties remain considerations.

Evaluate PepsiCo's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives