- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP) Expands Energy Drink Portfolio; New US$585 Million Partnership with Celsius

Reviewed by Simply Wall St

PepsiCo (PEP) recently announced a significant strategic partnership with Celsius Holdings, reinforcing their long-term alignment in the beverage industry. This was part of the diverse news landscape that accompanied PepsiCo’s share price increase of nearly 12% over the last quarter. While the major market indices, like the S&P 500 and Dow Jones, experienced a general uptrend, the Celsius agreement likely bolstered sentiment by enhancing PepsiCo's energy drink portfolio. Concurrently, market retreats in tech stocks may have shifted investor focus to more stable sectors, potentially benefiting PepsiCo amidst its positive quarterly momentum.

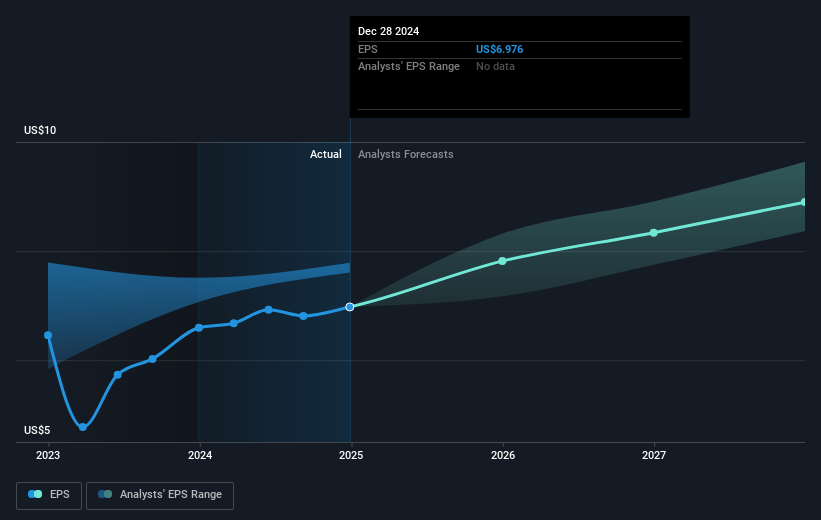

PepsiCo's recent partnership with Celsius Holdings could significantly drive its strategy of diversifying its product line, particularly in the growing energy drink segment. This aligns with PepsiCo's broader aim of expanding internationally and adapting to health trends, which has already been a focal point of the company's growth narrative. In the context of revenue and earnings forecasts, the collaboration may enhance PepsiCo’s revenue channels and bolster profit margins due to the potential introduction of higher-margin products. Analysts forecast revenue growth at 3.3% annually and a rise in profit margins over the next three years, which these developments may support.

Over the past five years, PepsiCo's total shareholder return, factoring in both share price and dividends, has been 21.53%. This illustrates a steady performance amidst varied industry pressures and evolving consumer preferences. However, within the past year, PepsiCo's shares have underperformed the U.S. beverage industry, which saw an 8.3% decline. Despite a price target set at US$153.05, the current share price of US$146.98 represents approximately a 4% discount, suggesting that investors still see some upside potential. The shares are trading at a slight discount to consensus fair value, providing a potential opening for reassessment as the impact of the Celsius partnership unfolds. As analysts project PepsiCo's earnings to grow by 10.8% annually, the integration with Celsius Holdings might further strengthen this growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives