- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (NasdaqGS:PEP) Expands AWS Partnership And Raises Dividend To US$5.69 Per Share

Reviewed by Simply Wall St

PepsiCo (NasdaqGS:PEP) recently entered into a multi-year agreement with Amazon Web Services to accelerate digital transformation through cloud and AI advancements, while announcing a 5% increase in its quarterly dividend to $1.42 per share. Despite these promising developments, the company's share price slipped by 3% last week. This price movement contrasted with broader market trends, where indices such as the Dow and S&P 500 saw modest gains, driven by investor optimism over potential U.S.-China trade negotiations and upcoming Federal Reserve actions. PepsiCo's price decline suggests specific company factors may have added weight to this broader market momentum.

PepsiCo has 3 weaknesses we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

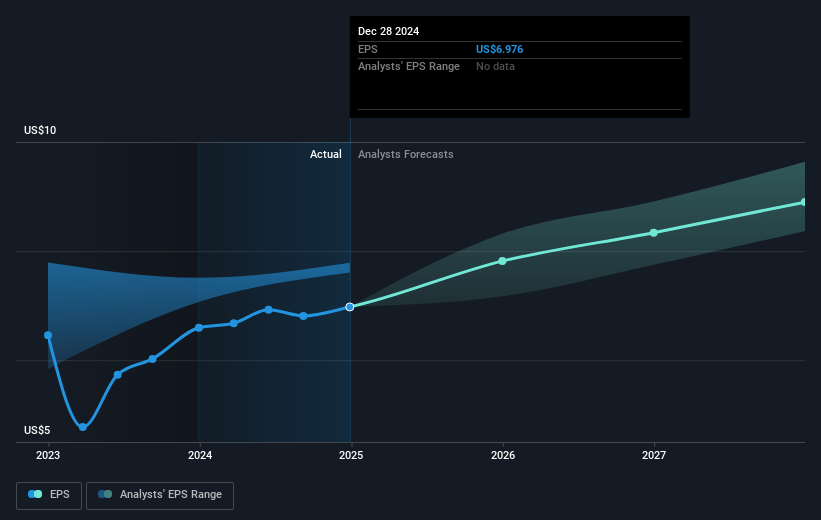

The recent collaboration with Amazon Web Services and the dividend increase are pivotal for PepsiCo as it aims to enhance profitability through digital transformation and maintain shareholder confidence. These initiatives could bolster the company's revenue and earnings forecasts. The partnership with AWS might streamline operations, improving cost efficiency and potentially leading to an increase in its current profit margin of 10.2%. Additionally, the dividend raise to US$1.42 per share signals strong cash flow management, even as economic uncertainties and tariffs present challenges. These factors could positively influence PepsiCo's attractiveness to investors.

Over a longer horizon, PepsiCo's total return, which includes share price and dividends, was 13.78% over the past five years. This performance provides a context against which recent price movements can be assessed. In the last year alone, PepsiCo underperformed the US Beverage industry, which saw a 6% decline.

Despite these promising developments, the stock currently trades at a discount compared to the consensus price target of US$151.55, having declined 3% last week to US$134.31. If its strategic initiatives adequately counterbalance the economic pressures and projected revenue growth is realized, reaching the analyst's target seems plausible. Presently, PepsiCo remains a compelling option for investors to evaluate, considering the broader market dynamics and personalized growth strategies focusing on international expansion and operational efficiency.

The valuation report we've compiled suggests that PepsiCo's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PepsiCo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives