- United States

- /

- Beverage

- /

- NasdaqGS:PEP

Is PepsiCo’s Recent 15% Rally Justified After Steady Cash Flow Growth?

Reviewed by Simply Wall St

If you are trying to decide what to do with PepsiCo stock right now, you are not alone. Whether you are weighing your next move or just checking in on a long-held position, it is a great time to take stock of what is driving PepsiCo’s share price. Over the last three months, the stock has crept up over 15%, showing a clear bounce from earlier in the year. On a five-year timeline, returns are still strong at 26%, despite a dip in the past twelve months.

What is behind these moves? Like many consumer goods giants, PepsiCo has been navigating shifts in consumer habits and supply costs. The company’s annual revenue and net income growth have clocked in at just over 3% and 10% respectively, pointing to underlying strength even as the sector faces uncertainty. Still, some recent hesitation among investors suggests there are questions about future growth and competition. This is exactly the kind of debate that turns valuation analysis from an academic exercise into a live-wire topic.

Based on six valuation checks, PepsiCo scores a 3 out of 6, meaning it appears undervalued on half of the tests used. That puts it firmly in the “worth a closer look” category not just for value hunters, but for anyone interested in steady earnings and possible upside. Next, let us break down the major methods investors use to assess whether a stock like PepsiCo is truly undervalued, or if there is more to the story than the numbers suggest. At the end, you will find an even more insightful way to look at valuation that could change how you view the stock altogether.

PepsiCo delivered -10.8% returns over the last year. See how this stacks up to the rest of the Beverage industry.Approach 1: PepsiCo Cash Flows

A Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting its future cash flows and then discounting them back to their total value today. This method aims to cut through market noise to find the company’s intrinsic value based on real, sustainable earning power.

At present, PepsiCo generates more than $6.8 billion in free cash flow (FCF). Analysts project this number to grow steadily, reaching about $11.6 billion by 2035. These figures suggest the company is on a path of solid but not spectacular expansion.

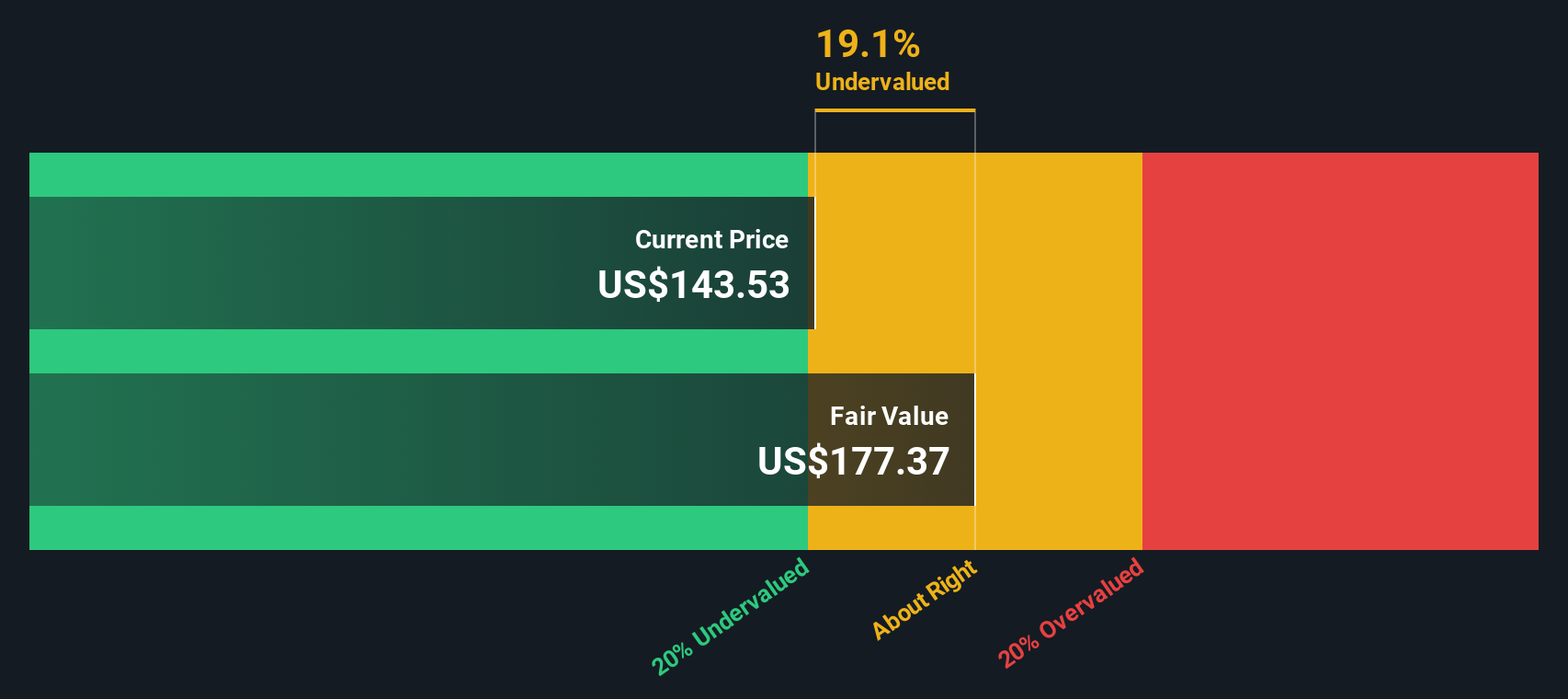

When all those projected cash flows are added up and discounted to reflect today’s dollars, the DCF model estimates PepsiCo’s intrinsic value at $177.37 per share. With PepsiCo’s price currently about 15.0% below that intrinsic value, the stock appears to be 15% undervalued.

This means that, based on expected cash flows and current market pricing, PepsiCo may present a value opportunity for long-term investors who focus on fundamentals.

Result: UNDERVALUED

Approach 2: PepsiCo Price vs Earnings

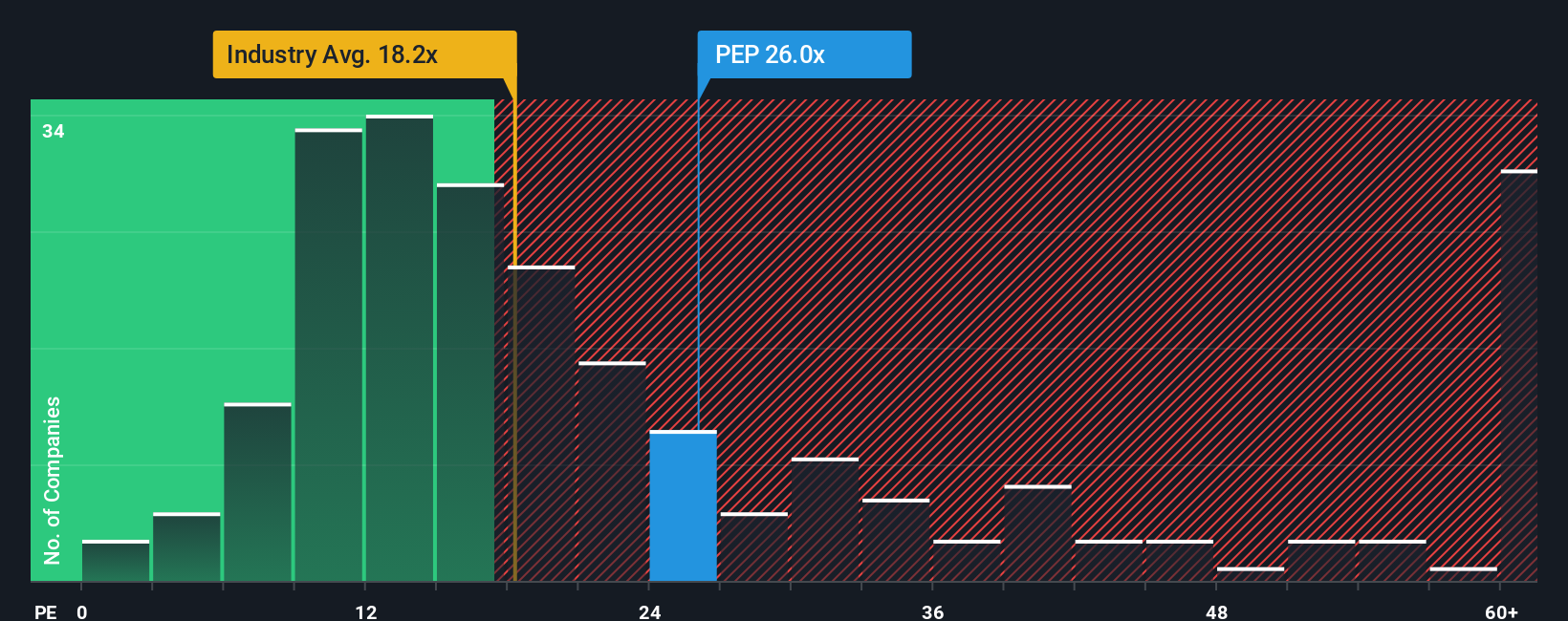

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like PepsiCo, as it compares a company’s share price to its earnings per share. This approach is often applied to established businesses with steady profits because it links investor expectations of future growth and risk to the amount they are willing to pay for current earnings.

Growth expectations and perceived risk play major roles in determining what a “normal” PE ratio should be. Companies expected to grow quickly, or those considered less risky, can command higher multiples. On the other hand, slower-growing or riskier companies tend to trade at lower PE ratios.

Currently, PepsiCo trades at a PE ratio of 27.3x. This is close to its peer average of 27.5x and above the beverage industry average of 18.2x, which reflects PepsiCo's reputation for stable earnings and market leadership. For additional perspective, Simply Wall St’s proprietary Fair Ratio incorporates factors such as PepsiCo’s earnings growth, financial health, and industry context, resulting in a calculation of 28.2x. Because PepsiCo’s current multiple is just below this fair value, the shares appear to be about appropriately valued on this basis.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your PepsiCo Narrative

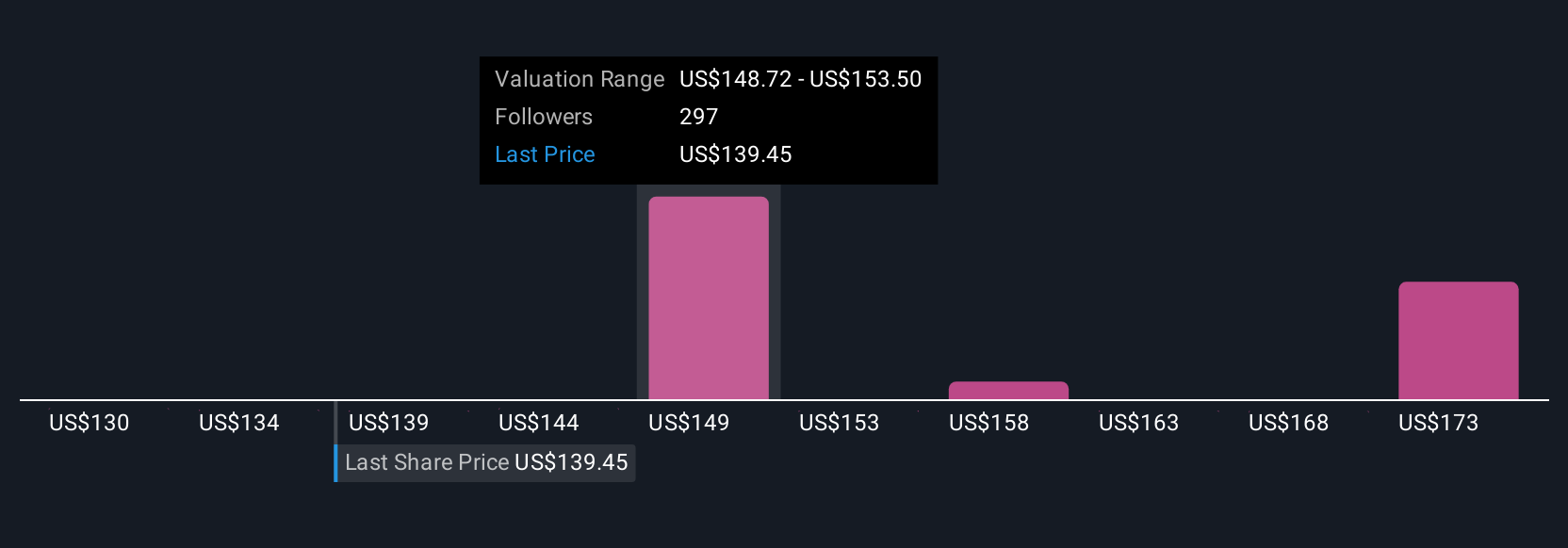

Instead of just relying on numbers, investors can use Narratives. This approach connects the company’s story, an understanding of its future, and the financial estimates that support a personal fair value. Narratives make it easy to articulate your perspective: you decide how PepsiCo’s growth, margins, and business trends might play out, and those beliefs tie directly to the fair value you assign the stock.

On Simply Wall St, Narratives are available to everyone and let millions of investors shape, share, and update their views in real time as new earnings or news emerge. This approach helps you make clear decisions on when to buy or sell by comparing your narrative-driven fair value with the current market price. Because Narratives are dynamic, your investment thesis always stays current.

For example, one investor’s Narrative might highlight PepsiCo’s digital and geographic expansion, strong brand, and stable margins to support a fair value well above the current price. Another might focus on slower growth or margin pressures and see the company as just fairly valued today. By building your own Narrative, you can put market movements and analyst targets in context and make confident, informed decisions shaped by your personal outlook.

Do you think there's more to the story for PepsiCo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives