- United States

- /

- Beverage

- /

- NasdaqGS:PEP

Has PepsiCo’s 8.5% Rally Sparked a Fresh Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

If you are holding PepsiCo stock or thinking of making a move, you are definitely not alone. With a brand as iconic as PepsiCo, investors naturally want to know whether now is the right time to buy, sell, or hold. Over the past month, the stock has jumped 8.5%, showing some fresh optimism after a stretch of more lackluster performance. Compare that to a return of just 1.2% over the last week and a modest 1.9% gain year to date, and you can see some momentum building but also hints of lingering caution.

Stepping back, PepsiCo’s one-year return stands at -8.1%, and even the three-year mark is slightly negative at -6.0%. This signals that recent gains have a lot of ground to make up. Still, over the last five years, the stock has delivered a strong 32.7% return. This reminds us that PepsiCo tends to reward patient investors, especially in less turbulent climates. Over the last several months, investors have been watching news of shifting consumer demand and the company’s moves to adapt outside of traditional soft drinks. While none of the recent headlines have dramatically shifted the narrative, they have helped stabilize sentiment around PepsiCo’s prospects.

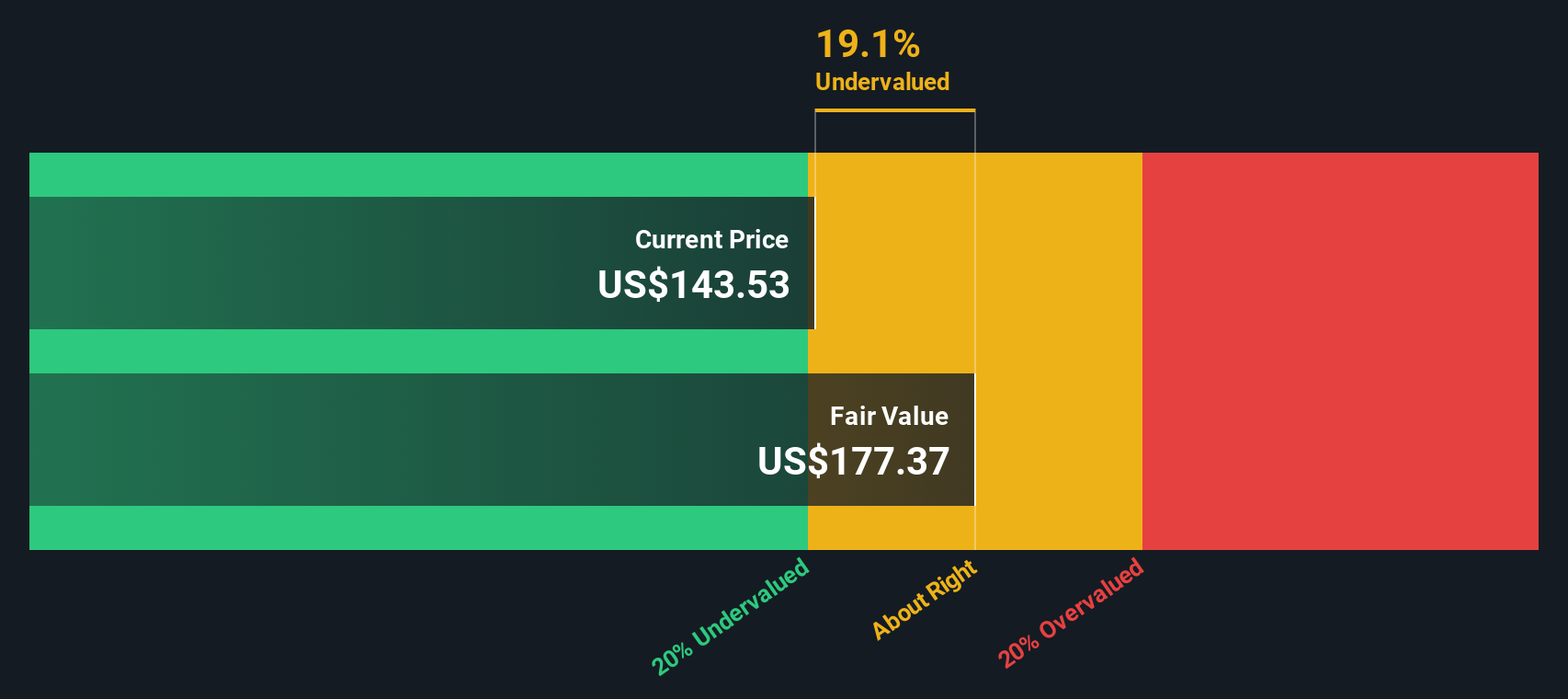

From a valuation standpoint, PepsiCo currently scores 3 out of 6 based on our in-depth checks for undervaluation. That means it passes about half of our favored tests for finding a bargain. In the next section, let’s break down those valuation approaches one by one and keep an eye out for what may be an even smarter way to measure whether PepsiCo deserves a spot in your portfolio.

Why PepsiCo is lagging behind its peers

Approach 1: PepsiCo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model values a business by estimating all the future cash flows it can generate, projecting those into the years ahead, and discounting them back to what they are worth today. In PepsiCo's case, the model uses a 2 Stage Free Cash Flow to Equity approach. This focuses on what shareholders could pocket after all expenses and reinvestments.

Currently, PepsiCo’s Free Cash Flow stands at $6.4 Billion. Analysts expect this to grow steadily, with projections reaching $11.4 Billion by 2027. Simply Wall St extrapolates this trend further and forecasts $14.9 Billion by 2035. These growth assumptions are grounded in both near-term analyst forecasts and more conservative estimates for later years.

According to this model, the intrinsic value of PepsiCo stock is calculated at $223.84 per share. With the current share price roughly 31.6% below this level, the DCF result suggests PepsiCo is trading at a significant discount and may offer compelling value for long-term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PepsiCo is undervalued by 31.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

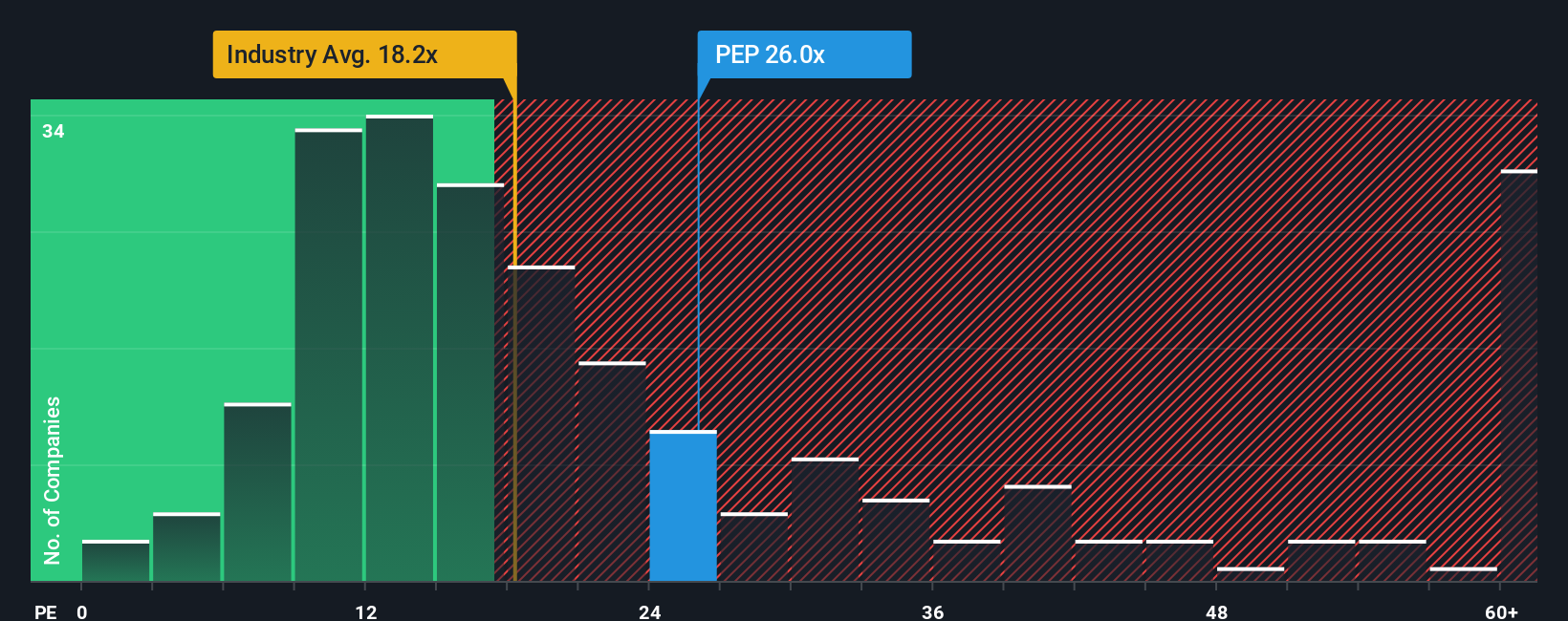

Approach 2: PepsiCo Price vs Earnings

For a profitable company like PepsiCo, the Price-to-Earnings (PE) ratio is a tried-and-true way to gauge valuation. The PE ratio is popular because it shows how much investors are willing to pay for each dollar of company earnings. Generally, higher growth expectations or lower risk can justify a higher PE ratio. On the other hand, lower growth or higher risk would call for a more modest multiple.

At present, PepsiCo trades at a PE ratio of 29x. To put this in context, the industry average sits at 17.8x and a basket of direct peers averages 26.2x. This suggests that PepsiCo is priced at a premium relative to most of its competitors in the broader beverage space.

However, Simply Wall St’s proprietary “Fair Ratio” refines the analysis. This metric is designed to provide a more complete picture than a simple peer or industry comparison because it factors in PepsiCo’s unique earnings growth prospects, profit margins, risk profile, industry placement, and market cap. For PepsiCo, the Fair Ratio works out to 29.3x, nearly identical to its current PE. This close alignment means the market is pricing PepsiCo almost precisely in line with its underlying qualities and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

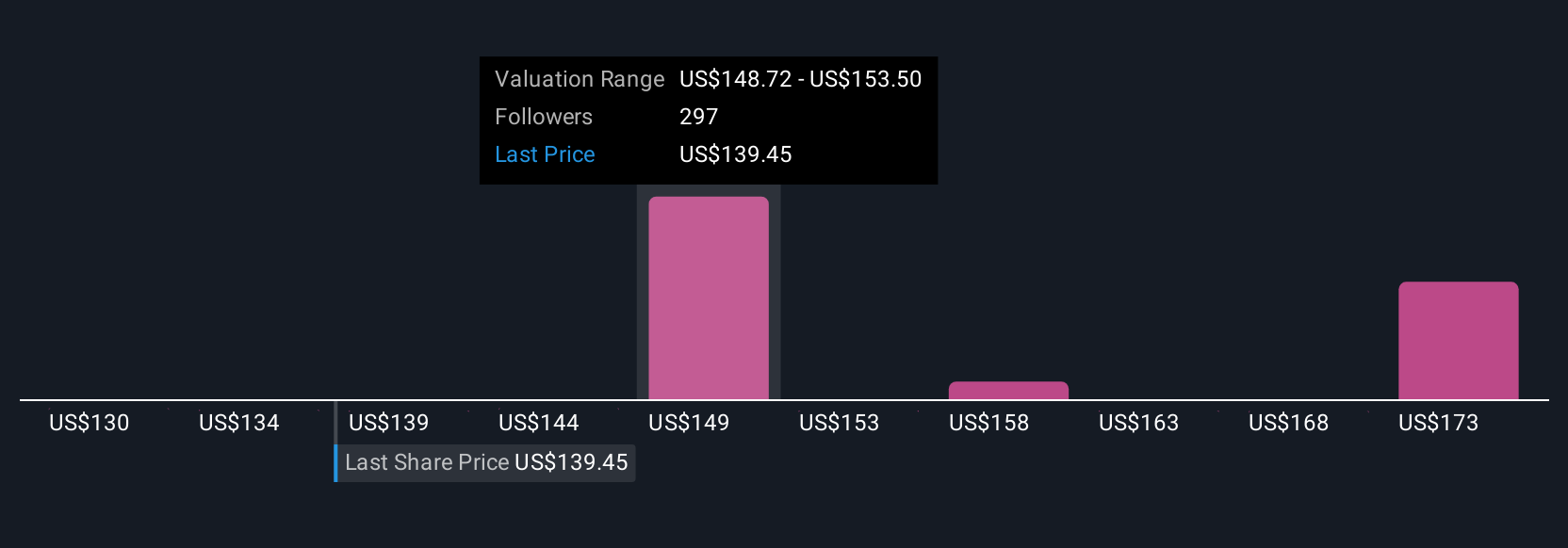

Upgrade Your Decision Making: Choose your PepsiCo Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is essentially your story behind the stock's numbers; it connects your own assumptions about PepsiCo’s future revenue, earnings, and margins to a specific fair value, all rooted in your expectations for the company's journey ahead.

Narratives make investing more personal and actionable, because instead of just comparing ratios or consensus targets, you are empowered to articulate and revise your view of PepsiCo’s future. This approach is straightforward and accessible on Simply Wall St’s platform, where millions of investors post, update, and share their perspective on each stock through the Community page.

With Narratives, you can quickly see how a company’s story and forecasts translate into a calculated fair value, then compare that to the current market price, making it easier to decide whether to buy, hold, or sell. Plus, these Narratives update dynamically whenever fresh news or new earnings land, helping your investment view stay relevant.

For example, different investors may see PepsiCo’s fair value as anywhere from $115 to over $160 per share based on their own beliefs about international expansion, healthier product innovation, and the business’s long-term margins. The Narrative you choose guides your decision and adapts as new information emerges.

For PepsiCo, we will make it easy for you with previews of two leading PepsiCo Narratives:

Fair Value: $160.43

Current Valuation: 4.6% undervalued (calculated as (160.43 - 153.03) / 160.43)

Revenue Growth Assumption: 2.0%

- PepsiCo is making major investments in supply chain automation, digitalization, and data-driven marketing to optimize operations and drive growth.

- Significant geographic expansion is planned via new factories in Vietnam and acquisitions in Africa and India, along with diversification through brands like Siete Foods.

- Strong commitment to sustainability, with targets for carbon neutrality and regenerative agriculture, positions PepsiCo as robust and adaptable compared to sector peers.

Fair Value: $152.57

Current Valuation: 0.3% overvalued (calculated as (153.03 - 152.57) / 152.57)

Revenue Growth Assumption: 3.5%

- Analyst consensus points to international market expansion and a shift toward healthier products as primary growth drivers, with technology boosting productivity and margins.

- Risks include slow consumer adoption of healthier snacks, reliance on core soft drink and snack segments, and cost pressures from sustainability requirements and input inflation.

- The current price is just above the analyst fair value, suggesting PepsiCo is fairly valued given existing growth, margin, and risk assumptions, with only limited upside.

Do you think there's more to the story for PepsiCo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives