- United States

- /

- Food

- /

- NasdaqGS:OTLY

Why Investors Shouldn't Be Surprised By Oatly Group AB's (NASDAQ:OTLY) 31% Share Price Surge

Despite an already strong run, Oatly Group AB (NASDAQ:OTLY) shares have been powering on, with a gain of 31% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.7% in the last twelve months.

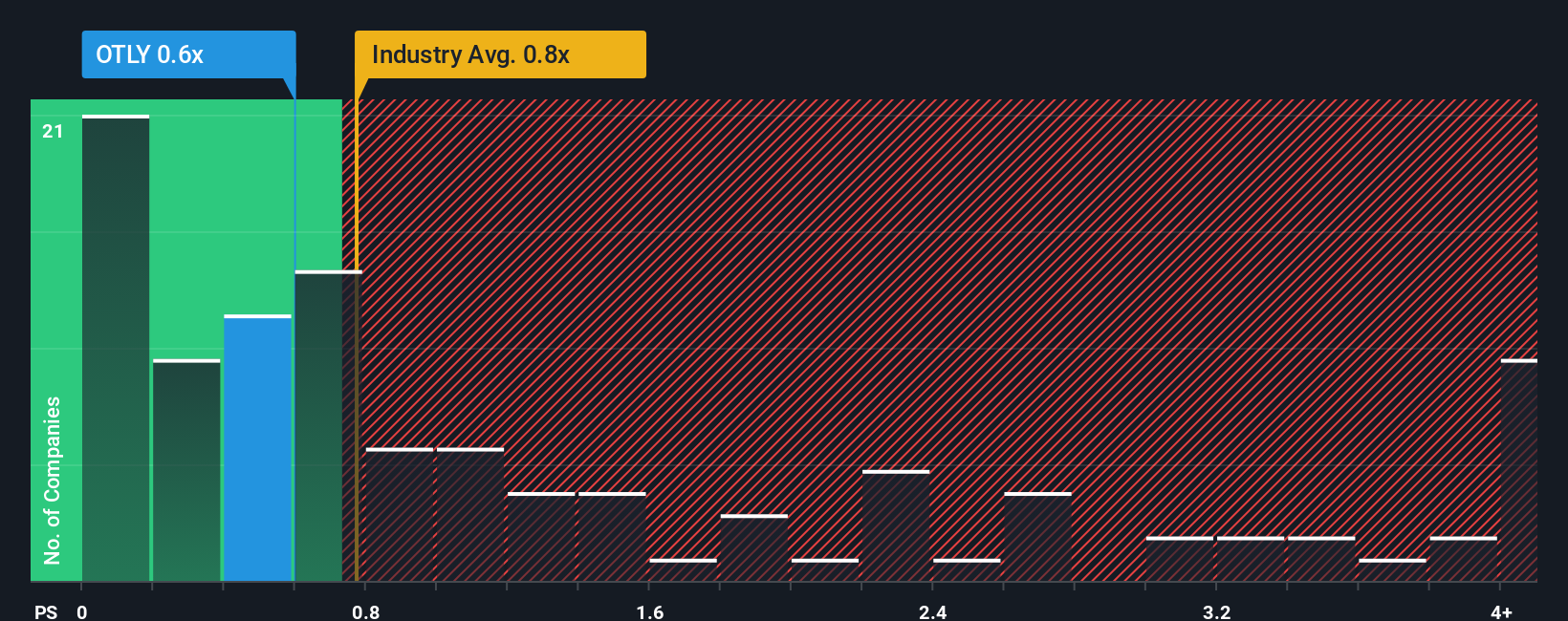

Although its price has surged higher, it's still not a stretch to say that Oatly Group's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Food industry in the United States, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Oatly Group

What Does Oatly Group's P/S Mean For Shareholders?

Oatly Group's revenue growth of late has been pretty similar to most other companies. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Oatly Group will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Oatly Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Oatly Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.4%. The solid recent performance means it was also able to grow revenue by 18% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 4.6% each year as estimated by the six analysts watching the company. That's shaping up to be similar to the 2.7% each year growth forecast for the broader industry.

With this information, we can see why Oatly Group is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Oatly Group's P/S Mean For Investors?

Its shares have lifted substantially and now Oatly Group's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Oatly Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Oatly Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OTLY

Oatly Group

An oatmilk company, provides a range of plant-based dairy products made from oats in Europe, the Middle East, Africa, the Asia Pacific, Latin America, the United States, Canada, Mainland China, Hong Kong, and Taiwan.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives