- United States

- /

- Food

- /

- NasdaqGS:OTLY

Oatly (OTLY) Losses Rise 10.5% Annually, Undermining Value Narrative Despite Low Price/Sales Ratio

Reviewed by Simply Wall St

Oatly Group (OTLY) remains unprofitable, with annual losses having worsened at a rate of 10.5% over the past five years. The company’s net profit margin has shown no improvement, and analysts predict Oatly will stay in the red for at least three more years. Despite a price-to-sales ratio of 0.6x that undercuts industry peers, sentiment is tempered by ongoing losses and revenue growth forecast at just 4.4% per year, well below the broader US market’s expected 10.3%.

See our full analysis for Oatly Group.Next, we will see how these latest numbers stack up against the narratives most investors follow. Expect a closer look at what is driving the conversation and what might be missing from the consensus.

See what the community is saying about Oatly Group

Margins Improve Despite $3.6 Million Adjusted EBITDA Loss

- Oatly posted an adjusted EBITDA loss of $3.6 million for the last quarter, even as it reported over 10% reductions in cost of goods per liter and further SG&A efficiencies.

- According to the analysts' consensus view, margin improvements and localized production are expected to support a path to profitability, but one-time cost cuts may limit sustainability.

- Guidance for full-year EBITDA sits at a modest $5 to $15 million, underlining management’s cautious optimism about achieving lasting margin gains.

- Consensus points to strategic cost action and supply chain optimization but highlights the risk that much of these savings are non-recurring and may only temporarily prop up profitability.

What matters next: The latest margin gains show operational progress but analysts remain wary of one-off improvements and muted demand.

📊 Read the full Oatly Group Consensus Narrative.Global Expansion Strong, but Regional Setbacks Hurt

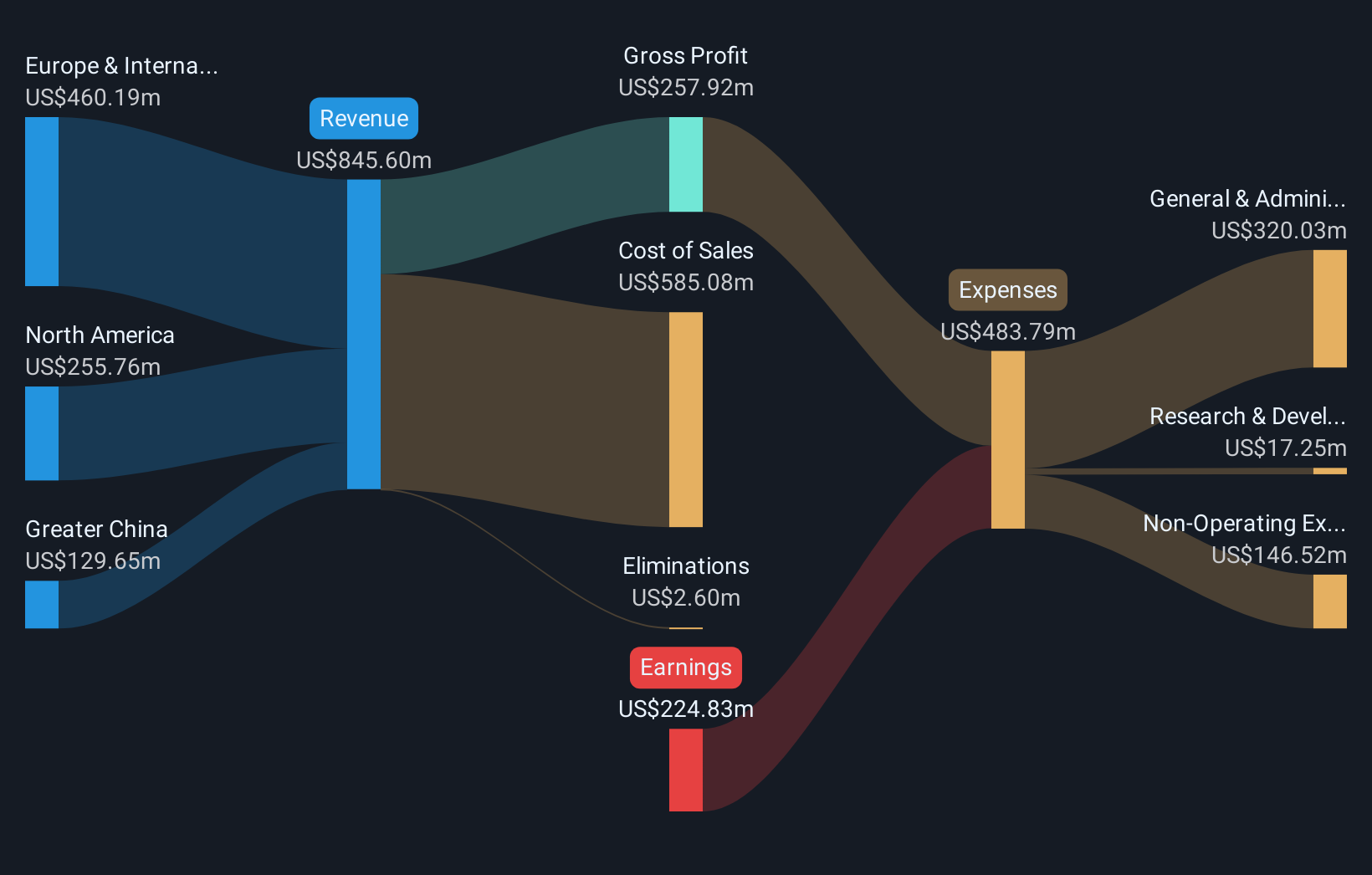

- North American segment revenue fell 6.8% due to a major customer’s sourcing change and weak market demand, even as European and international markets report volume gains outpacing overall category growth and high margins in key areas.

- The analysts' consensus notes robust performance abroad and product innovation but acknowledges that regional weaknesses and strategic uncertainty in Greater China could stall global momentum.

- While local launches and new premium products are winning over health-focused consumers worldwide, a strategic review in China and flat US guidance highlight persistent top-line growth challenges.

- Critics highlight that without organic recovery in North America or a decisive China turnaround, even international outperformance may not offset structural demand issues in key geographies.

Price-to-Sales Discount vs. Peers Signals Value

- With a price-to-sales ratio of 0.6x, Oatly trades at a notable discount to both the US Food industry average (0.9x) and close peer group (1.6x).

- Per the analysts' consensus narrative, investors might see relative value if Oatly can deliver its projected $58.2 million in earnings by 2028 and close the profitability gap.

- To justify the consensus price target of 20.67, Oatly would need to achieve a profit margin near the industry average of 6.2% and trade at a future PE of 12.7x, both significant hurdles with ongoing losses and slow revenue growth.

- The share price at $15.67 currently sits about 18% below the consensus target, but most rewards hinge on a successful turnaround story rooted in operational execution and growing market share.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Oatly Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the results? Share your perspective in just a few minutes and shape the story with your own insights. Do it your way

A great starting point for your Oatly Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite some margin improvements and international gains, Oatly continues to face prolonged losses, slow revenue growth, and regional setbacks that raise sustainability concerns.

If you’re looking for steadier performance and consistent results, check out stable growth stocks screener (2113 results) and discover companies delivering predictable growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTLY

Oatly Group

An oatmilk company, provides a range of plant-based dairy products made from oats in Europe, the Middle East, Africa, the Asia Pacific, Latin America, the United States, Canada, Mainland China, Hong Kong, and Taiwan.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives