- United States

- /

- Beverage

- /

- NasdaqGS:MNST

Monster Beverage (NasdaqGS:MNST) Reports Q4 Sales Of US$1.8B With 26% Dip In Net Income

Reviewed by Simply Wall St

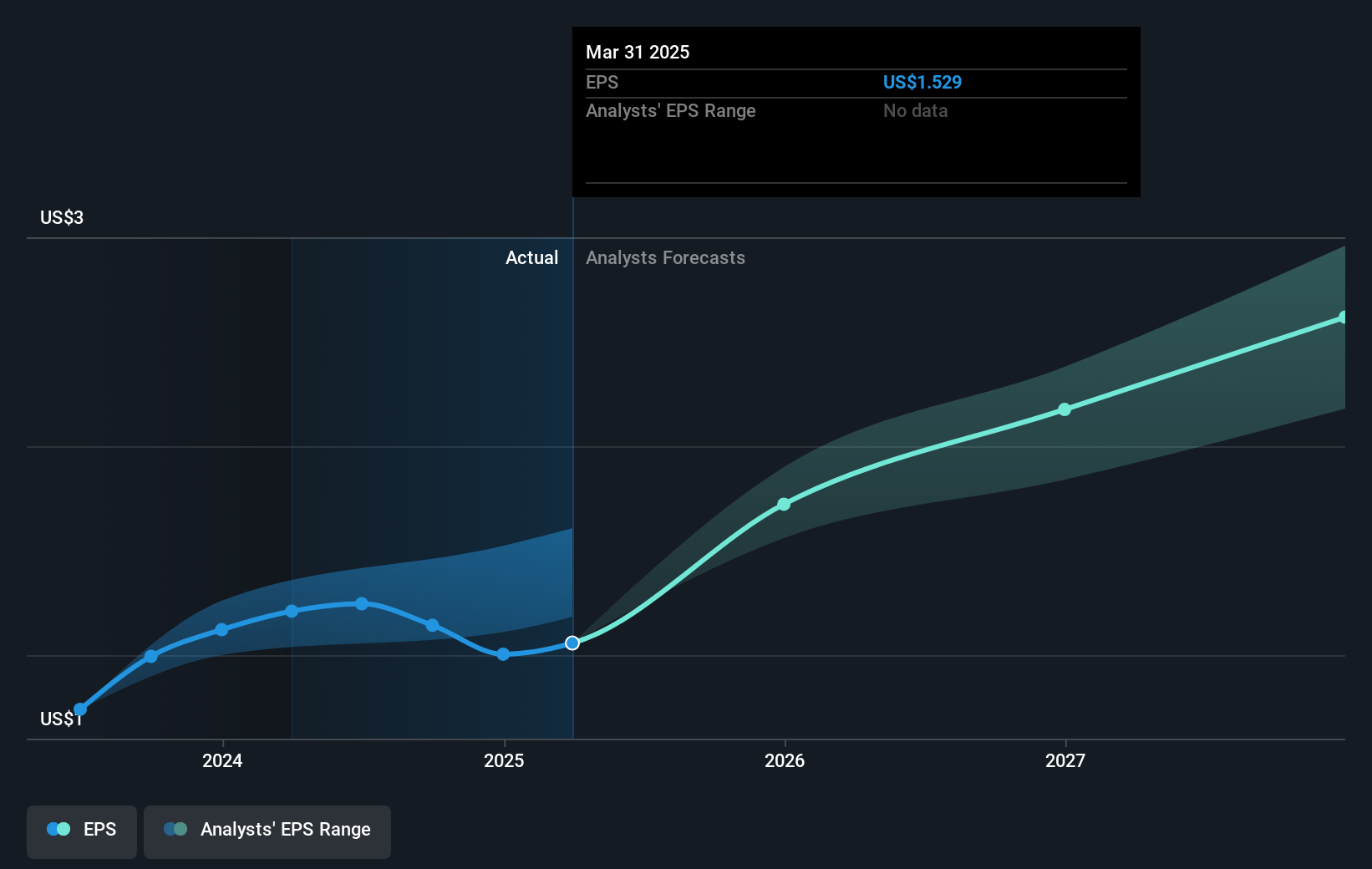

Monster Beverage (NasdaqGS:MNST) recently announced its fourth-quarter results, which showed strong revenue growth with sales rising to $1.81 billion from $1.73 billion, even as net income and EPS decreased compared to the previous year. During the same period, the company's stock experienced a price move of 6.72% last month. This exceptional performance contrasts with broader market trends, as the Nasdaq fell 5.5% for the worst month since September 2023, with the S&P 500 and Dow also in decline. The key market influence was a benign inflation report, easing fears about Federal Reserve actions. Despite Nvidia's earnings leading to a tech stock sell-off, Monster Beverage's positive sales figures set it apart in a volatile market, potentially providing resilience against broader declines and contributing to its robust share performance.

Get an in-depth perspective on Monster Beverage's performance by reading our analysis here.

The last five years have seen Monster Beverage's total shareholder returns reach 54.68%. This performance, however, did not align with the broader US market or the beverage industry over the most recent year. During this period, significant events shaped the company's trajectory. Notably, in 2023, Monster announced a 2:1 stock split effective in March, which often attracts investor interest by increasing liquidity. A substantial share buyback also occurred in late 2024, where the company repurchased over 10 million shares for US$500 million, reflecting a commitment to returning value to shareholders.

Noteworthy is the company's inclusion in major indices, such as the Russell 3000 Value Index and Russell 1000 Value-Defensive Index, in mid-2024. This inclusion can enhance stock visibility among institutional investors. Leadership changes, such as the election of Bill Douglas III as a director, also hint at a refreshed strategic direction. Despite varied market conditions, these initiatives likely played a role in the solid long-term returns for Monster Beverage shareholders.

- Discover whether Monster Beverage is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Gain insight into the risks facing Monster Beverage and how they might influence its performance—click here to read more.

- Have a stake in Monster Beverage? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNST

Monster Beverage

Through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives