- United States

- /

- Beverage

- /

- NasdaqGS:MNST

Is Monster Beverage Still a Smart Bet After Its 33% 2025 Rally?

Reviewed by Bailey Pemberton

Are you trying to figure out whether Monster Beverage deserves a spot in your portfolio right now? You’re not alone. The stock has been anything but sleepy lately, rising 1.6% in the past week and up a solid 9.0% over the last month. Zoom out and you’ll see even more reason for curiosity, with a 33.3% year-to-date return and a five-year surge of 80.2%. That is serious outperformance, which naturally brings up the big question: has all this good news already been priced in, or could there be more room to run?

Part of Monster’s recent buzz can be traced to broader beverage industry headlines and investor optimism around new product innovations and expanded distribution. While not making splashy headlines every week, the company continues to benefit from the enduring appeal of energy drinks, plus the gradual normalization of consumer demand post-pandemic. That has contributed to renewed confidence among some investors, and it is hard to ignore the ripple effects when you look at the chart.

But when it comes to valuation—the scorecard that matters most for many investors—the outlook isn’t quite as glowing. Based on key valuation checks, Monster scores a 0 out of 6 for being undervalued right now, suggesting that by traditional metrics, it may not be a bargain at current prices.

So how should you approach the numbers? Are classic valuation methods telling the real story? Next, we’ll break down the most common ways analysts assess value, and we’ll wrap up with an even better lens you should have in mind when weighing Monster’s true worth.

Monster Beverage scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Monster Beverage Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) valuation model estimates a company’s intrinsic worth by projecting its future cash flows and discounting them back to today’s value. In other words, this method forecasts how much cash Monster Beverage will generate and calculates what that stream is worth in present-day dollars.

For Monster Beverage, the current Free Cash Flow sits at about $1.80 billion. Analyst estimates project Free Cash Flow to grow steadily and reach approximately $2.29 billion by 2029. After five years, projections are extrapolated, but the trend shows continued upward momentum, supported by the company’s history of robust cash generation and industry demand. All figures are in US dollars.

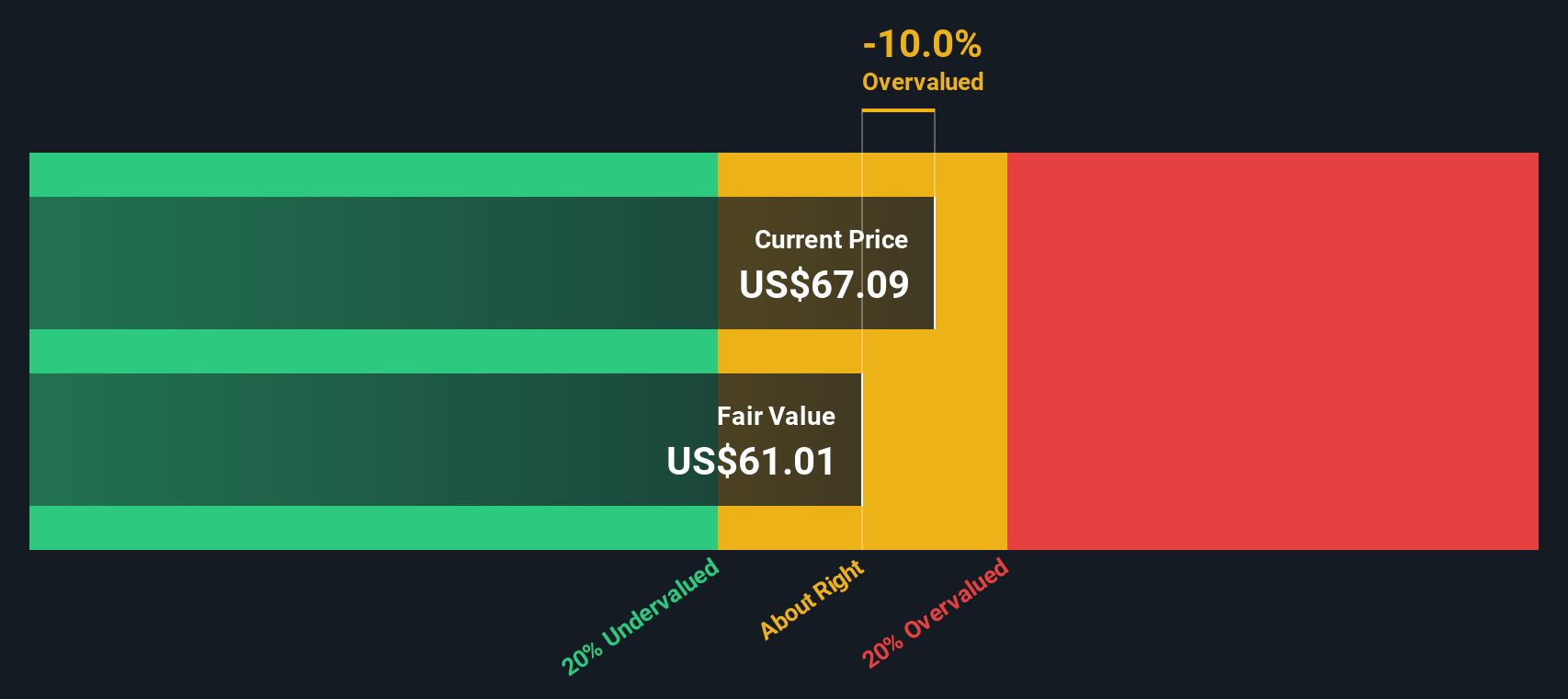

These calculations result in an estimated intrinsic value per share of $61.01. With Monster Beverage’s actual share price trading around 14.3% above this valuation, the stock appears to be overvalued when viewed through the lens of the DCF model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Monster Beverage may be overvalued by 14.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Monster Beverage Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic valuation tool for analyzing profitable companies, as it measures what investors are currently willing to pay for each dollar of earnings. For established, cash-generating businesses like Monster Beverage, it offers a direct perspective on market sentiment and company outlook.

Interpreting the "right" PE ratio is not always straightforward. It reflects not only how investors rate a company’s growth potential, but also incorporates expectations about risk and broader market conditions. Typically, higher growth or lower risk justifies a higher PE, while slower growers or riskier bets command lower multiples.

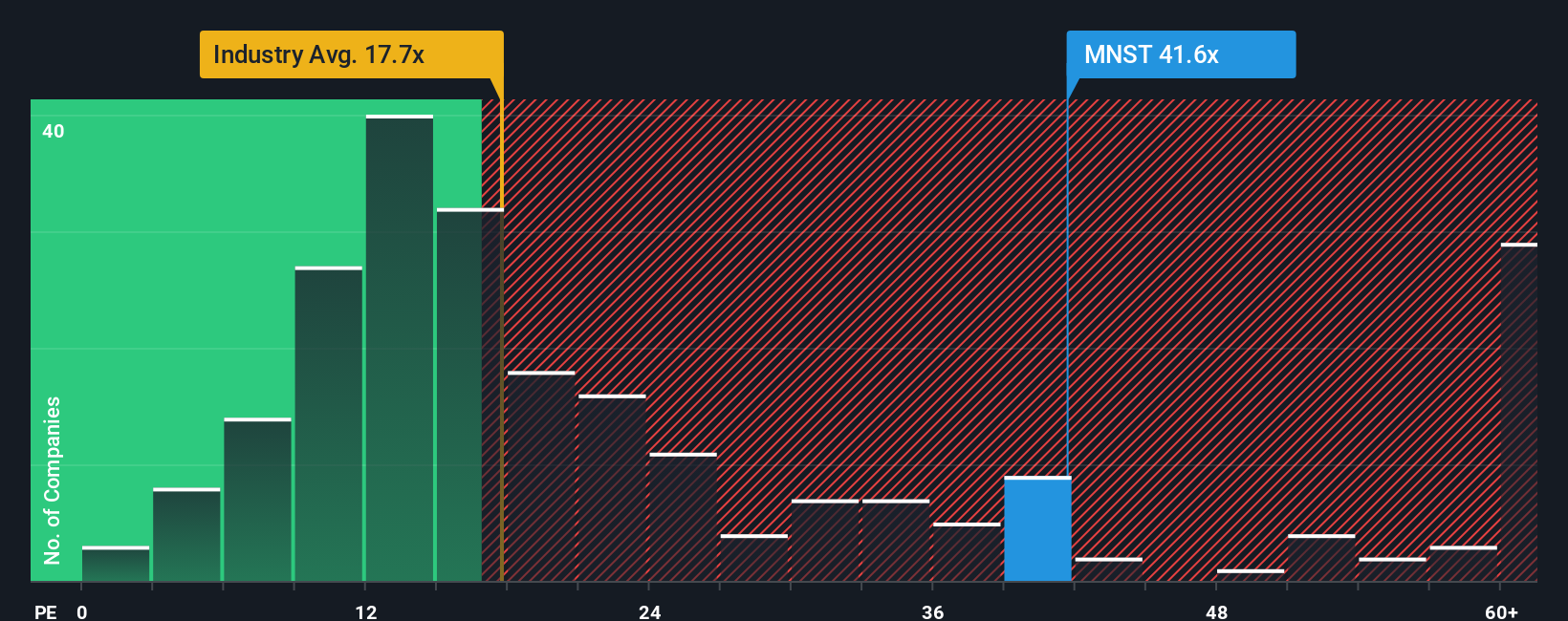

Monster Beverage is presently trading at a lofty 43.3x PE, which stands well above the beverage industry average of 17.6x and also surpasses the average among its peers at 22.6x. At first glance, this might raise eyebrows about an excessive premium.

This is where Simply Wall St’s "Fair Ratio" comes in. Unlike a straight peer or sector comparison, the Fair Ratio adjusts for exactly what matters: Monster’s actual earnings growth, risk profile, industry dynamics, profitability, and market cap. For Monster, the Fair Ratio stands at 24.9x, a notable step below its current PE.

Given that Monster’s current PE is materially higher than its Fair Ratio, the stock appears overvalued when assessed through this lens.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

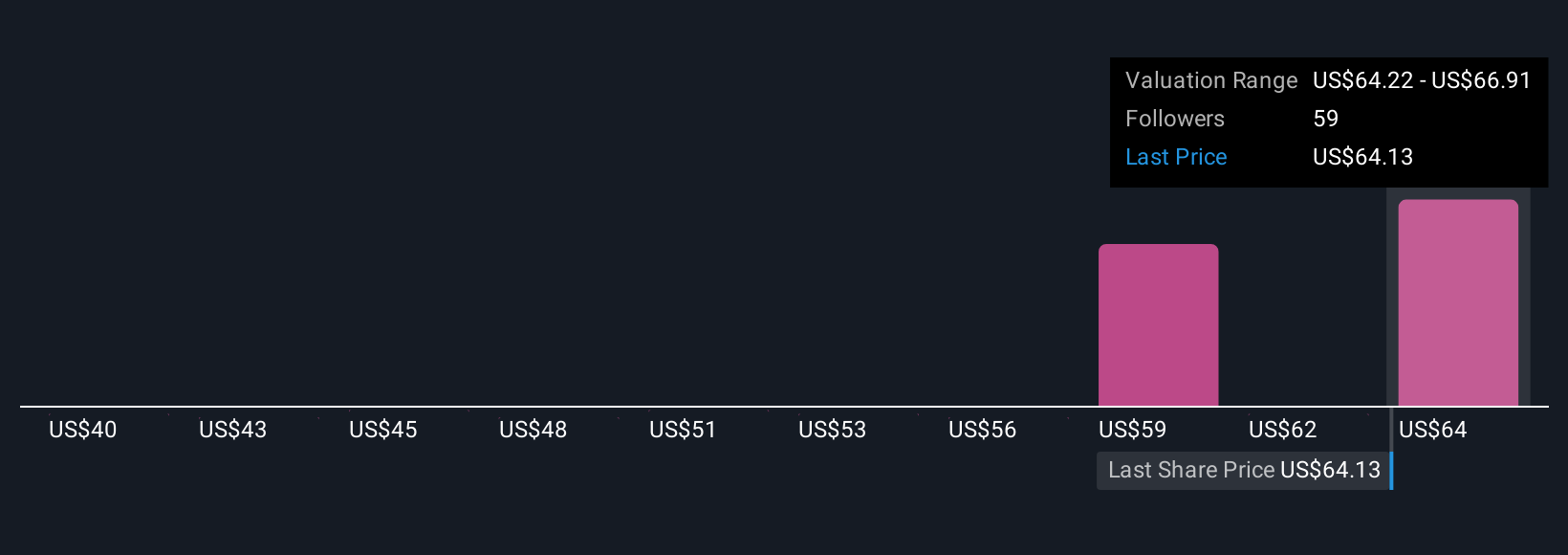

Upgrade Your Decision Making: Choose your Monster Beverage Narrative

Earlier, we mentioned a better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story behind the numbers, allowing you to connect the company’s catalysts, risks, and growth assumptions to your own forecast and fair value. It empowers you to move beyond just market prices or peer multiples by building a believable scenario. For example, you can map how Monster Beverage’s product innovation or international strategy might boost revenue, margins, or valuation, right inside Simply Wall St’s Community page, where millions of investors share perspectives.

Narratives make investing more accessible by letting you visually test your assumptions and instantly see how your fair value compares with Monster’s current share price, helping you decide whether to buy, hold, or sell. Plus, they auto-update as new news or earnings reports are released, so your Narrative always reflects the latest facts.

For example, some investors might craft a bullish Narrative for Monster based on anticipated margin expansion and robust international uptake, targeting a fair value of $75.00 per share. Others may be more cautious, focusing on competitive risks or cost pressures, and arrive at a more conservative value like $50.00. The choice of Narrative is yours, grounding every investment decision in logic you can revisit and refine as the story unfolds.

Do you think there's more to the story for Monster Beverage? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNST

Monster Beverage

Through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives