- United States

- /

- Beverage

- /

- NasdaqGS:MGPI

Positive Sentiment Still Eludes MGP Ingredients, Inc. (NASDAQ:MGPI) Following 27% Share Price Slump

The MGP Ingredients, Inc. (NASDAQ:MGPI) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

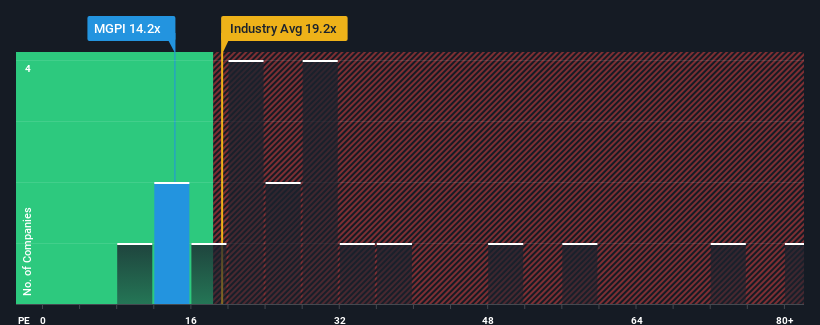

Since its price has dipped substantially, MGP Ingredients may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.2x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 35x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, MGP Ingredients has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for MGP Ingredients

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like MGP Ingredients' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 12%. Even so, admirably EPS has lifted 39% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 14% per annum over the next three years. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader market.

With this information, we find it odd that MGP Ingredients is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On MGP Ingredients' P/E

The softening of MGP Ingredients' shares means its P/E is now sitting at a pretty low level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of MGP Ingredients' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You always need to take note of risks, for example - MGP Ingredients has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MGPI

MGP Ingredients

Produces and supplies distilled spirits, branded spirits, and food ingredients worldwide.

Excellent balance sheet and good value.

Market Insights

Community Narratives