- United States

- /

- Food

- /

- NasdaqGS:MDLZ

Assessing Mondelez International (MDLZ) Valuation as Investors Weigh Recent Share Price Trends

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 14.4% Undervalued

The latest and most widely followed narrative suggests Mondelez International is currently trading at a significant discount to its estimated fair value. There may be room for future upside as growth initiatives take hold and operational strategies evolve.

Mondelez’s focus on innovative brand activations and product collaborations, such as the Oreo and Post Malone partnership and Cadbury Dairy Milk with Lotus Bakeries, is expected to enhance consumer engagement and drive revenue growth. Ongoing investment in sustainability initiatives, including scaling the Cocoa Life program and reducing carbon emissions, is likely to support long-term value creation and enhance brand loyalty, potentially improving net margins.

Want to know the big financial playbook powering this double-digit undervaluation? This narrative relies on bullish estimates tied to potential future brand impact and long-term profit expansion. What drives the analysts’ strong confidence? Explore the full narrative to see which forward-looking projections contribute to this stock’s current appeal.

Result: Fair Value of $74.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained high cocoa prices or continued weakness in consumer demand could challenge earnings growth and cast doubt on optimistic analyst projections.

Find out about the key risks to this Mondelez International narrative.Another View: Market-Based Valuation Raises Questions

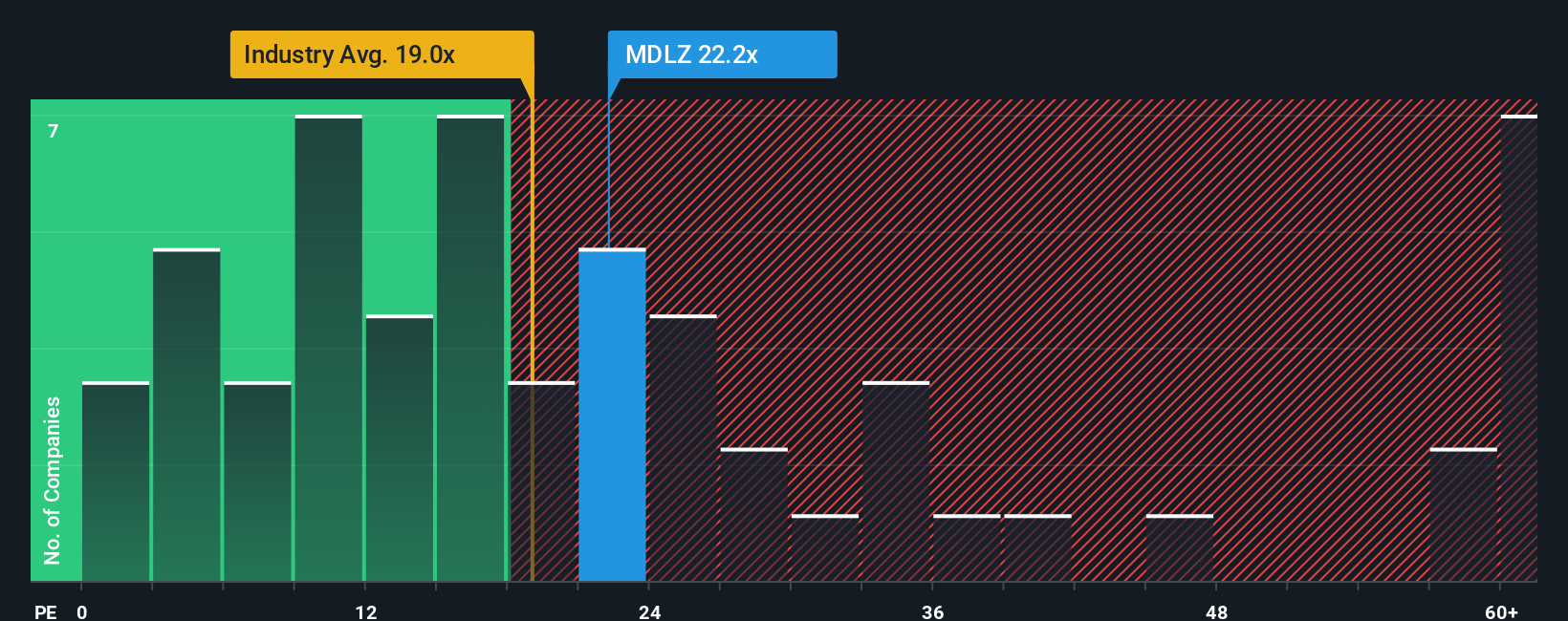

While our first approach suggests the stock is undervalued, comparing Mondelez International’s current price-to-earnings ratio to others in its industry hints that shares may actually be a bit expensive. Could the market be seeing risks the forecasts miss?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Mondelez International to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Mondelez International Narrative

If these perspectives do not align with your own outlook or if you’d rather dig into the details personally, you can create a customized narrative in just a few minutes. Do it your way.

A great starting point for your Mondelez International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let exciting opportunities slip by. Power up your portfolio with new angles from the Simply Wall Street Screener and discover stocks shaping tomorrow’s market leaders.

- Spot undervalued companies poised for a turnaround by checking out undervalued stocks based on cash flows. Catch potential winners before they make headlines.

- Benefit from the rise of automation with AI penny stocks, featuring emerging innovators transforming the future through artificial intelligence breakthroughs.

- Secure consistent income streams with dividend stocks with yields > 3% and uncover stocks offering robust dividends and impressive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDLZ

Mondelez International

Through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives