- United States

- /

- Food

- /

- NasdaqGS:MZTI

Lancaster Colony's (NASDAQ:LANC) Upcoming Dividend Will Be Larger Than Last Year's

Lancaster Colony Corporation (NASDAQ:LANC) has announced that it will be increasing its dividend on the 31st of March to US$0.80. Although the dividend is now higher, the yield is only 1.8%, which is below the industry average.

View our latest analysis for Lancaster Colony

Lancaster Colony's Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. Prior to this announcement, Lancaster Colony's dividend was only 67% of earnings, however it was paying out 28,701% of free cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

Looking forward, earnings per share is forecast to rise by 12.0% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 66%, which is in the range that makes us comfortable with the sustainability of the dividend.

Lancaster Colony Has A Solid Track Record

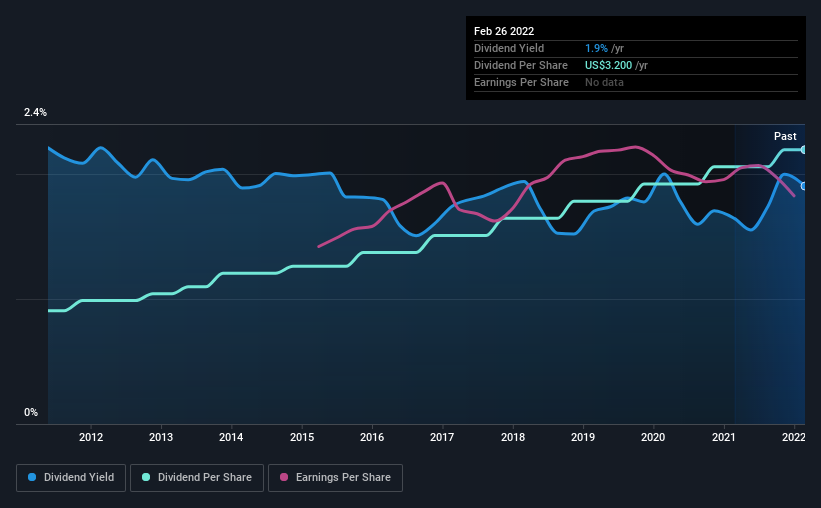

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from US$1.32 in 2012 to the most recent annual payment of US$3.20. This implies that the company grew its distributions at a yearly rate of about 9.3% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Lancaster Colony May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Unfortunately, Lancaster Colony's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Lancaster Colony is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Now, if you want to look closer, it would be worth checking out our free research on Lancaster Colony management tenure, salary, and performance. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MZTI

Marzetti

Engages in manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026