- United States

- /

- Food

- /

- NasdaqGS:MZTI

How Should Investors React To Lancaster Colony's (NASDAQ:LANC) CEO Pay?

This article will reflect on the compensation paid to Dave Ciesinski who has served as CEO of Lancaster Colony Corporation (NASDAQ:LANC) since 2017. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Lancaster Colony

How Does Total Compensation For Dave Ciesinski Compare With Other Companies In The Industry?

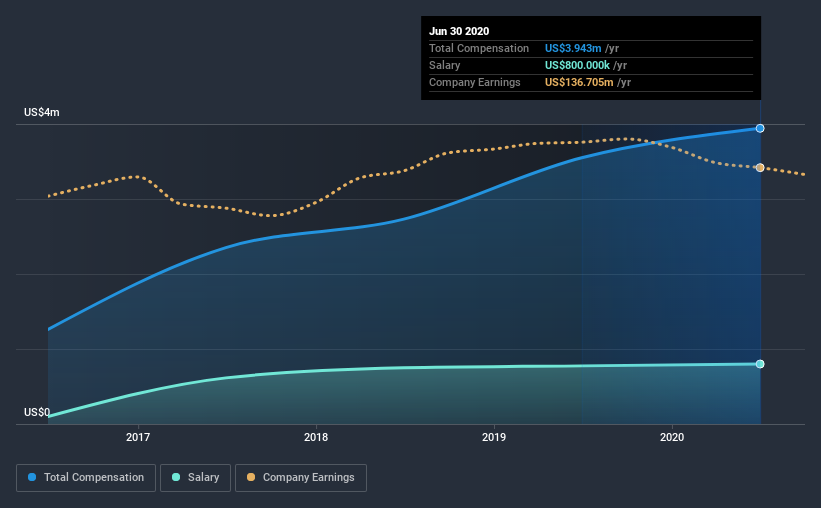

Our data indicates that Lancaster Colony Corporation has a market capitalization of US$4.9b, and total annual CEO compensation was reported as US$3.9m for the year to June 2020. Notably, that's an increase of 11% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$800k.

In comparison with other companies in the industry with market capitalizations ranging from US$4.0b to US$12b, the reported median CEO total compensation was US$7.1m. Accordingly, Lancaster Colony pays its CEO under the industry median. Furthermore, Dave Ciesinski directly owns US$6.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$800k | US$775k | 20% |

| Other | US$3.1m | US$2.8m | 80% |

| Total Compensation | US$3.9m | US$3.6m | 100% |

On an industry level, roughly 24% of total compensation represents salary and 76% is other remuneration. It's interesting to note that Lancaster Colony allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Lancaster Colony Corporation's Growth Numbers

Lancaster Colony Corporation has seen its earnings per share (EPS) increase by 6.1% a year over the past three years. In the last year, its revenue is up 1.4%.

We'd prefer higher revenue growth, but it is good to see modest EPS growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Lancaster Colony Corporation Been A Good Investment?

Most shareholders would probably be pleased with Lancaster Colony Corporation for providing a total return of 55% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As we noted earlier, Lancaster Colony pays its CEO lower than the norm for similar-sized companies belonging to the same industry. On the other hand, shareholder returns have been have been very pleasing, over the last three years, and that should put a smile on the faces of investors. Considering this fine result for investors, we believe CEO compensation to be apt.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Lancaster Colony that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Lancaster Colony, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:MZTI

Marzetti

Engages in manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026