- United States

- /

- Food

- /

- NasdaqGS:KHC

Kraft Heinz (NasdaqGS:KHC) Unveils New Ready-To-Eat Lunchables PB&J, Solving Parent Pain Points

Reviewed by Simply Wall St

Kraft Heinz (NasdaqGS:KHC) recently launched the Lunchables PB&J, a no-thaw dippable product aimed at providing fun and convenience to children and parents alike. This initiative enhances their product range appeal. Over the last quarter, Kraft Heinz's stock displayed a flat performance, consistent with the general market's moderate movement. The company's mix of product launches, consistent dividend announcements, and share buybacks likely contributed to maintaining investor confidence. However, recent earnings and revised corporate guidance reflecting lowered sales expectations may have countered upward momentum amidst broader market fluctuations.

We've spotted 2 risks for Kraft Heinz you should be aware of.

The launch of Kraft Heinz's Lunchables PB&J introduces new potential revenue streams, aligning with its strategy to enhance brand appeal through product innovation. However, the company's recent flat share performance contrasts with its longer-term five-year total return of 21.88%. During this time, Kraft Heinz has outpaced the one-year decline of 9.9% seen in the US Food industry, despite underperforming the broader US market, which grew 8.2%. This suggests a need to address short-term hurdles while continuing to build on its long-term advancements.

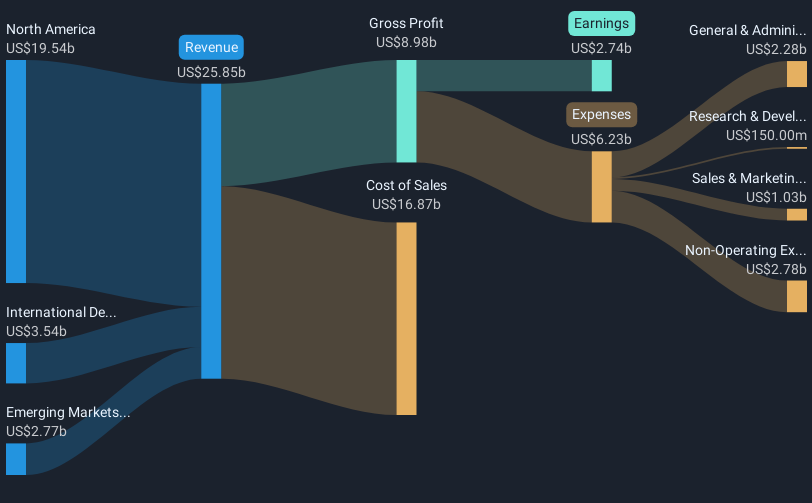

With a management focus on marketing and R&D investments, efforts like the new Lunchables PB&J could bolster revenue. Yet, the recent downward revision in sales expectations may temper the immediate optimism surrounding these product innovations. As for earnings forecasts, despite expectations of growth to $3.6 billion by 2028, the recent guidance cut might raise questions about these targets. Currently, Kraft Heinz's share price of US$28.87 is a 11.2% discount to the analyst price target of US$32.52. Investors may need to weigh the potential for value appreciation against near-term market and operational challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kraft Heinz, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives