- United States

- /

- Food

- /

- NasdaqGS:KHC

Kraft Heinz (NasdaqGS:KHC) Launches Limited Edition HEINZ Chip Dip For National Potato Chip Day

Reviewed by Simply Wall St

Kraft Heinz (NasdaqGS:KHC) experienced a 6% price increase over the past month, likely influenced by its recent product initiatives that have captured consumer attention. The launch of the HEINZ Chip Dip on March 12, with its playful pairing of potato chips and ketchup, coinciding with National Potato Chip Day, may have contributed to increased brand visibility in the consumer market. Additionally, the launch of Crystal Light Vodka Refreshers and the Flavor Tour Sauces have diversified its product offerings and potentially sparked renewed consumer interest in the brand's portfolio. Meanwhile, broader market sentiments showed a mix of volatility with recent declines, but some stability emerged following an inflation report that may have eased concerns about imminent economic tightening. Despite these market fluctuations, Kraft Heinz’s proactive product strategy appears to maintain investor interest, culminating in a notable uptick in its share price last month.

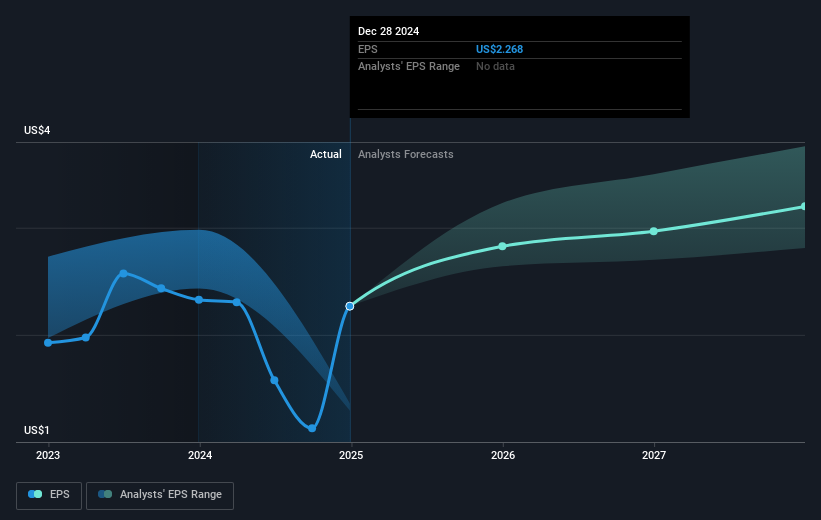

Learn about Kraft Heinz's future growth trajectory here.

The past five years have seen Kraft Heinz Company (NasdaqGS:KHC) deliver a total shareholder return of 63.17%, a reflection of its evolving business strategies and market dynamics. Throughout this timeframe, the company has emphasized product expansion and consumer trends, which include the introduction of globally-inspired sauces and the launch of Crystal Light Vodka Refreshers in March 2025. Despite the company's underperformance relative to the US market over the past year, the strategic focus on innovation has been pivotal.

Key financial maneuvers, such as the robust share buyback program initiated in November 2023, which repurchased over 32 million shares for US$1.10 billion, have further bolstered investor confidence. Additionally, management transitions, like appointing Marcel Regis as President of West and East Emerging Markets in early 2025, highlight Kraft Heinz's commitment to strengthening its market presence. These factors have collectively contributed to the company's steady performance over the longer term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives