- United States

- /

- Food

- /

- NasdaqGS:KHC

Kraft Heinz (NasdaqGS:KHC) Extends US$4 Billion Credit Facility to 2030

Reviewed by Simply Wall St

Kraft Heinz (NasdaqGS:KHC) recently amended their credit agreement, extending the maturity date for their $4 billion revolving credit facility. This development, although financially significant, did not impact the company’s stock price, which remained relatively flat over the past week amid broader market stability. As the Dow Jones and other major indices showed slight gains, primarily driven by tech sector advancements, Kraft Heinz’s modest price movement remains consistent with the broader market sentiment. Concerns over U.S. trade policy may have influenced overall investor behavior while having little direct effect on Kraft Heinz's performance.

You should learn about the 2 risks we've spotted with Kraft Heinz.

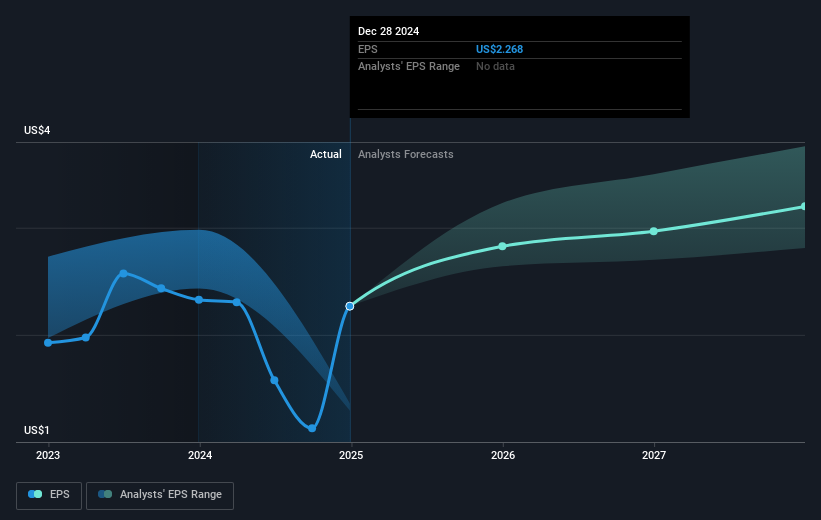

The recent amendment to Kraft Heinz's credit agreement, although significant, did not immediately impact the share price, which remained stable despite a favorable tech-driven broader market. Over a five-year period, the company recorded a total return of 0.60% decline, reflecting challenges in sustaining long-term investor confidence. In contrast, over the past year, Kraft Heinz underperformed the US Food industry, which saw a return of 5.8% decline, indicating competitive pressures within the sector.

The company's commitment to reinvigorating brands like Lunchables and Capri Sun through higher marketing and R&D investments suggests a potential direction for future growth, though these strategies may initially tighten net margins. The analyst price target of US$31.56 vs. the current share price of US$28.40 indicates a potential upside of 10%, primarily dependent on improved revenue and earnings forecasts. If these investments yield the anticipated results in consumer engagement and market expansion, it could align the company's performance closer to industry standards. However, the risks tied to cost pressures and market competition remain pivotal factors to monitor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives