- United States

- /

- Food

- /

- NasdaqGS:KHC

Can Kraft Heinz's Uber Eats Collaboration Shift Its Investment Thesis?

- Kraft Heinz's pursuit of strategic transactions and partnerships is aimed at driving growth and enhancing shareholder value.

- A new collaboration with Uber Eats highlights Heinz products in restaurants, signaling a strategic shift in response to evolving consumer demands.

- The implications of Kraft Heinz's strategic pursuits on its investment strategy and market positioning are yet to unfold.

Kraft Heinz Investment Narrative Recap

For Kraft Heinz investors, believing in the company's ability to adapt and thrive is crucial, especially amid recent collaborations like with Uber Eats. While such partnerships might not dramatically shift immediate catalysts or mitigate primary risks like inflation and margin pressures, they signal responsiveness to consumer trends. This flexibility can be pivotal in shaping Kraft Heinz's market positioning and aligning with broader branding and R&D initiatives. Despite past earnings declines and revised guidance, the company seems committed to strategic reinvestments, potentially revitalizing key brands and expanding its emerging market footprint. The Uber Eats collaboration underlines Kraft Heinz's ongoing pursuit of relevancy and innovation in a competitive landscape.

Read the full narrative on Kraft Heinz (it's free!)

Exploring Other Perspectives

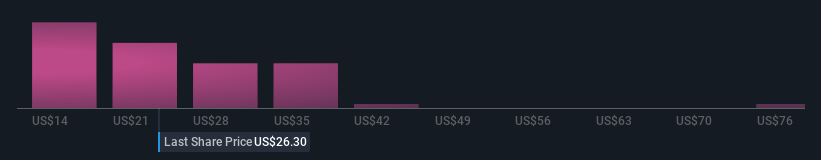

Among 27 investor opinions from the Simply Wall St Community, Kraft Heinz's fair value estimates range from $7.70 to $83.36, showcasing significant valuation diversity. As the company reportedly expands marketing efforts to enhance brand presence and cater to consumer demands, these differing perspectives highlight varying beliefs in Kraft Heinz's potential to leverage new partnerships for growth. Consider how such expansive views reflect both cautious and optimistic expectations for the company's future.

Explore 27 other fair value estimates on Kraft Heinz - why the stock might be worth just $7.70!

Build Your Own Kraft Heinz Narrative

Disagree with existing narratives? Create your own in under 3 minutes — extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kraft Heinz research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kraft Heinz research report provides a comprehensive fundamental analysis summarized in a single visual — the Snowflake — making it easy to evaluate Kraft Heinz's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar—for now. Get in early:

- AI is about to change healthcare. These 21 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives