- United States

- /

- Food

- /

- NasdaqGS:KHC

As Kraft Heinz (NASDAQ:KHC) Recovers, Institutions are Boosting Their Ownership

After declining for months, The Kraft Heinz Company (NASDAQ: KHC) is finally breaking out of the downtrend, as the stock reached levels not seen in over half a year.

Despite the hefty P/E ratio and a pressured dividend, the optimistic future growth makes it attractive to the market participants looking to park their money into traditionally defensive sectors.

View our latest analysis for Kraft Heinz

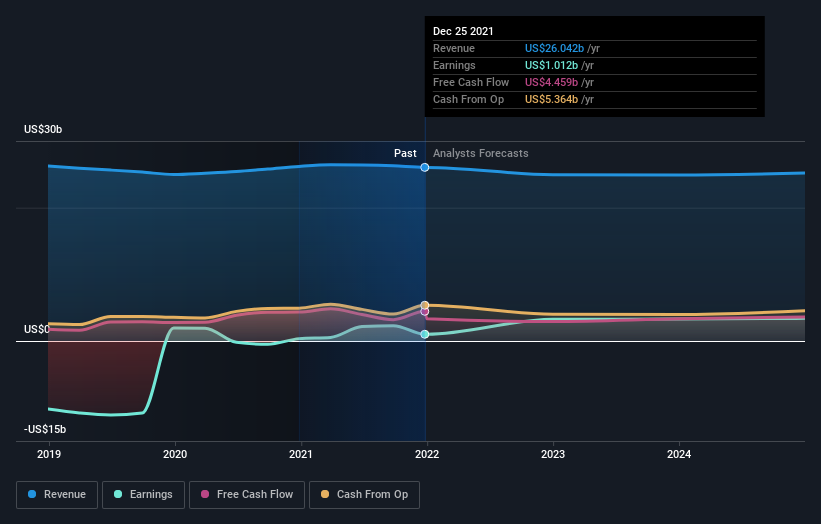

Full-year 2021 results:

- EPS: US$0.83 (up from US$0.29 in FY 2020).

- Revenue: US$26.0b (flat on FY 2020).

- Net income: US$1.01b (up 184% from FY 2020).

- Profit margin: 3.9% (up from 1.4% in FY 2020).

Over the last 3 years, on average, earnings per share have increased by 114% per year, but its share price has only increased by 4% per year, which means it is significantly lagging earnings growth.

Speaking about inflation Executive VP Carlos Abrams-Rivera stated that the company is fighting it by improving the quality of the products over time while simultaneously reducing costs. Meanwhile, Rafael Oliveira, Zone President of International, reiterated the company's focus on emerging markets to achieve double-digit organic growth.

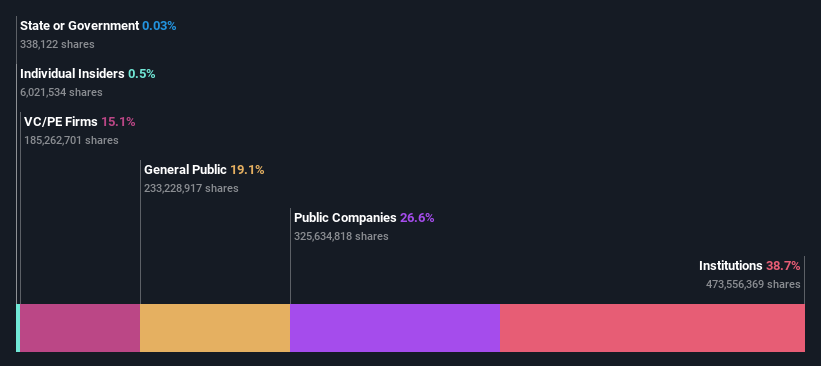

Who Currently Owns Kraft Heinz?

Kraft Heinz has a market capitalization of US$47b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. In the chart below, we can see that institutional investors have bought into the company.

You can zoom in on the different ownership groups to learn more about Kraft Heinz.

What Does The Institutional Ownership Tell Us About Kraft Heinz?

Institutional investors commonly compare their returns to the returns of a widely followed index. So they generally do consider buying larger companies included in the relevant benchmark index.

We can see that Kraft Heinz has institutional investors, and they hold a good portion of its stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a significant share price drop if two large institutional investors try to sell out of stock simultaneously. Of course, keep in mind that there are other factors to consider, too.

Berkshire Hathaway Inc. is currently the company's largest shareholder, with 27% of shares outstanding. With 15% and 4.6% of the shares outstanding, respectively, 3G Capital, Inc. and The Vanguard Group, Inc. are the second and third largest shareholders.

Furthermore, we found that the top 4 shareholders control more than half of the company, which implies that this group has considerable sway over the company's decision-making.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Kraft Heinz

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board, and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, too much power is concentrated within this group on some occasions.

Our most recent data indicates that insiders own less than 1% of The Kraft Heinz Company. It is a large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own US$232m worth of shares (at current prices). It is good to see board members owning shares, but it might be worth checking if those insiders have been buying.

General Public Ownership

With a 19% ownership, the general public, mostly comprised of individual investors, has some degree of sway over Kraft Heinz. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Equity Ownership

Private equity firms hold a 15% stake in Kraft Heinz. This suggests they can be influential in key policy decisions. Sometimes we see private equity stick around for the long term, but generally speaking, they have a shorter investment horizon and don't invest in public companies much. After some time, they may look to sell and redeploy capital elsewhere.

Public Company Ownership

Public companies currently own 27% of Kraft Heinz stock. It's hard to say for sure, but this suggests they have entwined business interests. This is Berkshire Hathaway's stake, which has been present since 2013 when the company acquired a stake in Kraft and then helped finance the merger with Heinz in 2015.

Next Steps:

Looking back at our previous analysis of the KHC ownership, we notice that the general public reduced their stake while the institutions boosted it. This can be due to the recent broad market shake-up that scared retail investors. However, seeing an uptick in institutional interest is a positive sign, as they are usually in for a long haul.

To truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Kraft Heinz you should know about.

But ultimately, it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives