- United States

- /

- Beverage

- /

- NasdaqGS:KDP

Is Keurig Dr Pepper's 14.7% Slide Creating Value After Recent Industry Shifts?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Keurig Dr Pepper's current share price truly offers good value, you are not alone. Let's dig in to see what the numbers say.

- Despite a flat week (0.0%), the stock has climbed 5.1% in the last month, but remains down 14.7% over the past year. This signals both volatility and possible opportunity for investors keeping an eye out for signs of a turnaround.

- Recent headlines highlight changing consumer trends and increased competition in the beverage space, which are playing a big role in Keurig Dr Pepper's market performance. These developments are shaping expectations, especially as the company refocuses its portfolio and marketing strategy.

- Currently, Keurig Dr Pepper scores 5 out of 6 on our undervaluation checks, suggesting some compelling metrics. Before you decide if that really means "underpriced," we will break down the usual methods for valuing stocks and hint at a smarter, big-picture approach at the end of our analysis.

Find out why Keurig Dr Pepper's -14.7% return over the last year is lagging behind its peers.

Approach 1: Keurig Dr Pepper Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach provides a big-picture view by looking beyond short-term market moves and focusing on what the business is expected to generate over the long run.

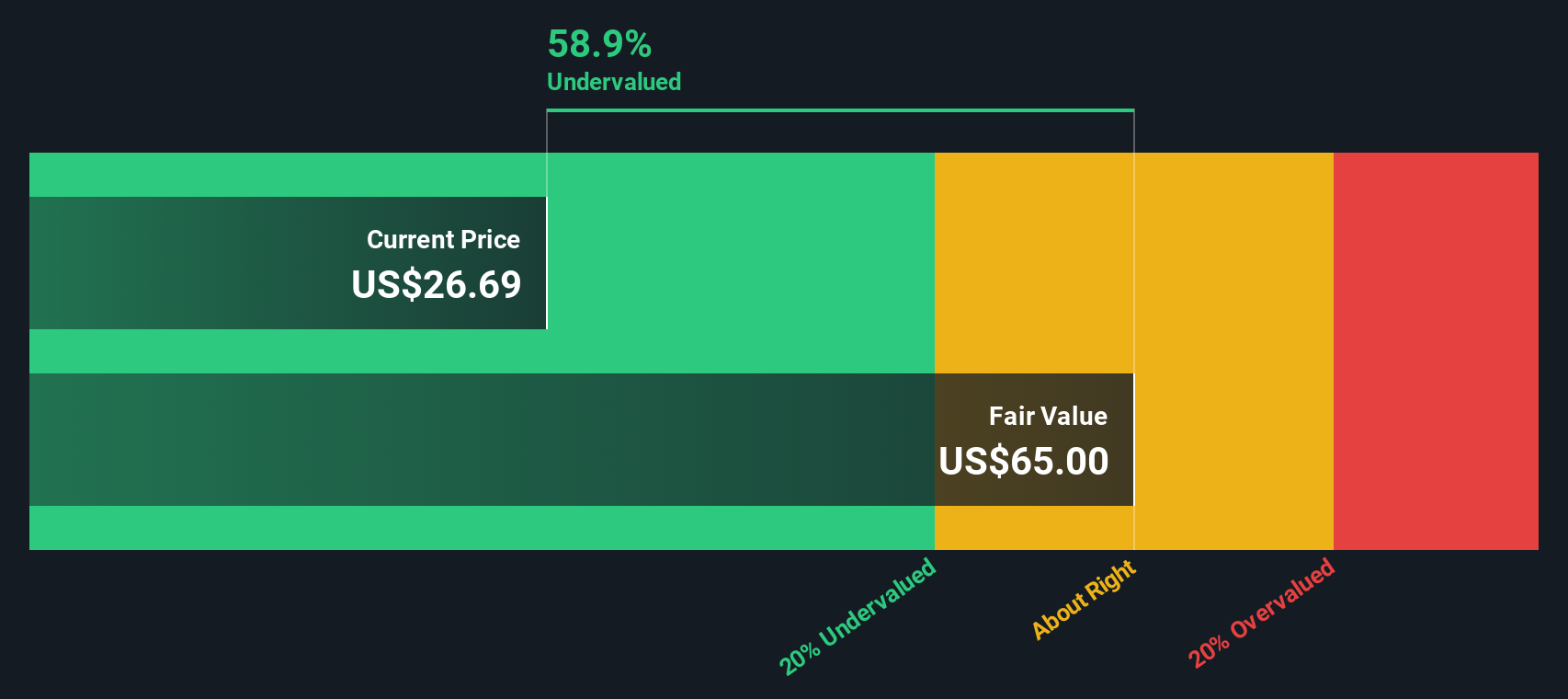

For Keurig Dr Pepper, the latest twelve months' Free Cash Flow (FCF) sits at $1.58 billion. Analyst forecasts extend five years out, predicting steady growth, with FCF expected to reach $3.56 billion by 2029. Projections for the next decade, including those extrapolated by Simply Wall St, show FCF climbing even further. This steady upward trend suggests that the company is building a solid cash-generating base for the future.

Based on this outlook, the DCF model estimates Keurig Dr Pepper's intrinsic value at $64.87 per share. Compared to the current share price, this implies the stock is trading at a striking 58.1% discount. In plain terms, the DCF signals that Keurig Dr Pepper may be significantly undervalued at today's market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Keurig Dr Pepper is undervalued by 58.1%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Keurig Dr Pepper Price vs Earnings

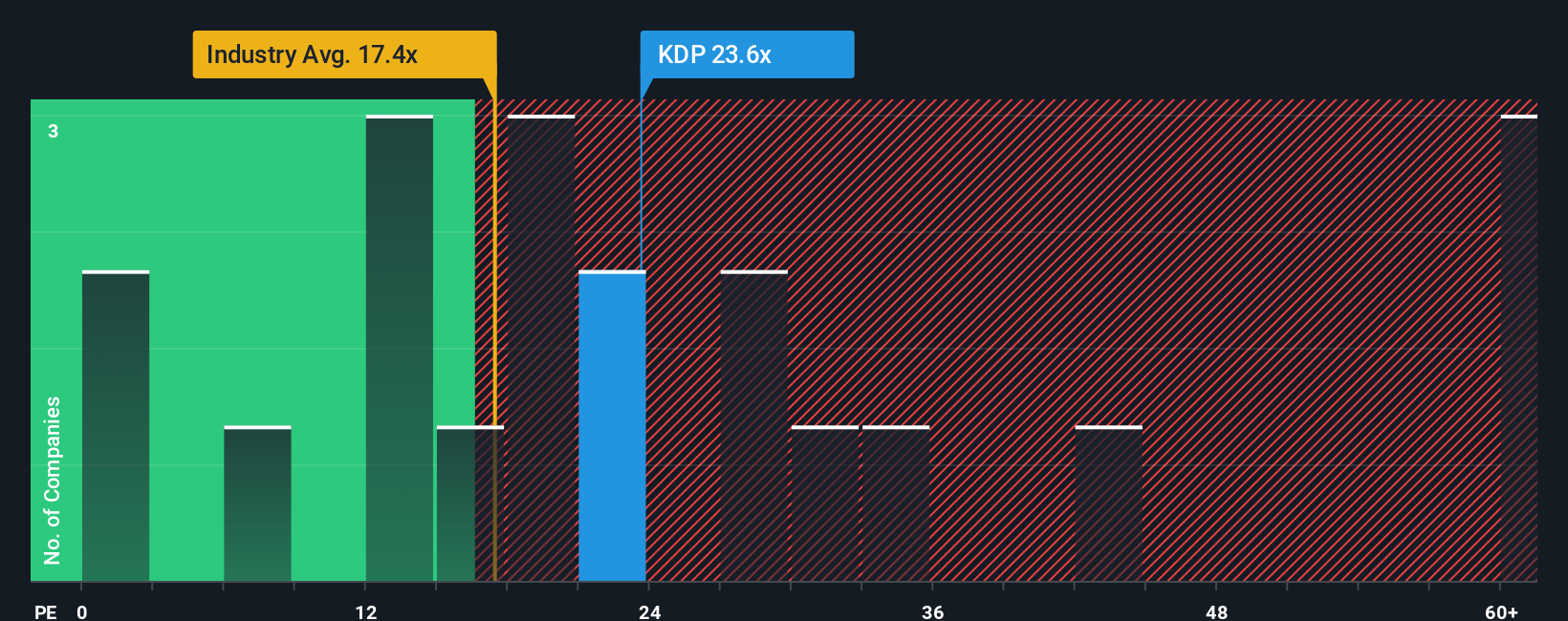

The Price-to-Earnings (PE) ratio is especially useful for valuing profitable companies like Keurig Dr Pepper, as it shows how much investors are paying for each dollar of the company’s earnings. It remains a go-to metric for quickly sizing up whether a stock seems cheap or expensive relative to its earning power.

However, it is important to remember that what counts as a “fair” PE ratio can vary. Higher expected growth and lower risks typically justify a higher multiple, while slower growth or greater uncertainties might lead to a lower one.

Keurig Dr Pepper currently trades at a PE ratio of 23.3x. Compared to the Beverage industry average of 17.6x and its peer group’s average of 59.0x, the stock is positioned in the middle range, appearing neither unusually high nor low by sector standards.

Simply Wall St's proprietary “Fair Ratio” goes a step further, calculating a company-specific benchmark based on earnings growth potential, profit margin, risk profile, industry, and market capitalization. This provides a more insightful reference point than a straightforward comparison to peers or sector averages.

For Keurig Dr Pepper, the Fair Ratio is 27.4x, suggesting that the current PE is somewhat below what would typically be expected given all relevant factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

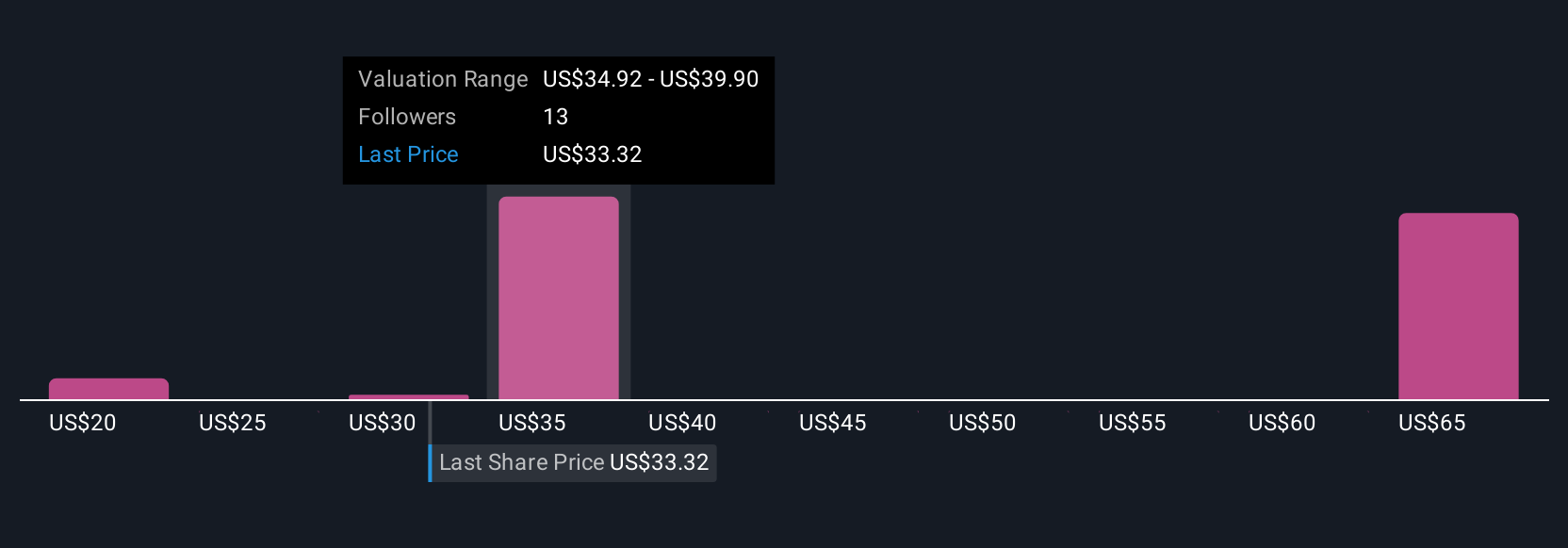

Upgrade Your Decision Making: Choose your Keurig Dr Pepper Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects the story you believe about a company with the actual financial forecasts, including your expected revenue, margins, and fair value. This forms a clear, evidence-based view of what a business is really worth.

Rather than just relying on static ratios or models, Narratives let you define your own perspective. You can consider why you think Keurig Dr Pepper will win or struggle, and how this outlook should shape its future numbers. This approach focuses on linking a company's real-world strategy and news to numbers, helping you see exactly how and why your assumptions impact its valuation.

Available on the Simply Wall St Community page, Narratives are used by millions of investors to decide when to buy or sell. They make it easy to compare your fair value to the current price, keep track of why you made certain calls, and see how your reasoning stacks up against others. Narratives are updated automatically when new news or earnings come in, giving you timely insights without any extra work.

For example, some investors see Keurig Dr Pepper’s fair value as high as $42.00 if new product launches succeed and margins grow, while others see it as low as $30.00 if coffee headwinds persist and integration risks play out. Narratives make it simple to adopt the view that fits your research and adapt as new facts emerge.

Do you think there's more to the story for Keurig Dr Pepper? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives