- United States

- /

- Tobacco

- /

- NasdaqCM:ISPR

Not Many Are Piling Into Ispire Technology Inc. (NASDAQ:ISPR) Stock Yet As It Plummets 31%

Ispire Technology Inc. (NASDAQ:ISPR) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 71% share price decline.

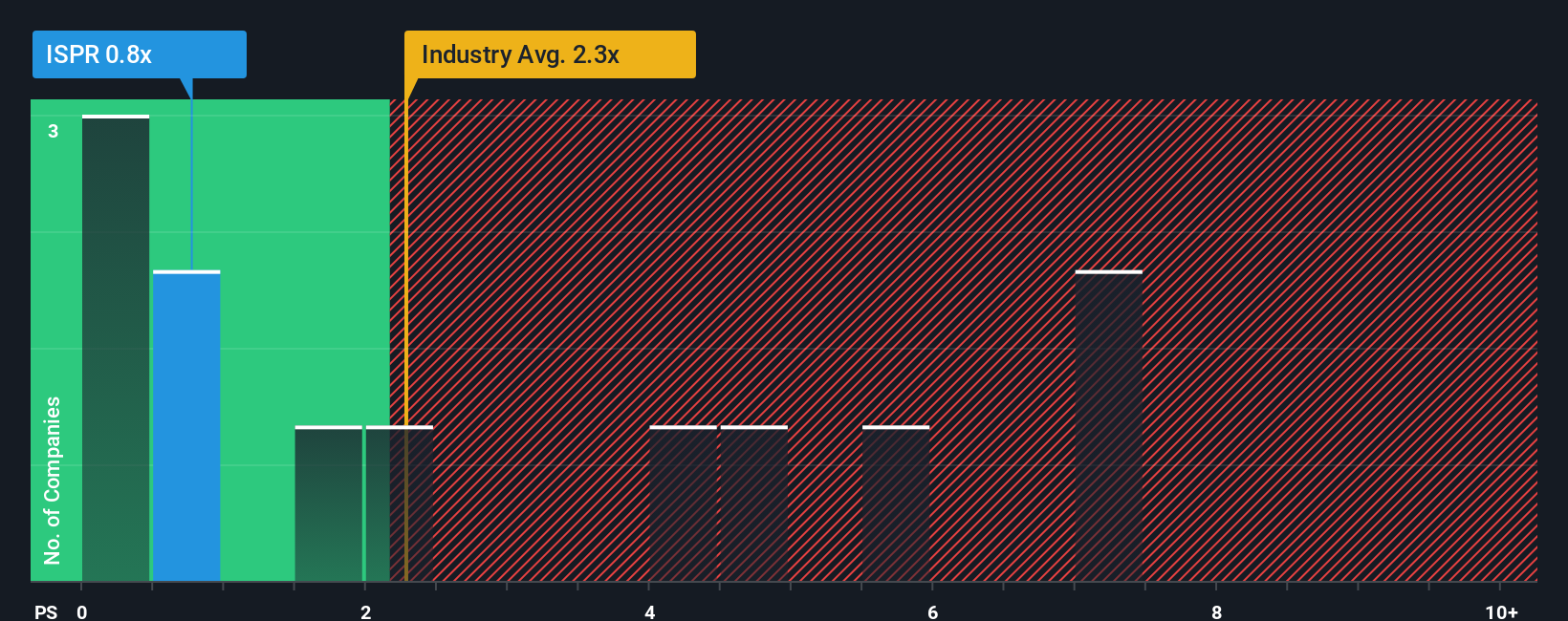

Even after such a large drop in price, it's still not a stretch to say that Ispire Technology's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Tobacco industry in the United States, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Ispire Technology

What Does Ispire Technology's P/S Mean For Shareholders?

Ispire Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Ispire Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Ispire Technology?

The only time you'd be comfortable seeing a P/S like Ispire Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 45% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 58% over the next year. With the industry only predicted to deliver 0.9%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Ispire Technology is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Ispire Technology's P/S?

With its share price dropping off a cliff, the P/S for Ispire Technology looks to be in line with the rest of the Tobacco industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Ispire Technology's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Ispire Technology that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ISPR

Ispire Technology

Researches, develops, designs, commercializes, sells, markets, and distributes e-cigarettes and cannabis vaping products worldwide under the Ispire and Aspire brands.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Robinhood Stock: Profitability Arrives, But Can Tokenization and Trading Growth Last?

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion