- United States

- /

- Tobacco

- /

- NasdaqCM:ISPR

Market Participants Recognise Ispire Technology Inc.'s (NASDAQ:ISPR) Revenues Pushing Shares 28% Higher

Those holding Ispire Technology Inc. (NASDAQ:ISPR) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.0% in the last twelve months.

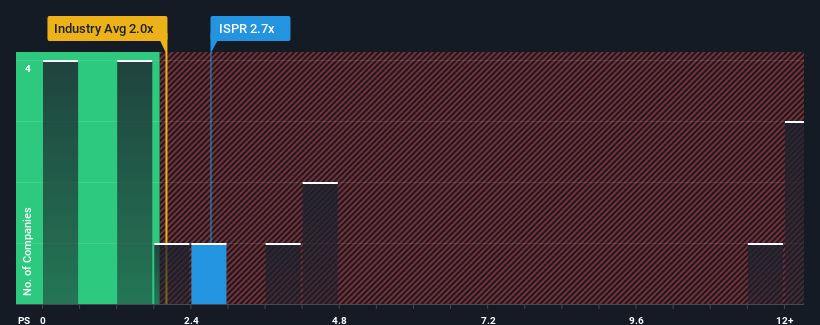

Since its price has surged higher, when almost half of the companies in the United States' Tobacco industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Ispire Technology as a stock probably not worth researching with its 2.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Ispire Technology

How Ispire Technology Has Been Performing

Recent times have been pleasing for Ispire Technology as its revenue has risen in spite of the industry's average revenue going into reverse. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ispire Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ispire Technology?

The only time you'd be truly comfortable seeing a P/S as high as Ispire Technology's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. The latest three year period has also seen an excellent 132% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 36% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 2.4% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Ispire Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Ispire Technology's P/S Mean For Investors?

Ispire Technology shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Ispire Technology shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Ispire Technology (1 shouldn't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Ispire Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ISPR

Ispire Technology

Researches, develops, designs, commercializes, sells, markets, and distributes e-cigarettes and cannabis vaping products worldwide under the Ispire and Aspire brands.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success