- United States

- /

- Food

- /

- NasdaqGS:HAIN

The Hain Celestial Group, Inc. (NASDAQ:HAIN) Might Not Be As Mispriced As It Looks After Plunging 29%

Unfortunately for some shareholders, the The Hain Celestial Group, Inc. (NASDAQ:HAIN) share price has dived 29% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

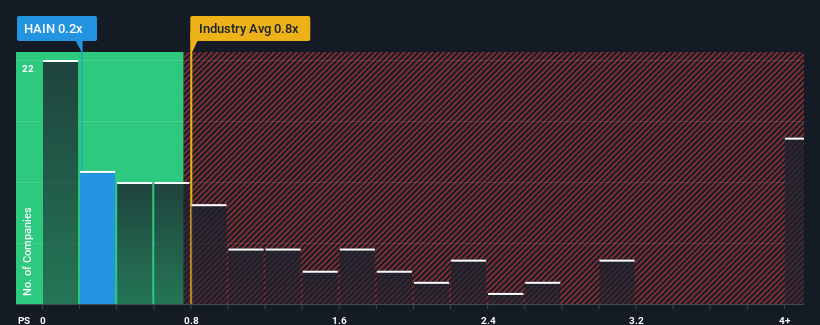

Following the heavy fall in price, when close to half the companies operating in the United States' Food industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider Hain Celestial Group as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Hain Celestial Group

What Does Hain Celestial Group's Recent Performance Look Like?

Hain Celestial Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hain Celestial Group.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Hain Celestial Group's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 6.7% decrease to the company's top line. As a result, revenue from three years ago have also fallen 11% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 1.0% per year during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 2.5% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Hain Celestial Group's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

The southerly movements of Hain Celestial Group's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hain Celestial Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about this 1 warning sign we've spotted with Hain Celestial Group.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hain Celestial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HAIN

Hain Celestial Group

Manufactures, markets, and sells organic and natural products in the United States, United Kingdom, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives